Sui Unveils Native Stablecoins Amid Surge in Synthetic Dollar Popularity

As the stablecoin sector continues to evolve, new innovations are emerging to enhance stability and appeal to investors seeking reliable digital assets. Notably, the launch of native stablecoins on the Sui blockchain signals a growing interest in blending traditional financial backing with advanced blockchain strategies, including synthetic and delta-neutral approaches. This development reflects broader trends in crypto markets, emphasizing innovation in stability mechanisms amid increasing regulatory clarity and market growth.

- Publicly traded SUI Group plans to introduce suiUSDe and USDi, marking the first native stablecoins on the Sui blockchain, developed in partnership with Ethena Labs and the Sui Foundation.

- USDi will be fully backed by tokenized shares of BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL), while suiUSDe employs a synthetic, delta-neutral strategy to maintain its peg.

- Ethena’s USDe is currently the third-largest stablecoin globally, with a market cap exceeding $14.8 billion, driven by innovative collateralization and hedging techniques.

- The stablecoin market surpasses $300 billion in total circulating value, predominantly led by traditional fiat-backed tokens like Tether’s USDT and Circle’s USDC.

- The sector’s growth is partly attributed to recent U.S. regulatory progress, notably the passage of legislation establishing standards for fully collateralized stablecoins.

Revolutionizing Stablecoins: Native and Synthetic Approaches

Synthetic stablecoins are gaining renewed attention this year, with developers leveraging financial engineering to combat crypto market volatility through delta-hedged strategies. The latest move involves SUI Group, a publicly traded company focused on the Sui blockchain, announcing plans for suiUSDe and USDi — the first native stablecoins of the Sui ecosystem. Developed in collaboration with Ethena Labs and the Sui Foundation, these tokens aim to broaden the blockchain’s financial offerings.

The two stablecoins take different paths to maintaining a dollar peg. USDi will be fully backed by tokenized shares of BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL), which comprises short-term U.S. Treasurys and cash equivalents. Conversely, suiUSDe will utilize a synthetic, delta-neutral model, employing crypto collateral combined with short futures positions to stabilize its price.

Particularly notable is Ethena’s role. Its flagship product, USDe, is already the third-largest synthetic dollar coin by market cap, at over $14.8 billion. It maintains its stability through collateralized positions hedged with perpetual futures, efficiently offering a capital-effective alternative to fiat-backed stablecoins. This model has helped USDe rapidly grow, doubling its market cap since July.

Ethena’s innovative approach has drawn attention from institutional investors, exemplified by Mega Matrix’s recent $2 billion shelf registration to acquire Ethena’s governance tokens (ENA). Holdings in ENA could potentially generate revenue from Ethena’s USDe protocol, linking traditional capital markets with DeFi innovations.

Sui’s move into native stablecoins signifies a strategic step for one of the fastest-growing layer 1 blockchains. Developed by Mysten Labs, Sui emphasizes parallel transaction processing, which enhances scalability and efficiency, making it competitive against established giants like Ethereum. Currently, Sui ranks as the 15th-largest blockchain by market capitalization, valued at approximately $13 billion.

Stablecoin Market Now Exceeds $300 Billion

The global stablecoin market has recently crossed a significant threshold, surpassing $300 billion in circulating value. While traditional fully collateralized tokens still dominate, the rise of synthetic stablecoins—such as Ethena’s USDe—demonstrates ongoing innovation within the sector.

The recent growth has been partly fueled by regulatory developments in the United States. The passing of the GENIUS Act has set new standards for reserve transparency and reporting, providing a clearer legal framework that encourages institutional participation and market stability.

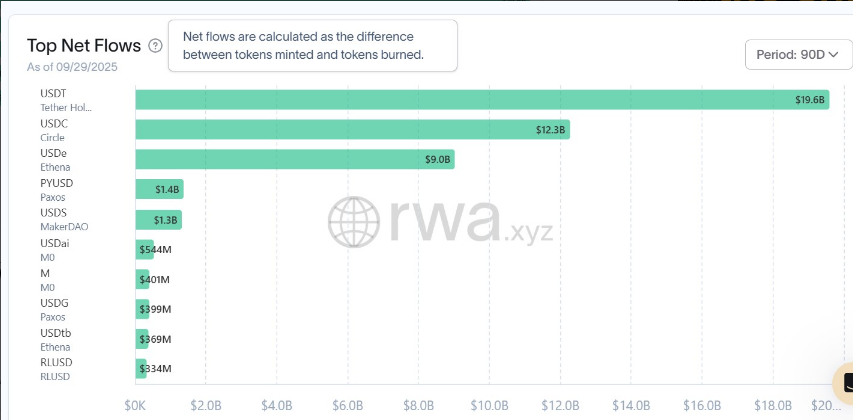

Leading stablecoins like Tether’s USDT and Circle’s USDC continue to dominate the space, with inflows of $19.6 billion and $12.3 billion in the third quarter, respectively. Ethena’s USDe attracted approximately $9 billion during the same period, highlighting the sector’s dynamic evolution and diversification.

Stablecoin inflows over the past 90 days. Source: RWA.xyz

Stablecoin inflows over the past 90 days. Source: RWA.xyz

Despite increasing competition, the stablecoin ecosystem remains heavily concentrated within Ethereum’s network, which hosts more than half of all circulating stablecoins. As innovative models like synthetic and native stablecoins gain ground, the landscape is poised for further evolution, blending traditional finance with decentralized technology.

This article was originally published as Sui Unveils Native Stablecoins Amid Surge in Synthetic Dollar Popularity on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

Fed Decides On Interest Rates Today—Here’s What To Watch For