Top 3 Emerging Cryptos to Watch: Mutuum Finance (MUTM) Joins Solana (SOL) and Ethereum (ETH)

The post Top 3 Emerging Cryptos to Watch: Mutuum Finance (MUTM) Joins Solana (SOL) and Ethereum (ETH) appeared first on Coinpedia Fintech News

As the crypto market continues to evolve, established giants like Ethereum (ETH) and Solana (SOL) remain core pillars, but cracks are appearing in their trajectories, opening room for new players to climb. Meanwhile, Mutuum Finance (MUTM) is showing early signs of becoming a serious contender. In this article, we compare these three tokens, what works, what limits their upside, and why MUTM may offer one of the most compelling asymmetric upsides right now.

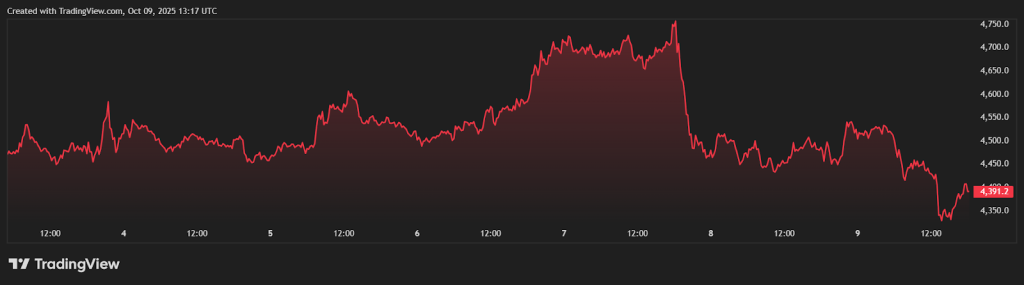

Ethereum (ETH)

Ethereum is currently trading around $4,350, backed by a dominant market cap, strong network effects, and a deeply entrenched role in DeFi and smart contract ecosystems. Its advantages remain clear, extensive developer activity, staking demand, and broad infrastructure adoption keep it at the core of the crypto landscape. However, resistance between $4,800–$5,000 has repeatedly capped rallies, with whale profit-taking (including a recent $72M sell-off) often triggering momentum shifts.

Because of its sheer size, Ethereum’s percentage upside is naturally limited compared to smaller projects. Its market cap already sits in the hundreds of billions, making large multiple gains far harder to achieve. By contrast, Mutuum Finance (MUTM) enters the market at a much earlier stage, where price discovery has far more room to run.

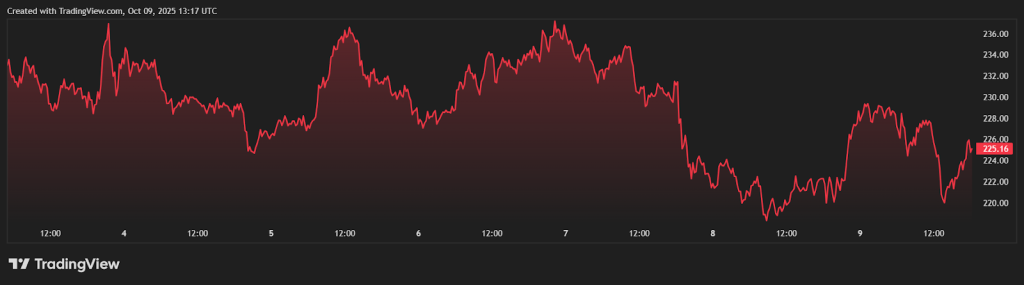

Solana (SOL)

Solana, known for its speed and low transaction costs, remains a major hub for NFTs, gaming, and DeFi activity. It currently trades in the $200–$230 range, with $220–$245 acting as immediate resistance and a longer-term ceiling near $250. Analysts view the $210–$230 zone as a critical battleground for momentum.

However, network congestion, occasional outages, and its growing valuation have started to limit Solana’s explosive potential. Many forecasts see only modest gains unless it can break decisively above $250, with mid-term targets around $260–$300 if that happens.

Mutuum Finance (MUTM)

While ETH and SOL are established names competing on network scale, Mutuum Finance (MUTM) is positioning itself differently, as a DeFi-native lending and borrowing protocol where token value is tied directly to usage.

MUTM’s architecture includes dual lending markets: a Peer-to-Contract (P2C) model for pooled liquidity (ETH, USDT) and a Peer-to-Peer (P2P) model for isolated or niche tokens. This hybrid approach enables broader participation while protecting the core pools from volatility.

On the presale front, MUTM has a structured, fixed-price, staged model. It began at $0.01 in Phase 1 and has climbed to $0.035 in Phase 6, representing a 250% surge from the start. Phase 6 is now over 60% sold with a final listing price locked at $0.06. Early participants are poised for up to 500% token appreciation, while new buyers still have near 2x MUTM upside.

Already, over $17 million has been raised, and more than 750 million tokens are allocated among 16,800 investors. That distribution helps reduce extreme positioning risk and supports healthier post-launch liquidity.

Value Projection & Analyst Opinion

Given ETH and SOL’s large bases, their upside is significant but somewhat constrained in percentage terms. Mutuum Finance, still in its growth phase, has far higher upside potential as long as execution is solid.

Analysts suggest that with a clean rollout and early adoption, MUTM could reach $0.15–$0.25 in the months following listing, roughly 4x–7x from the current presale price. A key part of this outlook is the protocol’s mtTokens, which accrue yield for suppliers as borrowers pay interest, and the buy-and-distribute model, where a portion of platform revenue is used to purchase MUTM on the open market and redistribute it to mtToken stakers, creating continuous buying pressure tied to real activity.

Additionally, the beta platform is scheduled to launch alongside the token listing, giving users immediate access to core lending markets, a rarity among presale-stage projects. Over a 12–24 month horizon, analysts point out that once lending usage scales and these mechanisms function as designed, $0.50–$1.00 remains in view, implying 14x–28x token appreciation, far exceeding most forecasts for SOL or ETH over the same period.

Why MUTM Stands Out

Ethereum will always be a foundational layer; its deep liquidity, broad adoption, and technical dominance make it a core long-term play. Solana offers scalability and ecosystem upside, especially in high-throughput use cases. But both carry the burden of size, expectations, and market positioning.

Mutuum Finance, on the other hand, enters at a moment where the market is hungry for utility-driven tokens that don’t just compete on hype, but on protocol economics. Its early-stage status means more room for growth, and its design rewards actual usage, not sentiment alone.

With Phase 6 rapidly selling out and the pipeline of features ready to launch, MUTM is now in that narrow window where timing and fundamentals align. Looking beyond the giants and focusing on asymmetric upside, experts point out this DeFi crypto protocol stands out as one of the most compelling projects currently flying under the radar.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

You May Also Like

Coinbase Data Breach Fallout: Former Employee Arrest in India Over Customer Data Case Raises Bitcoin Security Concerns

Burmese war amputees get free 3D-printed prostheses, thanks to Thailand-based group