US Bitcoin Miners Face $100M+ in Tariff Liabilities as New Asia Import Duties Take Effect

The United States has finalized steep new tariffs on any goods imported from Asia, imposing a 57.6% rate for machines of Chinese origin and a 21.6% tariff for hardware from Indonesia, Malaysia, and Thailand. The rates, which took effect on August 7, 2025, have pushed large US-based Bitcoin mining companies into potential liability exposure exceeding $100 million as Customs and Border Protection (CBP) pursues claims over imported equipment.

CleanSpark and IREN disclosed receipt of invoices from CBP regarding the alleged Chinese origin of mining rigs imported in 2024. CleanSpark estimates its possible tariff liability could reach $185 million if the agency maintains its position. IREN is contesting a similar $100 million claim, according to TheMinerMag’s July-August report. Both companies are challenging CBP’s assertions, examining their supply chains, and seeking a resolution as the risks to their financial positions rise.

Even with all this happening in the industry, American Bitcoin Corporation is considering purchasing approximately 14 EH/s in Antminer U3S21EXPH machines from Bitmain; the deal is worth close to $320 million. This appears to be part of a new strategy by Bitmain to establish a plant in the US to reduce tariffs on its miners.

Network Hits Record Highs as Miner Profitability Drops

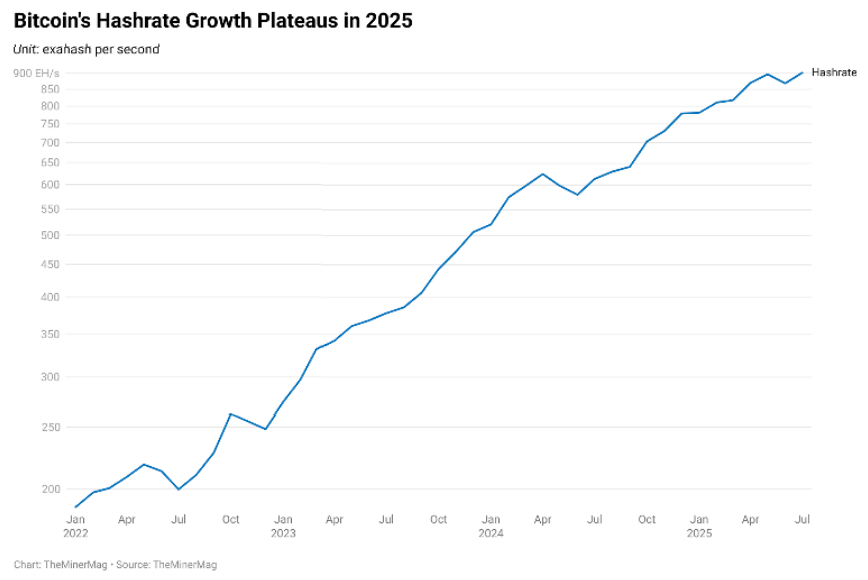

All these challenges for US Bitcoin BTC $114 225 24h volatility: 0.7% Market cap: $2.27 T Vol. 24h: $43.82 B miners come at a moment of historic strength in the network. According to recent data, the Bitcoin network hash rate has rebounded after summer curtailments, hitting a record seven-day moving average above 970 exahashes per second (EH/s) in early August and pushing mining difficulty to an all-time high of 129 trillion.

Graphic of Bitcoin network hashrate vs time. Source: TheMinerMag

The network is now less than 3% away from reaching the one zettahash-per-second (ZH/s) milestone. However, the pace of hash rate growth has slowed, and the compression in miner margins continues. Hashprice stayed below $60/PH/s, even as Bitcoin’s spot price approached $120,000, indicating difficulty growth is offsetting gains in the asset’s price.

Transaction fee revenue for miners also dropped, with July’s fees accounting for less than 1% of total block rewards for the first time in history. Amid these pressures, the four largest public Bitcoin miners—MARA, IREN, CleanSpark, and Canaan—mined 19.07% of all block rewards in July despite three of them operating below 90% fleet utilization.

Bitcoin Miners’ Stocks Show Mixed Market Performance

Stock market performance reflects shifting dynamics within the industry. Shares of TeraWulf surged 50% on news of an HPC deal backed by Google, highlighting investor interest in miners pivoting toward AI and high-performance computing infrastructure as Bitcoin mining becomes less profitable.

Bitfarms posted gains of 23.3%, while IREN and Hut 8 rose 12.2% and 9.7%, respectively. By contrast, companies specializing solely in Bitcoin mining, such as Canaan, MARA, and CleanSpark, posted double-digit stock declines as market apprehension grew over revenue dependency on mining alone.

The evolving tariff regime adds new layers of uncertainty for US Bitcoin miners, especially those with significant infrastructure investments tied to imported machines. With companies now facing possible liabilities in the hundreds of millions of dollars, and given current Bitcoin network and market conditions, the financial calculus for future hardware sourcing and operational expansion is set for recalibration as the US seeks to reshape the sector’s supply chain.

nextThe post US Bitcoin Miners Face $100M+ in Tariff Liabilities as New Asia Import Duties Take Effect appeared first on Coinspeaker.

You May Also Like

BitGo expands its presence in Europe

A Netflix ‘KPop Demon Hunters’ Short Film Has Been Rated For Release