The altcoins are “bleeding”, are the VCs in the exit period the culprits?

Author: 0xLouisT , L1D Investment Partner

Compiled by: Felix, PANews

Altcoins are bleeding heavily - why? High FDV? CEX listing strategy? Should Binance and Coinbase invest their treasury funds in new altcoins in the form of TWAP (time-weighted average price)?

The real culprit is nothing new. It all goes back to the 2021 crypto VC bubble.

ICO boom ( 2017-2018 )

The crypto market is inherently a highly liquid industry — projects can launch tokens representing anything at any stage. Before 2017, most activity took place in the open market, where anyone could buy directly through a CEX.

Then came the ICO bubble: an era of wild speculation, marred by scams (lawsuits, deceptions, and regulatory crackdowns). The SEC stepped in, and ICOs became all but illegal. Founders who wanted to avoid U.S. justice had to find another way to raise money.

VC boom ( 2021-2022 )

As retail investors exit, founders turn their attention to institutional investors. From 2018 to 2020, crypto VCs continued to evolve: some companies were pure venture capital, others were hedge funds that allocated a small portion of AUM (asset management scale). At that time, investing in alternative assets was a contrarian operation: many people believed that these assets would go to zero.

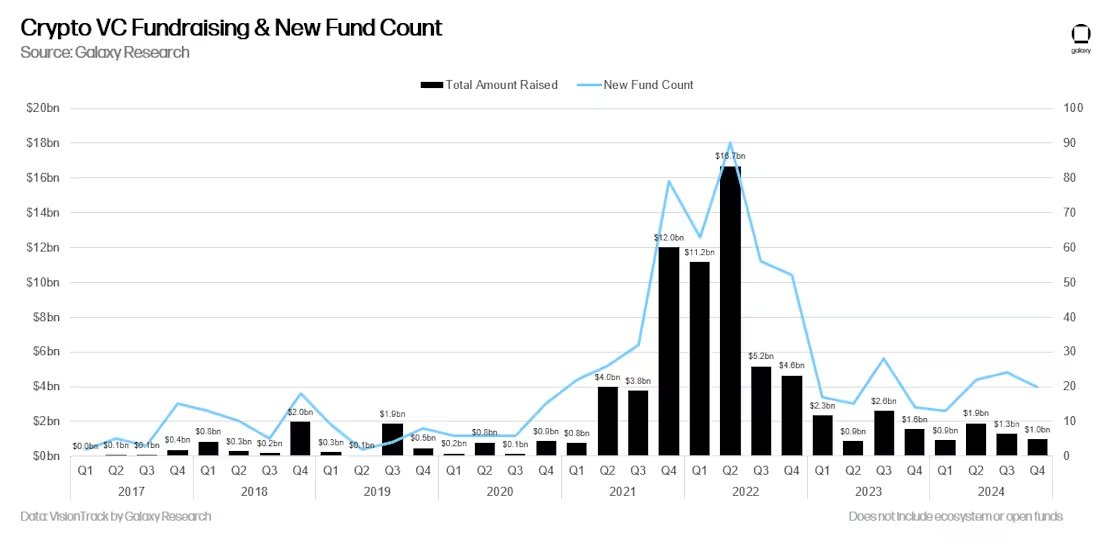

Then came 2021. The bull market sent VC portfolios soaring (on paper). By April, funds were up 20x to 100x. Crypto VCs suddenly looked like money printing machines. LPs flocked in, eager to catch the next wave. New funds were 10x or even 100x the size of previous funds, and they believed they could replicate these excess returns.

Source: Galaxy Research

The Hangover Period ( 2022-2024 )

2022: Luna, 3AC, FTX, billions of dollars of paper profits evaporated overnight. (PANews Note: Like the headache and nausea of a hangover the next day after drinking too much, crypto VCs also experienced pain)

Contrary to popular belief, most VCs did not sell at the highs. They rode the crash with everyone else. Now they face two serious problems:

- Frustrated LPs: LPs that once cheered for 100-fold returns are now asking to exit, forcing funds to reduce risk and take profits early.

