Who Really Profits From Meme Coins? Galaxy Says It’s Not the Traders

A new Galaxy Research report finds that the primary beneficiaries of the meme coins are not the traders, but the infrastructure providers.

Platforms such as launchpads, decentralized exchanges (DEXs), and automated trading bots capture substantial revenues. Meanwhile, the majority of individual participants incur losses in what is called a zero-sum game with negative expected value (EV).

The Meme Coin Paradox: Mass Participation, Concentrated Profits

Meme coins, often described as tokens created around internet jokes or cultural trends with no utility, have been around for over a decade. Notably, the surge in popularity and ease of creation has sparked a full-scale boom. Millions of new tokens have flooded the market in the past few years.

Traders are frequently drawn to this space by the promise of quick profits. Nonetheless, Galaxy Digital noted that,

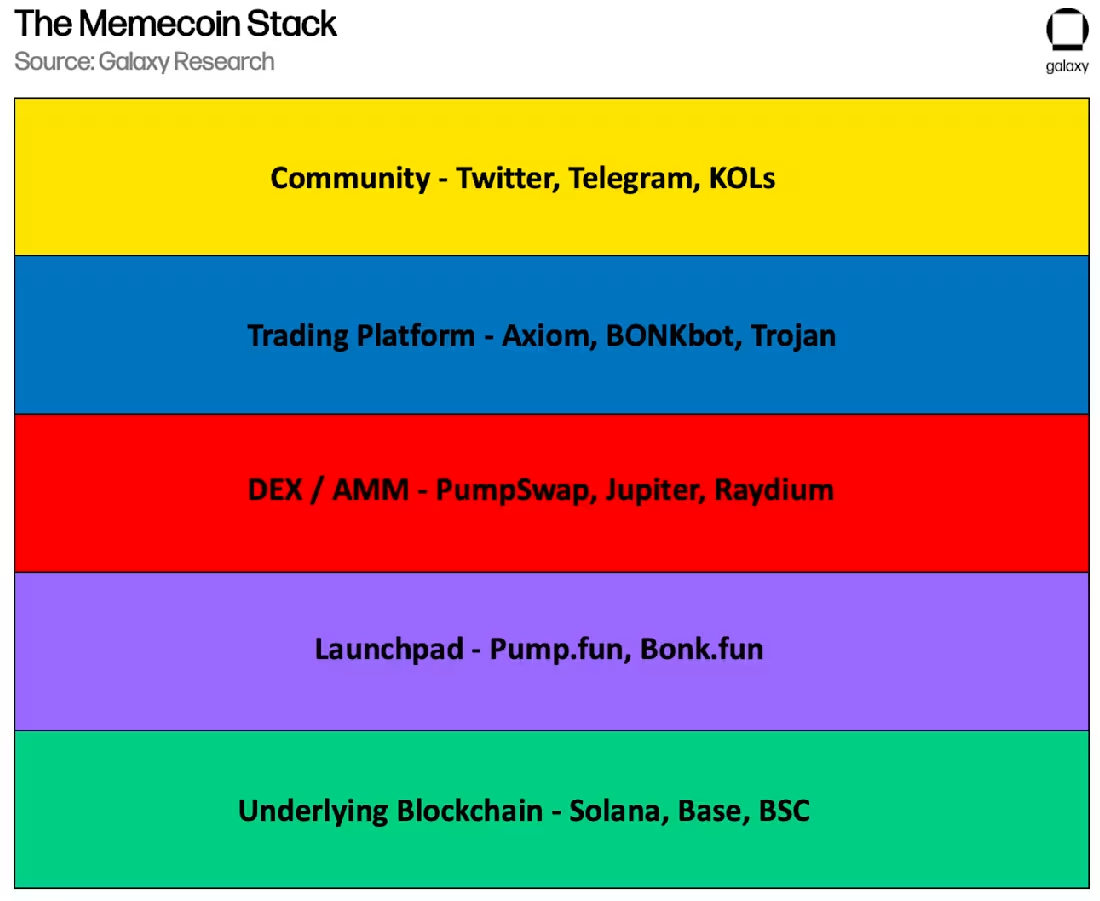

In the latest report, Galaxy Digital’s research analyst Will Owens explained that the meme coin ecosystem functions as a stack. Here, the flow of money is mostly concentrated in the infrastructure that supports creation and trading.

Meme Coin Ecosystem Structure. Source: Galaxy Digital

Meme Coin Ecosystem Structure. Source: Galaxy Digital

At the base level, blockchains like Solana dominate. It hosts over 32 million tokens, a more than 300% increase since early 2024. The blockchain accounts for 56% of the 57 million meme coins across major chains, including Ethereum, Base, and BNB Chain.

Solana’s low fees and high throughput have made it the preferred venue, with meme coins accounting for approximately 20- 30% of its DEX trading volume, down from 60% in January.

Next, launchpads form a critical layer, enabling rapid token deployment. Solana’s Pump.fun, which debuted in early 2024, exemplifies this trend by industrializing the process through bonding curves that guarantee liquidity at minimal cost.

The platform has created about 12.9 million tokens, which make up 40.31% of the total 32 million Solana tokens. Tokens launched on Pump.fun boast an aggregated fully diluted market cap (FDMC) exceeding $4.8 billion, though this peaked above $10 billion earlier in the year.

Furthermore, Pump.fun has generated significant fees from creation and trading. In summer 2024, it briefly lost ground to competitors like LetsBonk. Nonetheless, the launchpad reclaimed dominance through innovations such as Project Ascend, which introduces dynamic fee models for creators, and integrations with streamers for interactive launches.

Meanwhile, DEX aggregators and automated market makers (AMMs) like Jupiter, Raydium, Orca, and Pump.fun’s in-house PumpSwap further extract value by handling immediate post-launch trading. These platforms benefit from high volumes, with meme coins fueling user acquisition and ecosystem growth.

Trading bots, including Axiom, BONKbot, and Trojan, enhance this by enabling sniping—purchasing tokens at inception—and rapid execution, contributing to a hyper-competitive, player-versus-player (PvP) environment.

Lastly, token deployers, insiders, and key opinion leaders (KOLs) also reap rewards. Developers and insiders often retain large supply portions in hidden wallets, dumping into retail liquidity for gains. KOLs on platforms like X amplify narratives through coordinated campaigns.

Key Crypto KOLs on X. Source: Galaxy Digital

Key Crypto KOLs on X. Source: Galaxy Digital

Are Retail Traders the Biggest Losers in the Meme Coin Boom?

In contrast, most traders face structural disadvantages. The report revealed that the median hold time for Solana meme coins is around 100 seconds. This is quite a drop from 300 seconds a year prior.

Risks abound, including honeypots—tokens that allow buys but block sells—rug pulls, where insiders withdraw liquidity, and vamping, where copycats siphon value from originals. High-profile incidents, such as the LIBRA token incident, have resulted in millions in trader losses while insiders profited.

This ecosystem paradox highlights a broader trend: while meme coins serve as onramps to cryptocurrency, drawing new users into wallets and DEXs, the speculative frenzy primarily enriches a concentrated group of infrastructure owners.

For most participants, trading remains negative EV. Thus, meme coins may look like a casino, but it’s the house — not the players — that always wins.

You May Also Like

Lucid to begin full Saudi manufacturing in 2026

Exploring Market Buzz: Unique Opportunities in Cryptocurrencies