Tesla (TSLA) Stock Falls as FSD Investigation Threatens Trillion-Dollar Robotaxi Dreams

TLDR

- NHTSA opened an investigation into Tesla’s Full Self-Driving system covering 2.88 million vehicles after receiving reports of traffic violations and crashes.

- The probe focuses on two main issues: Tesla vehicles running red lights and making improper lane changes into opposing traffic.

- Tesla stock dropped 8.77% over the past week following the announcement of the investigation.

- The agency received 18 reports of FSD-engaged vehicles failing to stop properly at red lights, with six crashes resulting in injuries.

- Analysts view FSD and Robotaxi technology as critical to Tesla’s future valuation, with some price targets heavily dependent on autonomous driving success.

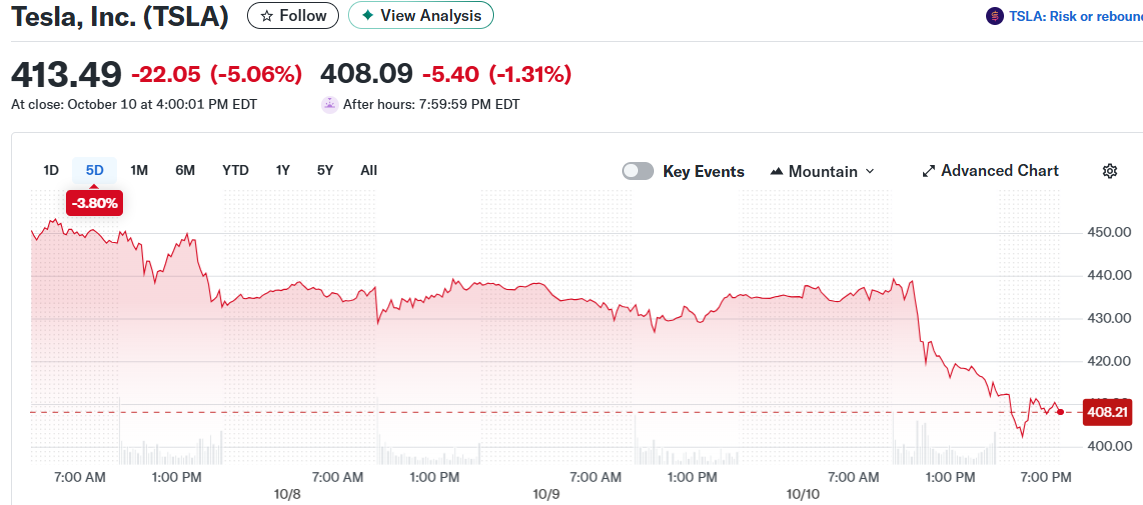

Tesla shares took a beating this week, dropping 8.77% after federal regulators opened a new investigation into the company’s Full Self-Driving technology. The U.S. National Highway Traffic Safety Administration is examining 2.88 million Tesla vehicles equipped with the FSD system.

Tesla, Inc. (TSLA)

Tesla, Inc. (TSLA)

The timing couldn’t be worse for the electric vehicle maker. Wall Street analysts consider FSD and the upcoming Robotaxi service essential to Tesla’s future growth. Ark Invest CEO Cathie Wood has a five-year price target of $2,600 per share, with much of that valuation riding on autonomous driving technology becoming a commercial reality.

The stock currently trades around $421. That means Wood expects the Robotaxi business alone to multiply Tesla’s trillion-dollar valuation by six times.

What NHTSA Found

The federal probe came after the agency received more than 50 reports of traffic safety violations involving FSD-equipped Teslas. The investigation centers on two specific problems: vehicles running red lights and cars making dangerous lane changes into oncoming traffic.

NHTSA documented 18 reports of Tesla vehicles failing to stop properly at red lights while FSD was engaged. Some didn’t stop at all. Others rolled through intersections or failed to stay stopped for the full duration of the red signal.

Six crashes involved Teslas running red lights with FSD active. Four of those accidents caused injuries. The agency also received complaints about FSD-engaged vehicles swerving into opposing lanes during turns or attempting to drive the wrong way down streets despite clear signage.

One troubling detail stands out. Some complaints alleged that FSD didn’t warn drivers before making these dangerous maneuvers. Tesla has always maintained that FSD requires constant driver attention and intervention when needed.

The investigation will examine whether certain FSD driving inputs interfere with a driver’s ability to supervise the system properly. NHTSA says it has evidence the technology has “induced vehicle behavior that violated traffic safety laws.”

Tesla’s Regulatory Track Record

This marks the fifth open NHTSA investigation involving Tesla. The company now ties with Honda for second place in active federal probes. Only Ford has more with eight investigations.

Earlier this year, the Department of Government Efficiency fired roughly 30 NHTSA workers under Elon Musk’s direction. Many of those employees were responsible for evaluating self-driving car safety. Musk has since been legally removed from his DOGE position.

The agency has been busy with Tesla lately. In October, NHTSA opened an investigation into FSD collisions during reduced visibility conditions like fog and sun glare. That probe followed four crashes, including one fatality.

Tesla missed a June 19 deadline to respond to a detailed FSD questionnaire from NHTSA. The company didn’t submit its answers until days after the due date. In January, regulators opened another investigation covering 2.6 million Tesla vehicles over crashes involving the remote parking feature.

In September, NHTSA announced it was reviewing incident reports Tesla submitted months late. The agency is also in the second phase of potentially recalling Model Y vehicles over an electrical problem that could cause door handles to fail.

What Analysts Think

William Blair analyst Jed Dorsheimer rates Tesla as “market perform” but sees Robotaxi as the key to future value. His firm’s $357.43 price target includes $298.61 attributed solely to the autonomous taxi business.

Investors banking on Tesla’s AI and robotics future now face fresh regulatory uncertainty. The company derives 90% of its revenue and 94% of its gross margin from vehicle sales today. But bulls like Cathie Wood and Wedbush’s Dan Ives believe the real money lies in software and services like FSD.

Tesla recently launched cheaper versions of the Model 3 and Model Y to boost sales. The company has also seen improved EV sales in China and Europe. Wall Street maintains a Hold consensus rating on the stock as analysts await the upcoming third-quarter earnings report.

The post Tesla (TSLA) Stock Falls as FSD Investigation Threatens Trillion-Dollar Robotaxi Dreams appeared first on CoinCentral.

You May Also Like

The Surprising 2025 Decline In Online Interest Despite Market Turmoil

Cryptos Signal Divergence Ahead of Fed Rate Decision