- Too much money: VCs have too much dry powder (note: unused cash reserves waiting to be invested) , but too few high-quality projects. Instead of returning capital to LPs, many funds invest in projects that do not make economic sense, just to deploy the remaining capital to reach the investment threshold and pave the way for a possible next round of financing.

Most crypto VCs are now in a dilemma - unable to raise new funds, with a bunch of low-quality projects on hand, which are destined to play out the "high FDV to zero" script. Under pressure from LPs, VCs have transformed from long-term vision supporters to those seeking short-term exits. Driven by VCs themselves, a large number of VC-backed tokens (copycat L1, L2, infrastructure tokens) are constantly sold at unreasonable valuations.

In other words, the incentives and timelines for crypto VCs have changed significantly:

- In 2020, venture capitalists are contrarians, capital-starved, and long-term thinkers.

- By 2024, there is too much venture capital, excess capital, and a focus on short-term gains.

Most VCs in 2021-2023 will underperform. VC returns follow a power law distribution, with a few winners making up for the majority of losers. But forced early selling will distort results, leading to weak overall performance.

It’s no surprise that entrepreneurs and communities are increasingly skeptical of VCs. Their incentives and timelines are misaligned with founders’ goals, leading to a shift toward:

- Community-led Financing

- Liquid funds support tokens in the long term, not venture capital

Assessing liquidity / venture capital cycles

Tracking the flow of capital between VC and liquid markets is crucial. Here is an indicator to assess the state of the VC market. This indicator is not perfect, but it is useful.

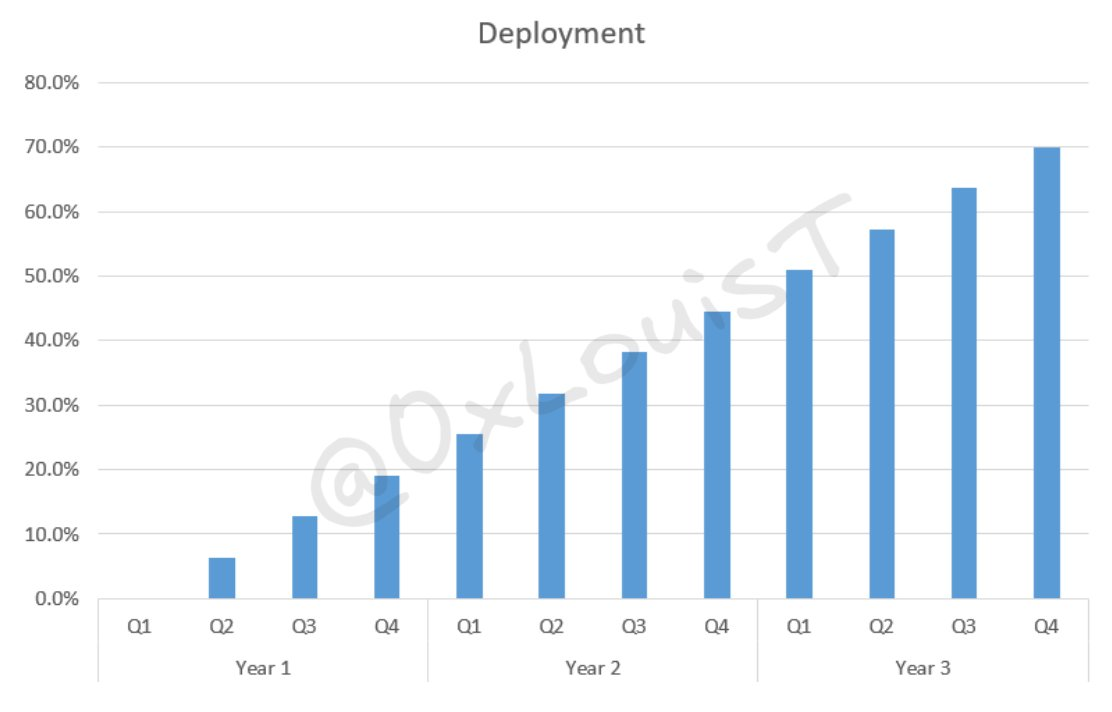

Assume that VCs deploy 70% of their capital linearly over three years — which seems to be the trend for most VC firms.

