The Trump family is making a comeback! The market value of the "First Lady Coin" MELANIA has exceeded 10 billion in a short period of time, and the details of multiple tokens have caused market contro

Author: Nancy, PANews

After Trump personally issued the MEME coin TRUMP, which caused an unprecedented craze inside and outside the circle, his wife Melania also launched her own official token MELANIA. Under the "First Lady" effect and the sentiment of TRUMP token being out of the market, the market value of MELANIA was once pushed up to over 13 billion US dollars, and the Solana network was also congested and even down due to the surge in transaction volume. However, this capital frenzy driven by FOMO sentiment also caused serious bleeding in the crypto market, and many details of MELANIA's coin issuance also caused market controversy.

In the early morning of January 20, Melania Trump said on social media that people can now buy MEME coins MELANIA. Subsequently, Trump retweeted to further confirm the information, which quickly detonated the market.

TRUMP fell in response, and the crypto market was severely drained of blood

Stimulated by the wealth effect brought by Trump's token TRUMP, MELANIA also grabbed a large amount of market liquidity in just a few hours. DEX Screener data showed that MELANIA's peak trading volume exceeded US$13.09 billion a few hours after its launch, and its cumulative trading volume exceeded US$1.36 billion.

Under MELANIA's bloodsucking attack, the crypto market generally fell due to the rapid withdrawal of funds, especially the bleeding on the chain was particularly serious. TRUMP was not spared and fell below $40 at one point.

According to SoSoValue data, the crypto market sectors generally pulled back, with the AI Agents sector falling as much as 12.08%, the PayFi sector falling 6.75%, the DeFi sector falling 6.94%, and the MEME sector falling 7.53%.

According to Coinglass data, in the past 12 hours, the total contract liquidation in the crypto market exceeded $710 million, of which $590 million was liquidated for long orders and $120 million was liquidated for short orders. Among them, the cryptocurrencies with the largest liquidation amounts were Bitcoin, Ethereum, Solana and TRUMP. Among them, GMGN data showed that TRUMP's highest drop today was as high as 59.6%.

The coin issuance website was hastily created yesterday, and the initial lock-up period of MELANIA tokens is only 30 days

While MELANIA was hyped up by the market, its original intention of token creation, unlocking mechanism and the Trump family's successive coin issuance also caused a lot of speculation and controversy.

On the one hand, MELANIA’s deployment time was accused of being too hasty. According to Abstract contributor cygaar, MELANIA’s official website and domain name were created yesterday (January 19), and the front-end code was incomplete. In contrast, TRUMP’s token deployment work began as early as December 2024;

