Tesla (TSLA) Stock: Musk Claims Optimus Robots Will Drive 80% of Company Value

TLDR

- Elon Musk claims 80% of Tesla’s future value will come from Optimus humanoid robots, not robotaxis

- Tesla faces stagnating sales with 2025 earnings expected to drop nearly 30%

- Optimus competes with Boston Dynamics’ Atlas and Figure AI’s humanoid platforms

- Musk estimates the robotics opportunity could reach $10 trillion in value

- The humanoid robot remains years away from commercial adoption and revenue impact

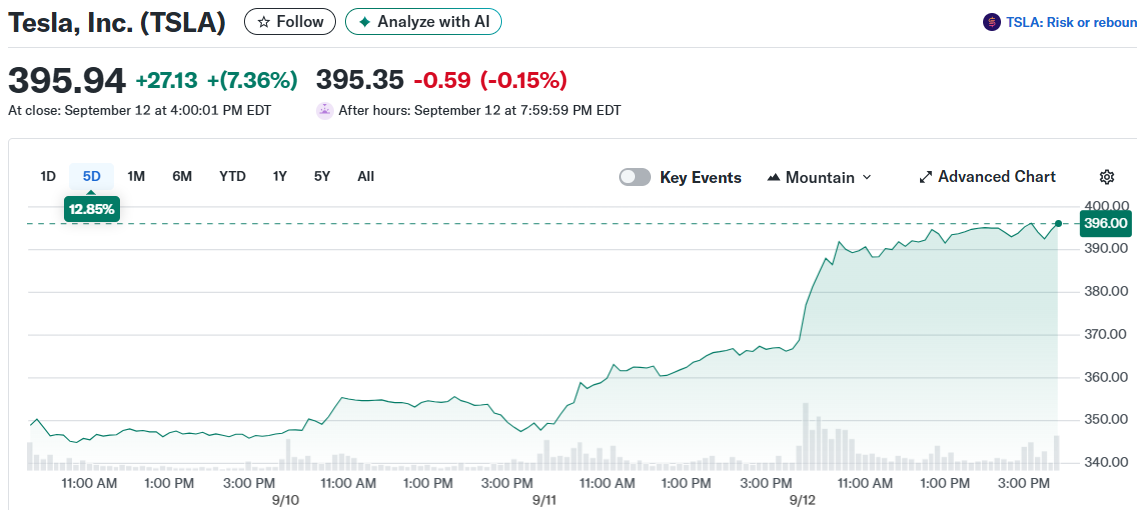

Tesla stock jumped 7.36% as CEO Elon Musk made his latest prediction about the company’s future direction. This time, he’s claiming that 80% of Tesla’s value will eventually come from humanoid robots rather than electric vehicles.

Tesla, Inc. (TSLA)

Tesla, Inc. (TSLA)

The bold forecast comes at a challenging time for the EV maker. Tesla’s 2025 earnings are projected to fall nearly 30% as the company struggles with stagnating sales. The stock’s current valuation leaves little room for disappointment.

Musk announced on X that the company’s Optimus humanoid robot project will drive most of Tesla’s future worth. The statement represents a dramatic shift away from the robotaxi narrative that has dominated Tesla’s AI discussions.

Optimus represents Tesla’s entry into general-purpose robotics. The humanoid platform is designed to perform human-level tasks in real-world environments. Unlike traditional industrial robots, Optimus features arms, legs and advanced dexterity.

The robot could first deploy in Tesla’s own gigafactories to reduce labor costs. Later, the company plans to sell Optimus commercially for manufacturing, logistics and household applications.

Tesla isn’t alone in this space. Boston Dynamics, backed by Hyundai, continues developing its Atlas humanoid robot. The platform demonstrates impressive mobility and agility capabilities.

Figure AI poses another competitive threat. The startup has backing from Microsoft, Nvidia, OpenAI and Jeff Bezos. Figure AI focuses initially on manufacturing and logistics use cases.

Labor Automation Market Opportunity

The humanoid robotics market represents a massive opportunity according to industry leaders. Nvidia CEO Jensen Huang has pointed to multitrillion-dollar potential at the intersection of AI and robotics.

Musk takes this further, suggesting the robotics opportunity could reach $10 trillion. That would dwarf Tesla’s current automotive business, which faces intense competition from other manufacturers.

Unlike vehicles, robots could provide recurring revenue streams for Tesla. Businesses might lease or service Optimus units rather than making one-time purchases. This model could generate higher margins than car sales.

The robotics business also offers protection from cyclical automotive demand. Car sales fluctuate with economic conditions and consumer preferences. Robot deployments could provide more stable revenue growth.

Current Reality vs Future Vision

Tesla’s immediate financial picture looks challenging despite the robotics promises. The company’s core EV business shows signs of slowing momentum. Competition from Chinese manufacturers and established automakers continues intensifying.

The robotaxi business, once seen as Tesla’s AI goldmine, faces its own hurdles. Waymo already operates commercial autonomous vehicle services in several cities. Tesla’s Full Self-Driving technology still requires human supervision.

Optimus remains in early development stages. The robot has appeared in demonstrations but lacks the capabilities needed for widespread deployment. Commercial availability appears years away at minimum.

Tesla’s stock trades at premium valuations that assume significant growth. The company needs to deliver on either robotics or autonomy promises to justify current share prices. Missing these targets could trigger substantial selloffs.

Musk’s track record includes both spectacular successes and delayed timelines. SpaceX revolutionized space travel, but Tesla’s robotaxi timeline has slipped repeatedly. Investors must weigh his visionary capabilities against execution risks.

Tesla reported stronger-than-expected delivery numbers for the most recent quarter, helping drive the 7.36% stock gain.

The post Tesla (TSLA) Stock: Musk Claims Optimus Robots Will Drive 80% of Company Value appeared first on CoinCentral.

You May Also Like

Washington Faces New Dilemma Over Venezuela’s Alleged BTC Reserves

We’re not being as forward-looking as normal