Smarter Web Company raises £17.5M to expand Bitcoin holdings

Smarter Web Company has raised £17.5 million in fresh equity to accelerate its aggressive Bitcoin accumulation strategy.

Smarter Web Company, a London-listed Bitcoin treasury company, has raised £17.5 million through an equity offering to institutional investors, continuing its aggressive Bitcoin (BTC) treasury strategy. The company sold 5.9 million new shares at £2.95 each in an accelerated bookbuild managed by Tennyson Securities and Peterhouse Capital Ltd.

The raise follows the company’s latest BTC purchase on July 16, where it acquired 325 BTC for £27.15 million ($36.45 million) at an average price of £83,525 ($112,157) per coin. This comes just days after a previous buy of 275 BTC at an average of $108,182.

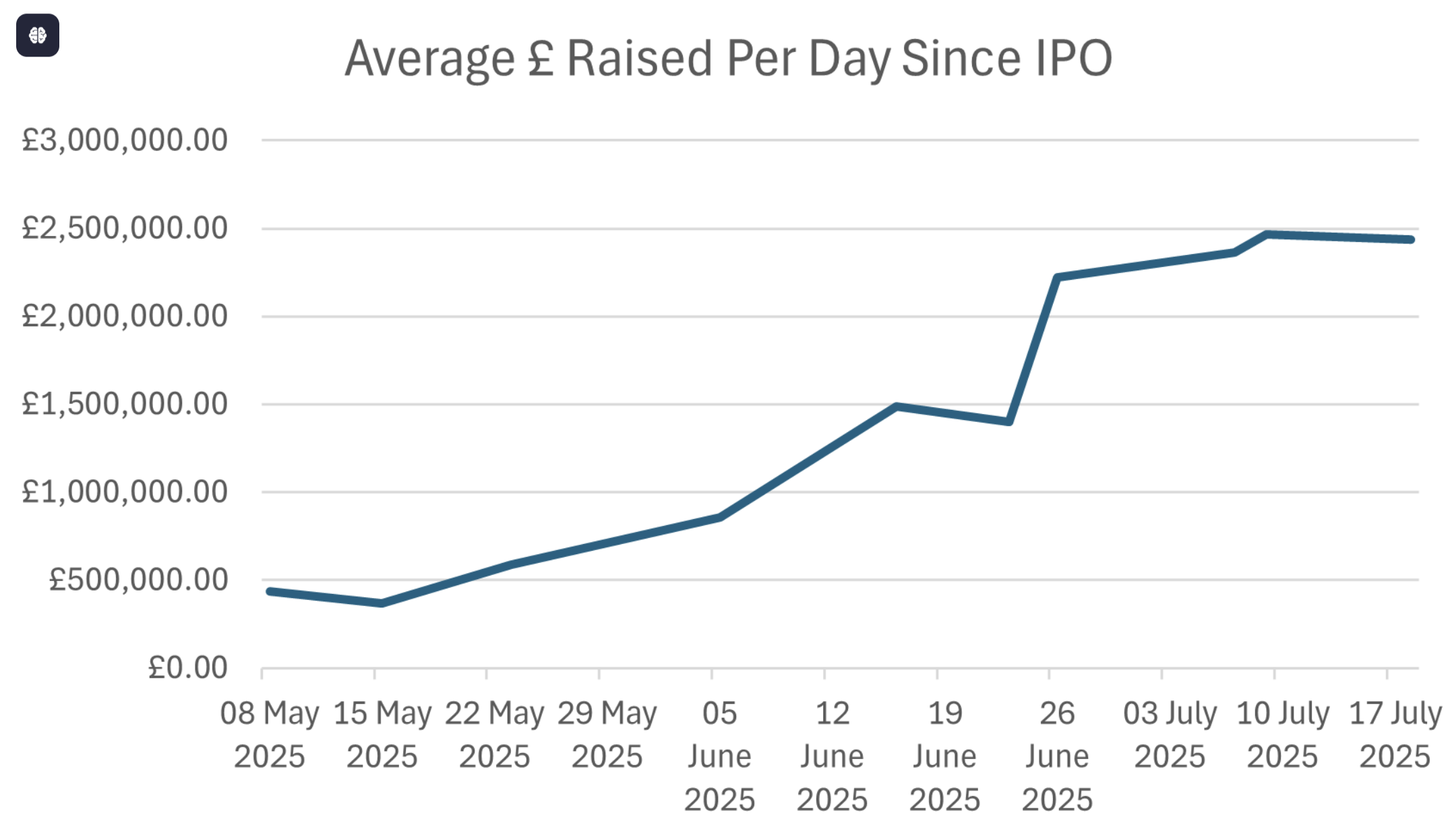

Smarter Web Company has been aggressively raising funds through institutional bookbuilding and qualified investor subscriptions. As investor @henrybomby pointed out, the company has raised £2,435,422 per day since its IPO, with much of the capital allocated to Bitcoin purchases as part of its “10-Year Plan,” which centers on keeping an active BTC treasury as a key part of its financial strategy.

Smarter Web Company adopted a Bitcoin treasury strategy just in April this year, yet it has already accumulated 1,600 BTC, enough to rank among the top 25 institutional holders globally.

You May Also Like

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny

Zimbabwean Doctor Pushes for Appeal in $550,000 Crypto Theft Case