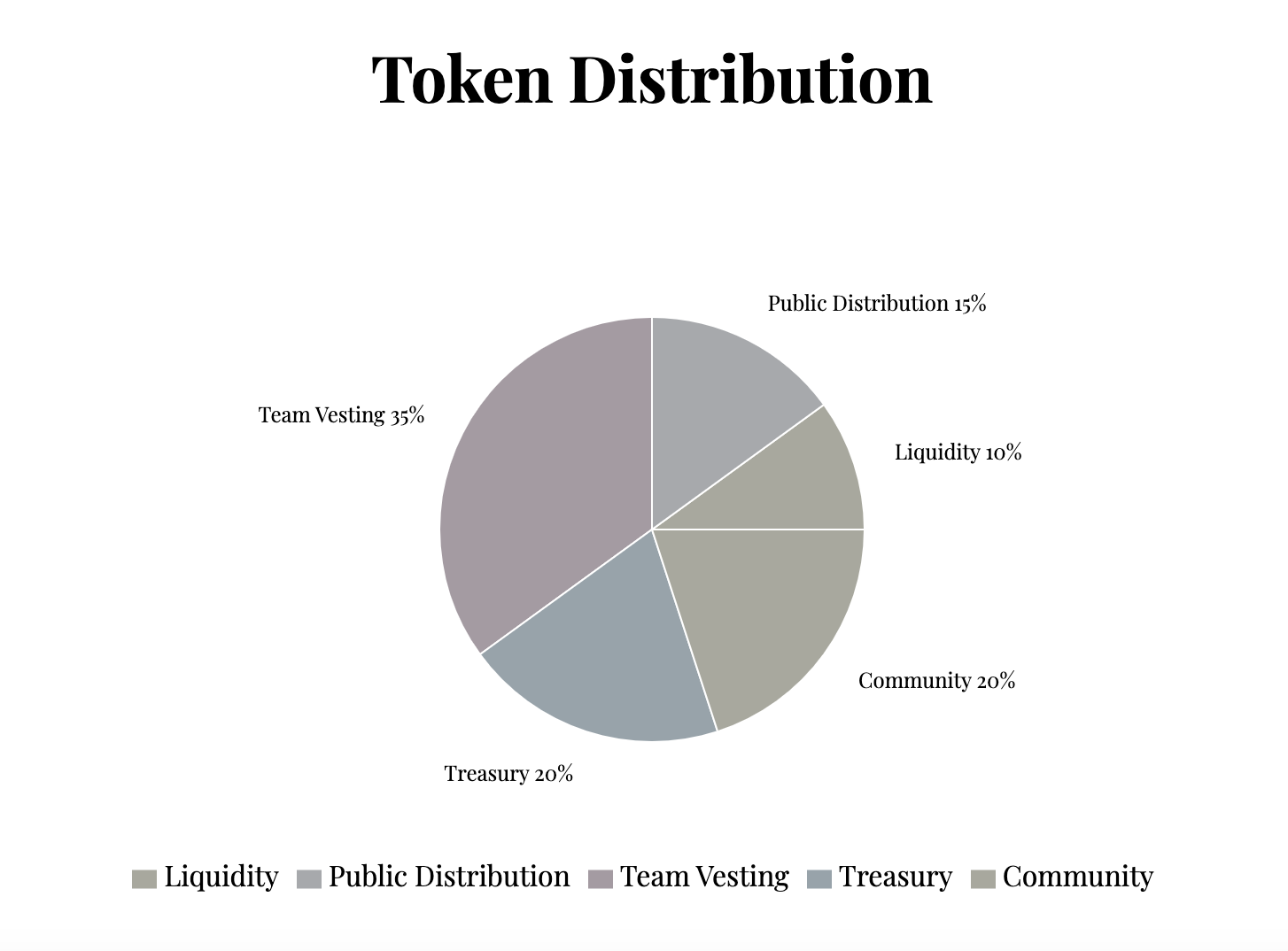

On the other hand, according to the information on the MELANIA official website, the MELANIA token distribution plan is 35% for the team share, 20% for the treasury, 20% for the community, 15% for public issuance, and 10% for liquidity. There are significant differences between MELANIA and TRUMP in the unlocking mechanism. The initial lock-up period for the MELANIA team's token share is only 30 days, while the team share of the TRUMP token needs to be locked for 3 years. At the same time, on-chain analyst Yu Jin pointed out that the value of the team unlocking part in the MELANIA token distribution is suspected to be wrong. According to the official token distribution, the team is allocated 35%, but according to the value in the unlocking rules, it is calculated at 30%. And only 35% of the team has unlocking rules, and the others are not written, which may mean that MELANIA can be 65% in circulation.

Regarding the successive issuance of coins by Trump and his family, Zack Guzmán, founder of the crypto media Coinage, published an analysis that the Trump family quickly launched TRUMP and ELANIA coins before the inauguration ceremony, possibly to avoid unconstitutional risks. According to the emoluments clause of the U.S. Constitution, the president may not seek personal gain from foreign governments. Trump has previously earned about $7.2 million through the NFT project, and his wife Melania has also earned more than $330,000 from NFT sales. Issuing tokens before officially taking office as president can reduce the risk of being accused of violating the emoluments clause.

Messari founder Ryan Selkis publicly called on Trump on social media regarding the launch of MELANIA, suggesting that he fire those who recommended the launch of the Melania project today. He pointed out the following problems: the project team lacks professional capabilities; it may cause significant economic losses and damage to reputation; and the project decision did not fully consider Trump's interests.

"MEME coin is a zero-sum lottery. It does not create wealth. Every buy order is simply matched with a sell order. After the initial surge, the price will eventually plummet, and the last investors to buy will lose everything. If the platform also takes a commission, then it is actually a negative-sum game. If you want to gamble moderately for entertainment, that's fine. If you are a professional trader, that's fine. But most people should buy assets that are long-term stores of value." Balaji Srinivasan, former CTO of Coinbase, advised.

Solana network is overwhelmed with congestion and is under huge stress test

Of course, this craze also brought a huge stress test to the Solana network. The surge in transaction volume caused abnormal congestion in on-chain transactions. Investors raised gas fees to seize the trading opportunity, and even forced mainstream exchanges to suspend Solana network withdrawal operations.

"All our systems are now under extreme load, and the team is working hard to restore normal service as soon as possible." DEX Jupiter said in a post. Solana wallet Phantom also revealed on social platforms that the number of wallet requests per minute has surged to more than 8 million. In the process of trying to stabilize the platform, transactions may not be completed smoothly on the first attempt.

Jito Labs co-founder Buffalu also wrote that Jito Labs' block engine API is experiencing severe service degradation due to unprecedented load levels. Although the Solana network continues to run and process blocks, transactions submitted through Jito Labs services are affected. The engineering team has been working on problem repairs for several hours and will provide the latest progress after full service is restored. According to 21.co strategy analyst Tom Wan, Jito validators' daily tip income reached US$23 million, a record high, higher than when TRUMP went online.

You May Also Like

Bitcoin Has Taken Gold’s Role In Today’s World, Eric Trump Says

Fed Makes First Rate Cut of the Year, Lowers Rates by 25 Bps