Solana officially promotes DePIN project Roam: With millions of nodes, South Korea becomes a major mining center

Author: Frank, PANews

On January 14, Solana’s official Twitter account pinned a recommendation for a DePIN project called Roam, and said that Roam is unifying more than 1 million WiFi hotspots on the Solana network. However, there have not been many introductions about Roam in the crypto space before.

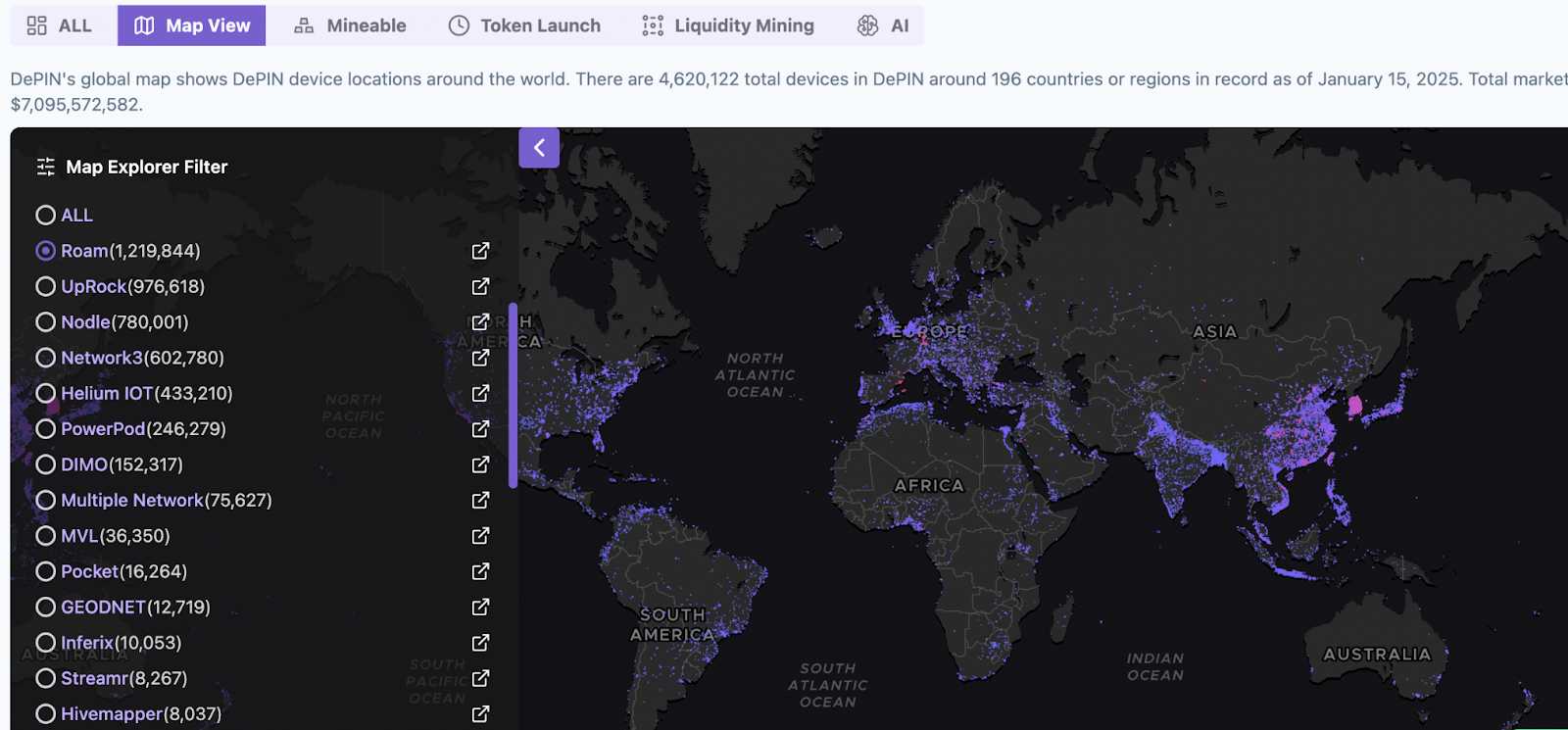

According to DePINscan data, the total number of Roam devices is currently about 1.21 million, ranking first in the world. What is the "magic" behind this rapid growth? Can its core model - "low-threshold router mining + token incentives" really support the global expansion of roaming WiFi networks?

Low-threshold router + token is expected to attract millions of nodes

Roam was founded in 2021. So far, it has completed two rounds of financing totaling $7 million (a seed round of $2 million and a strategic round of $5 million). As a DePIN project, compared with large financing companies such as IoTeX, io.net or Helium, Roam can be regarded as "spending little money to achieve big things" in terms of the amount of financing. The reason for this effect may be related to Roam's business model.