3-year VC linear deployment visualization chart

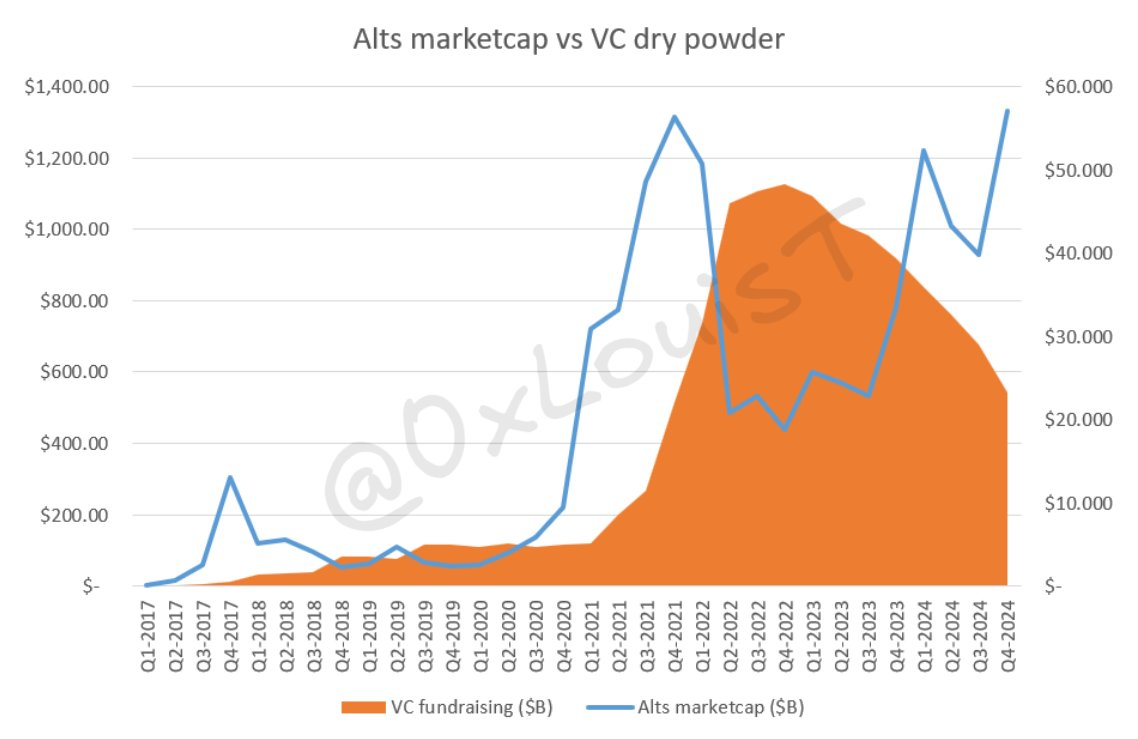

Based on Galaxy Research’s VC funding data, we weighted and summed 16 quarters of deployment rates to estimate unspent cash reserves. In the fourth quarter of 2022, VC unspent cash reserves were approximately $48 billion. With the stagnation of new funding, this number has at least been cut in half and continues to decline.

