Viralmind: A decentralized AI training protocol leveraging large action models

Author: Emperor Osmo

Compiled by: Felix, PANews

PANews Note: This article only represents the author’s views and does not constitute investment advice, DYOR.

Don’t just look for the most popular AI crypto projects, look for those that have fundamentals to back them up. Below is a detailed analysis of Viralmind, including the services it provides, its fundamentals, and a financial and market analysis of the VIRAL token.

summary

- Viralmind builds Large Action Models (LAMs) that can effectively enhance human-computer interaction in digital environments. Think of LAMs as digital tools that can actually use computers, websites, and documents to perform the exact same actions as you would.

- Viralmind is building a decentralized AI training ecosystem that allows its AI agents to be trained. This removes the inherent bias of centralized AI training models and provides these agents with highly native and highly centralized datasets to train.

- The core of Viralmind is the VIRAL token, which can be obtained through DEX or when training LAM on Viralmind.

- Viralmind is on the edge of an AI ecosystem and market that is expected to reach a trillion dollars. Human-trained AI models are valued at $60 million or more per year.

Overview

Viralmind is an open-source, decentralized collective intelligence platform that aims to truly transform AI agents into human assistants. In short, it is an agent that can operate in a human-like manner in any digital environment. Viralmind's LAM is designed to navigate and operate digital environments in a human-like manner. By leveraging keyboard input, mouse movement, and clicks, these AI agents can perform a wide range of tasks in games, productivity, and other creative fields.

To train AI agents, users can train through Trading Gym, which effectively uses the actions on the screen as training data. This information is then converted into detailed trajectories, enabling the AI agent to learn and improve over time. Viralmind has also introduced a data marketplace where users can trade these datasets to further enhance the overall learning capabilities of the system. A key innovation of Viralmind is the one-click fine-tuning feature that enables users to customize models such as GPT-4o using small datasets. This approach simplifies AI training and enables a large number of users (even those without deep technical expertise) to benefit from it. The system generates structured .jsonl files that capture human behavior and comprehensive reasoning, providing high-quality data for model improvement.

Viralmind's LAM aims to bridge the gap between LLM (Large Language Model) and direct interaction with computers, replacing outdated OCR-based technologies. Viralmind plans to deploy agents on-chain and on desktops, aiming to be seamlessly integrated into games, enterprise software, and blockchain applications. Viralmind is supported by its native token VIRAL, which incentivizes users to provide high-quality training data, participate in competitions, and promote the development of Viralmind's growing AI ecosystem.

Viralmind reinvests revenue generated by large-scale models into marketing and development, creating an efficient and self-sustaining economy that rewards contributors and supports the long-term growth of the platform.

Products/Services

Viralmind's main product is VM-1, a LAM that reflects human behavior in digital environments. As an advanced LAM, VM-1 enables AI agents to play games, complete tasks, and navigate complex interfaces through smooth, human-like interactions.

The VM-1 ecosystem will have two different tiers:

Open Source Small Models: These models are compact and efficient, meeting the needs of developers who want to enhance existing pipelines by replacing OCR modules. They can be used as plug-and-play extensions for any LLM, enhancing its capabilities without the need for full LAM training.

Base LAM via API: The large VM-1 models available via API are trained on millions of runs and are suitable for a wide range of applications from gaming and work automation to streaming. Their use is backed by VIRAL tokens, and fees will be reinvested in marketing and growth, ensuring the ecosystem is self-sustaining.

Viralmind has also entered into strategic partnerships with gaming studios, enterprise software providers, and crypto platforms to expand the reach of VM-1. These collaborations will integrate VM-1’s capabilities into the broader AI ecosystem, thereby enhancing the adoption and potential of the agent framework.

Why VM-1?

- For Gamers: VM-1 agents can seamlessly play games with users, engaging in cooperative, competitive, or creative play. Users can train their agents to master specific games, genres, or strategies using personalized data.

- For professionals: VM-1 can replace repetitive manual tasks such as form filling and document processing, streamlining workflows in real-world scenarios.

- For developers: Developers who lack the resources to train a full LAM can leverage VM-1’s smaller model to upgrade existing tools and frameworks. Additionally, Viralmind allows users to train their own AI agents, bridging the gap between text-based LLMs and real-world computer interactions.

Community sentiment

Viralmind did not achieve viral marketing like other projects. Viralmind does not have a Discord, but has a Telegram channel with over 1.1K members currently. The existing community has a deep understanding of Viralmind's products. Viralmind is not currently listed on GoatIndex, but is listed on Cookie.fun.

