Which Of These Could Rally 30x In October & Tipped As The Best Crypto To Buy Now: AVAX, ONDO, SUI Or RTX

Miss early entries and you may spend Q4 chasing green candles. AVAX, ONDO, SUI and the breakout RTX token are the names traders are watching for a possible 30x.

Momentum is alive and hesitation is costly. Choose wisely, because the best crypto to buy now will not wait for late money.

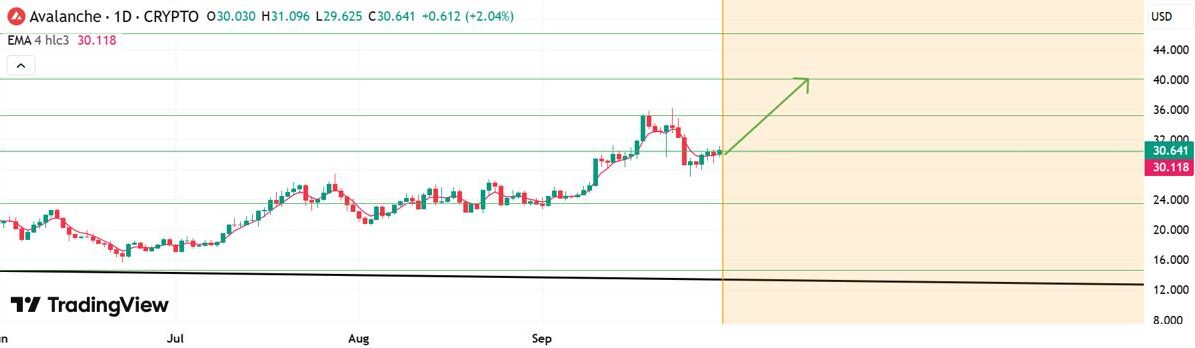

Avalanche (AVAX): Breaking Toward Resistance

AVAX trades around $30 today. Bulls are testing $33 to $34, with a clean break opening a path toward $40. Failure to hold could revisit $28 to $26. Narrative support remains strong after a treasury rebrand signaled large capital interest in accumulating AVAX.

AVAX is a credible contender for traders chasing the best crypto to buy now, but it still needs sustained network demand to punch through resistance with conviction.

ONDO Finance (ONDO): Quiet Strength In RWA

ONDO is priced near $0.89 to $1.09. The real world asset story is intact, with deeper liquidity partnerships and institutional attention. A push above $1.16 could invite a run toward $2.10, while a slip under $0.80 risks a deeper pullback. If the RWA bid accelerates, ONDO can ride it. ONDO offers steady fundamentals, but it may not be the sharpest October upside on this list.

SUI: Volatile Layer 1 Under Pressure

SUI trades around $3.10 to $3.38 after a choppy week that erased 15 to 20 percent. Support near $3.10 is critical; lose it and pressure increases. Recover momentum and models point to $4.50 potential. Developer updates and partnerships keep SUI interesting, yet it remains sensitive to risk cycles. SUI can work for traders, but it is hard to call it the best crypto to buy now while the trend is undecided.

Remittix (RTX): PayFi Utility That Investors Are Front-Running

RTX is approximately $0.1130 and built for payments that actually move. The protocol targets crypto to bank transfers, real-time fiat conversion and multi-chain flexibility across dozens of corridors. The wallet is in live beta with community testers.

On security, the project carries formal recognition on CertiK, which strengthens confidence as listings approach. For many hunting the best crypto to buy now, this blend of price, product and verification is exactly what sparks 30x narratives.

Why RTX is pulling buyers today

- Users can send value to bank accounts across 30 plus countries.

- The stack prioritizes utility and real transaction volume.

- Deflationary token design supports patient holders.

- Business friendly APIs aim to onboard real merchants and liquidity.

AVAX has momentum, ONDO owns a serious RWA lane and SUI can rebound fast. But RTX combines a low entry price, live product progress and recognized security status that buyers crave in a breakout month. If October delivers a 30x headline, the best crypto to buy now case tilts toward the project already turning interest into adoption.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250K Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post Which Of These Could Rally 30x In October & Tipped As The Best Crypto To Buy Now: AVAX, ONDO, SUI Or RTX appeared first on Coindoo.

You May Also Like

The Channel Factories We’ve Been Waiting For

Onyxcoin Price Breakout Coming — Is a 38% Move Next?