Visualization of VC unspent cash reserves

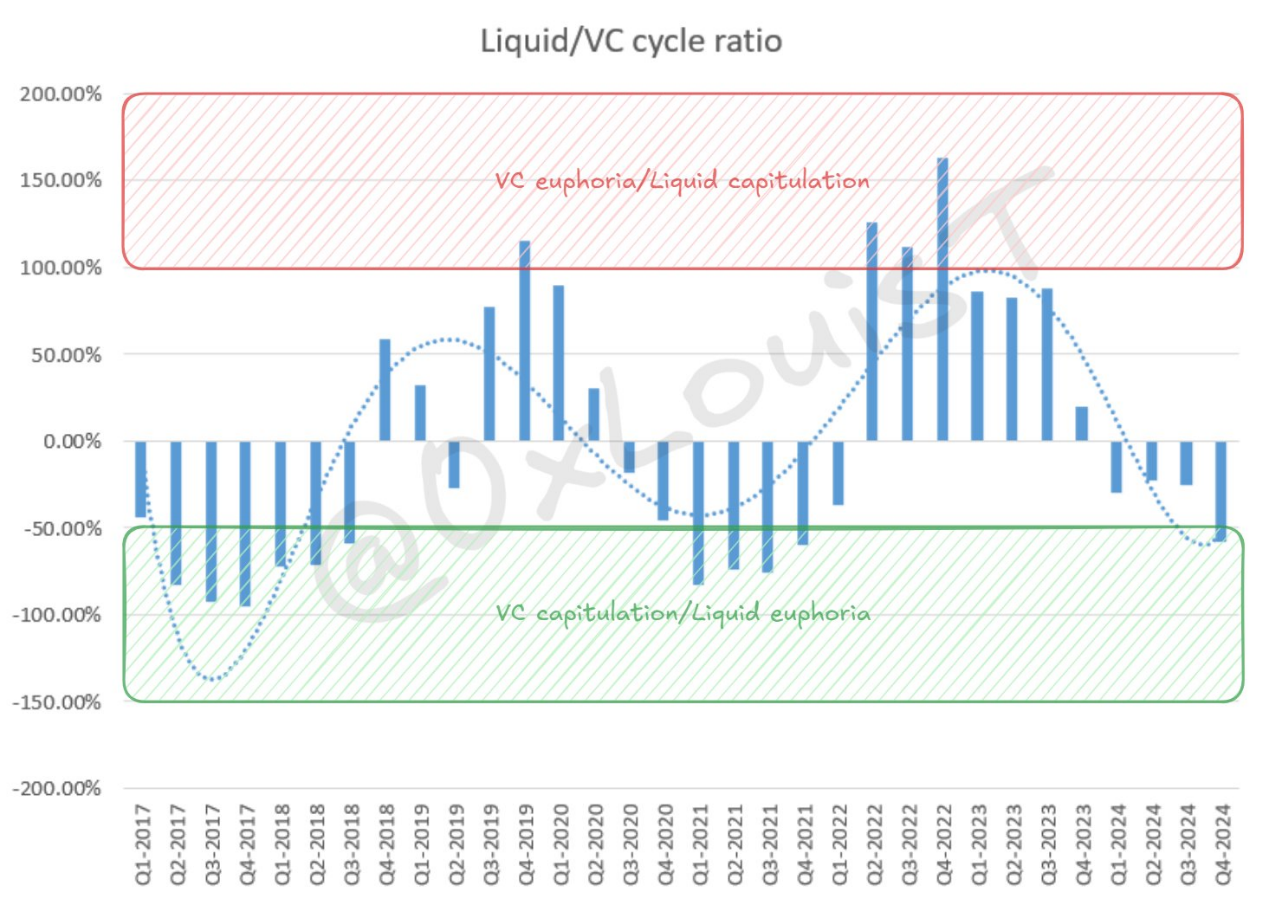

Next, compare each quarter’s VC unspent cash reserves to TOTAL2 (cryptocurrency market cap excluding Bitcoin) (since VCs typically invest in altcoins, this is the best metric). If VC unspent cash reserves are too high relative to TOTAL2, the market will not be able to absorb future token generation events (TGEs). Normalizing this data reveals the cyclical nature of the liquidity/VC ratio.

Generally speaking, being in the “VC mania” zone means that the risk-adjusted returns of liquid markets are better than those of VCs. The “VC capitulation” zone is trickier: it can indicate that VCs are capitulating or that the liquid markets are overheating.

Like all markets, crypto VC and liquidity markets follow cycles. The excess funding from 2021/2022 is quickly running out, making it harder for founders to raise capital. Underfunded VCs are getting pickier about deals and terms.

TLDR

- Venture capital has performed poorly in recent years and is turning to short-term selling and returning funds to LPs. Many popular crypto VC institutions may not survive in the next few years.

- The misalignment between VCs and founders is forcing founders to look to other funding sources

- Oversupply of VC capital leads to uneven distribution (more on this in the next article)

In the following articles, we will explore the impact on projects, liquidity markets, future development trends, and provide advice for founders starting businesses under current conditions.

Related reading: The crypto market from the perspective of VCs in the East and the West: Narration for the sake of narration is boring

You May Also Like

OpenVPP accused of falsely advertising cooperation with the US government; SEC commissioner clarifies no involvement

Will XRP Price Increase In September 2025?