'We Are Still Early': Morgan Stanley's Intern Survey Reveals as Crypto Interest Lags Behind AI & Robots

The phrase "we are still early" remains a popular sentiment in the crypto community in 2025, suggesting that despite bitcoin's (BTC) price surpassing $100,000, the overall adoption of digital assets is still in its infancy.

Morgan Stalney's recent survey of financial professionals confirms this sentiment. The investment banking giant surveyed more than 500 summer interns in North America from June 10 to 27, and 147 summer interns in Europe from June 26 to July 7.

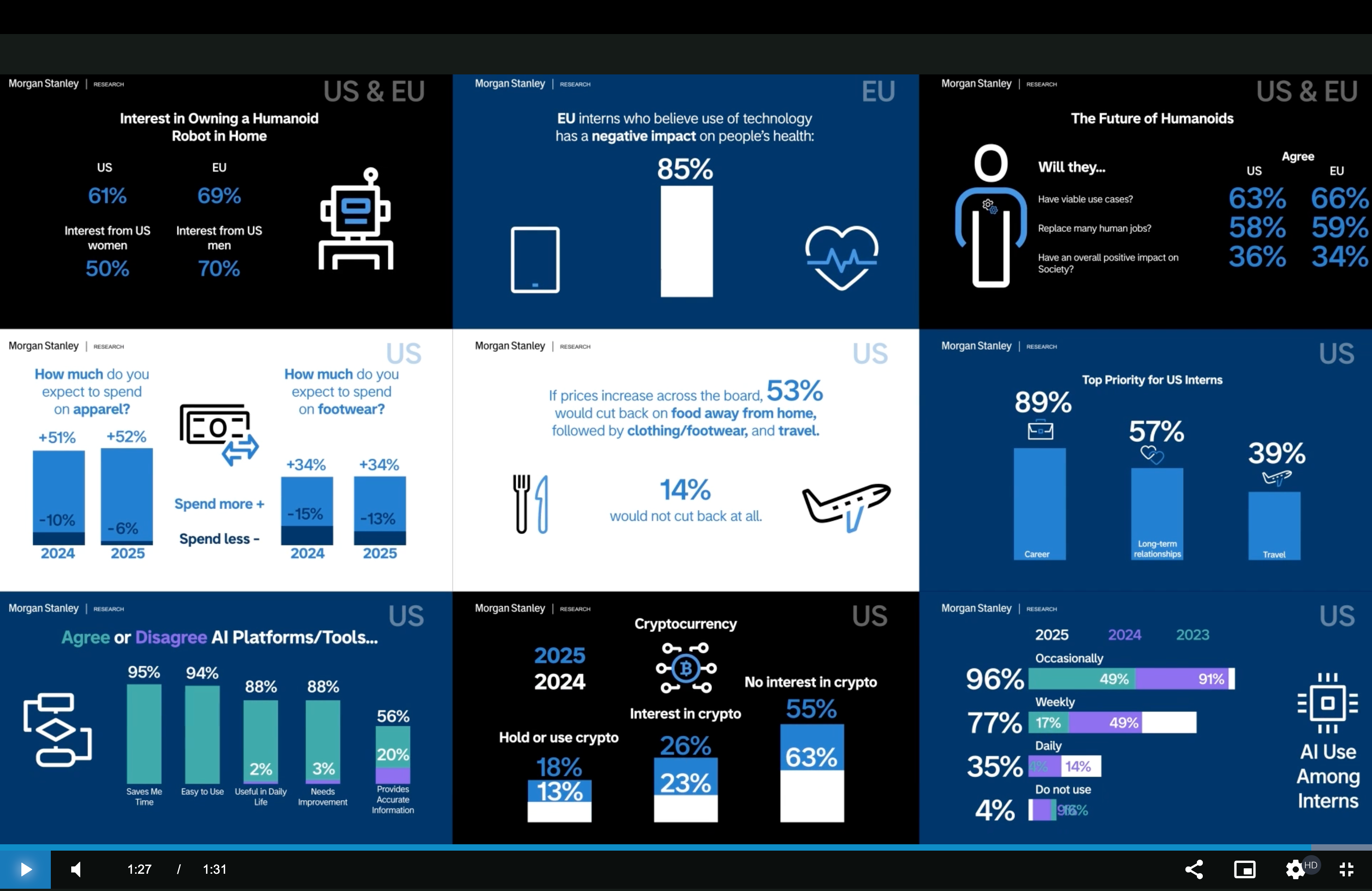

The survey revealed that only 18% of interns own or use cryptocurrencies, increasing from 13% the previous year. Meanwhile, the percentage of interns interested in digital assets has risen to 26% from 23%. Meanwhile, 55% still do not care for digital assets, a majority, although the number has receded from 63% last year.

The widespread lack of interest appears significant, especially considering that BTC has already gained acceptance on Wall Street through the introduction of ETFs.

The 11 spot BTC ETFs have amassed $53.7 billion in investor wealth since their debut in January last year, according to data source Farside Investors. Ether ETFs have registered an inflow of $12.4 billion. Corporations are rapidly adding both assets to their balance sheets.

BTC's price has surpassed $100,000 this year, gaining a foothold in institutional investor portfolios. Ether hit a record high of over $4,800 on Friday.

More open to AI

The survey revealed a clear adoption of artificial intelligence (AI) by future finance industry leaders, with 96% of U.S. interns and 91% of their European counterparts reporting the use of technology at least occasionally.

The consensus is that AI is effective, with nearly all respondents agreeing they "save me time" and are "easy to use". However, 88% of interns also had a nuanced view, believing the technology still "needs accuracy improvement."

The widespread adoption is consistent with the sentiment on Wall Street, where the Mag 7 firms are expected to spend $650 billion in capital expenditures and research and development this year.

Trillion dollar humanoids market

The survey revealed that most interns are interested in owning humanoids, or sophisticated machines designed with a human-like form and capabilities, but are cautious about their impact on society.

Over 60% of U.S. interns and 69% of European interns expressed interest in having a humanoid at home, with both regions believing the robots will have "viable use cases" and replace many human jobs.

Still, only 36% of U.S. interns and 24% of Europeans agreed that humanoids will have a positive impact on society.

Morgan Stanley estimates that the humanoid market could surpass $5 trillion by 2050, including sales from supply chains and networks for repair, maintenance and support.

"Although humanoids are still under development, there could be more than 1 billion by 2050, with 90% used for industrial and commercial purposes," the investment banking giant said in a report in May.

You May Also Like

BitGo expands its presence in Europe

Top political stories of 2025: The Villar family’s business and political setbacks