Roam is a decentralized WiFi network operator, whose main goal is to build a global decentralized WiFi roaming network. The narrative is relatively simple, users can contribute their own WiFi to join the Roam network, and if other users connect to the WiFi, the user who contributed the network can get corresponding reward points. These reward points can be exchanged for ROAM tokens.

In the research, PANews found that in July 2024, the number of registered users and devices of Roam was only more than 400,000. In just 7 months, the number of devices surged by 800,000 to 1.21 million. According to DePINscan data, its number of devices ranked first in the world, and the total number of registered users reached 2.08 million.

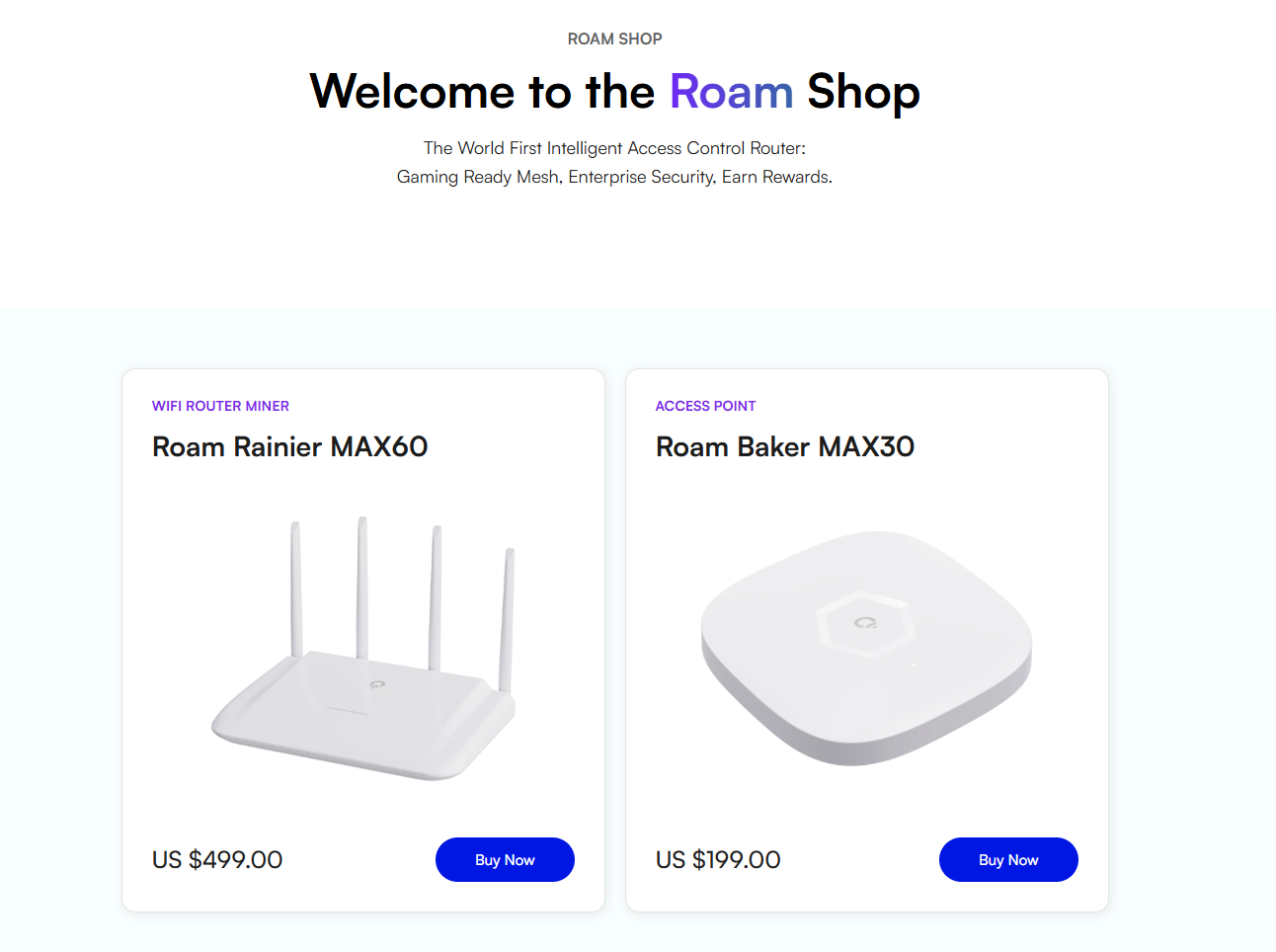

In addition to adding personal routers to the Roam network, Roam's economic mechanism also designs a self-operated device for WiFi miners. Users can purchase Roam's official routers and get additional rewards in addition to the basic rewards and an NFT, such as an additional 60 points per day, or up to 150 points when a user logs in. Currently, Roam has launched two routers: MAX30 (priced at $199) and MAX60 (priced at $499), but from the introduction, only MAX60 users can enjoy additional points rewards. In addition to the additional points rewards and NFTs, these two routers do not seem to have any special innovations in performance. A device with the same performance as the MAX30 produced by a domestic technology brand is priced at an average of less than 300 yuan, a price difference of more than 5 times.