Market Analysis

Having large datasets is fundamental to training AI models. Viralmind is at the heart of this training while incentivizing user participation, effectively allowing training to take place on a wider scale while also making it highly native to individual users. AI agents and models can typically be trained through centralized approaches, but this limits the AI's ability to understand the highly centralized needs of users. Additionally, centralized AI training models also absorb the biases of the institution/organization/individual that built it. This is where decentralized AI training models like Viralmind are needed. Viralmind is not the only project building distributed AI training.

FLock.io is also building custom and highly centralized AI models that can be trained by users. They have a similar, community-engaged AI training model where users can help train AI models on Flock. These models can then be commissioned by individuals or organizations. In this case, the FLOCK token has similar utility to the VIRAL token.

Sapien AI also provides the ability to train AI models based on participating users. In return, these users can receive rewards. But unlike Viralmind, Sapien provides AI training LLM for institutions/enterprises.

Prime Intellect is similar to bringing together researchers, users, and anyone interested in training AI models. It allows anyone to contribute capital, computing, or code to build these models. However, in contrast to Viralmind, Prime Intellect seems to limit the users who can join in training AI models.

DecentrAI also provides decentralized training. Users can take on responsibilities such as training models, quality checks, etc. DecentrAI is still in the development stage.

Prometheus-X also helps in decentralized AI training. But this solution is not based on blockchain technology. They are still in a very early stage of relying on users for decentralized AI training.

Looking at the existing small-scale AI training landscape, we can understand the need and importance of decentralized AI training models. Even some larger LLMs projects have reached an agreement with Reddit to use its content and data to train models. The amount of these transactions is more than 60 million US dollars per year. Therefore, the market size of AI training models is huge and the demand is growing.

Estimated potential market size of Viralmind:

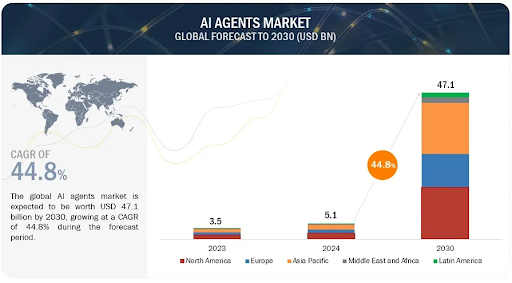

While the entire AI market is worth trillions of dollars, Viralmind captures only a relatively small but very important part of it – training. Its LAM will also play a key role in shaping the way humans interact with AI in the future, especially with AI agents. The AI agent market is expected to grow to $47 billion by 2030.

Even if it only has 1% of this market, it means $470 million. In addition, the market value of the decentralized AI ecosystem is only $6 billion and is expected to grow rapidly.

Financial Analysis

The core of the Viralmind protocol is the VIRAL token. Here are its two main functions:

- User-oriented LAM training incentive mechanism

- VIRAL token staking to participate in the competition

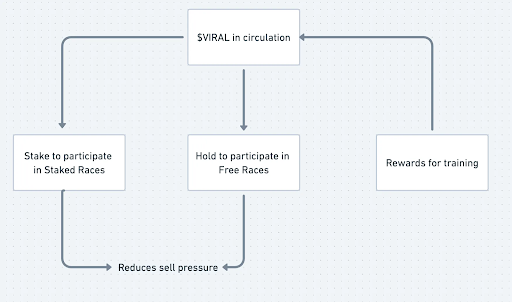

As part of training these models, the VIRAL tokens issued can be further used to participate in free or staking competitions. In the former, users receive rewards from the Training Gym library. These rewards are then distributed to users who complete the tasks. In the staking competition, users can receive:

Rewards = (total stake deposited by users + stake forfeited by losing users) - 5-10% protocol fee which is sent to their treasury.

Additionally, users must maintain a certain amount of VIRAL tokens in their wallets to participate in the free contest. This adds another layer of utility to the VIRAL token.

VIRAL Token Details:

- Circulating Supply: 965,888,531

- Max Supply: 1,000,000,000

- Market value: $14 million

- Total number of holders: 3,000

- Smart Wallet Holders: 5

- KOL/VC wallet holders: 22

- Whale: 86

AI Market Leader AIXBT Token Details:

- Market value: $573 million

- Circulating Supply: 855,612,732

- Max Supply: 1,000,000,000

VIRAL / AIXBT market cap ratio ⇒ 2.4%

Considering its limited share in the wider AI ecosystem, a 2.4% market ratio is “healthy” for a project that has just launched. In addition, the selling pressure of non-circulating tokens only accounts for 3-4% of the total selling pressure. This highlights the strong fundamentals of the VIRAL token, further strengthening its performance in the coming weeks/months.

Related reading: AI Agent track rebounds strongly, here are 10 emerging AI Agent projects that have attracted much attention

You May Also Like

SEC urges caution on crypto wallets in latest investor guide

Crucial Fed Rate Cut: October Probability Surges to 94%