In this narrative, the reason why Roam was able to quickly attract more than 1 million users may be because routers are the most common household devices at present, and there are no special performance requirements or excessive settings, so the threshold for participation is relatively low.

When PANews observed the network distribution of Roam, it found that the device density of Roam is highest in South Korea, almost covering the entire region. It is also relatively dense in China, Southeast Asia, Europe and other regions. The device density in the United States is not high. Judging from these distributions, the main coverage areas are also concentrated in areas with developed networks, while the device coverage in underdeveloped areas such as Africa is very low. Currently, Roam covers more than 140 countries.

Can mining with high-premium routers generate excess returns?

According to the official introduction, the total amount of ROAM tokens is 1 billion, 400 million will be generated by the TGE event, and the remaining 600 million will be mined later. Of the 400 million generated by TGE, 280 million will be used for sales and 120 million will be reserved for the team. In September 2024, the official announced that 20 million tokens will be distributed as airdrops to MAX60, MAX30 and NFT owners and previous Roam OG miners during TGE.

As of January 15, the number of points Roam has issued is approximately 2.139 billion, but there is no precise conversion ratio for points to ROAM tokens, and the exact TGE time has not been announced.

However, we can make some simple estimates. The current market value of IOTX tokens of another DePIN project that has already issued tokens and raised $85 million is about $330 million, and the market value of Helium's token HNT is about $867 million. If the initial market value of ROAM tokens after issuance can reach the market value level of IOTX, the average price of each ROAM token will be about $0.825, and the scale of its airdrop will be about $16.5 million. Currently, there are 2.09 million officially announced registered users, and the average points per user is about 1,023, and the average amount that each user can get is about $7.8. Assuming that half of the 1.21 million nodes are users who have purchased the equipment, then the average airdrop that each of the 600,000 users who have purchased the equipment can get is about $27.

Assuming that the official uses all 280 million tokens for sale in the token TGE for points redemption, based on the current points issuance, the exchange ratio of points to tokens is about 7.6:1. If its market value reaches the level of IOTX, then the value of each point is about $0.1. According to the points rewarded to users who purchase the device, the purchase of the device can get a reward of 3,000 points, plus 60 points per day for 100 days of power-on. If the total points reach 9,000 points, the total income may reach $900. However, this situation is the most ideal state, because the above calculation method estimates two extreme methods, but it should also have a certain reference significance. The average airdrop size may be between $7.8 and $900. For users who purchase equipment, if they only get a return of $900, plus 100 days, this input-output ratio does not seem to be high.

For Roam officials, if half of the devices are dedicated routers purchased by users, then this part of the revenue can reach at least $127 million. Even if only one-tenth of the devices are dedicated routers, this part of the revenue can reach at least $25.47 million. From this perspective, Roam's device revenue may make it the biggest winner in this airdrop narrative.

In addition to the decentralized WiFi network and token peg, Roam has also launched an international roaming network service eSIM. According to official introduction, Roam's eSIM service has covered 160 countries and regions. This eSIM is similar to the international roaming network service launched by telecom operators we are familiar with. From the pricing point of view, the price per 1GB ranges from US$1.19 to US$1.99. This service price is higher than the roaming service price of telecom operators in mainland China.

Roam has become a new force that cannot be ignored in the DePIN track. Compared with many projects that have raised hundreds of millions of dollars, Roam has achieved the effect of "spending little money to do big things" with only 7 million US dollars. However, in terms of the current coverage areas, Roam's coverage areas are all areas with developed networks. The demand for WiFi in these areas does not seem to be a rigid demand. The current device access mainly stems from the expectation of token incentives. For Roam officials, what kind of planning to make for the next token economy may be the biggest challenge. If the airdrop effect is not as expected, a large number of shutdowns may be ushered in. In addition, can the current number of nodes be maintained after the airdrop, and is there a motivation to attract more nodes to access? This is also a problem that cannot be ignored by Roam.

You May Also Like

Crucial US Stock Market Update: What Wednesday’s Mixed Close Reveals

Forbes' 2026 Crypto Investment Trends Outlook: Institutionalization, Tokenization, Stablecoins, and the AI Machine Economy