Why Bitcoin Dropped Below $110K — The Surprising Reasons Revealed

Certainly. Here’s the rewritten article with the specified enhancements and structure, including an added introductory paragraph to provide context:

—

Cryptocurrency markets continue to grapple with a complex mix of macroeconomic signals, regulatory uncertainties, and investor sentiment shifts. Despite anticipation of a post-options expiry rally, Bitcoin has struggled to regain critical levels amid rising traditional safe-haven assets and cautious Federal Reserve outlooks. Meanwhile, regulatory scrutiny on crypto treasury holdings adds further uncertainty to an already volatile environment.

- Strong U.S. economic data and rising gold prices divert investor attention from Bitcoin’s upside potential.

- Regulatory investigations and unclear plans for a U.S. Strategic Bitcoin Reserve suppress Bitcoin’s market performance.

- Bitcoin fails to hold its target levels despite favorable macro trends, weighed down by regulatory and policy uncertainties.

Bitcoin (BTC) failed to reclaim the $110,000 mark on Friday, despite growing expectations among traders following the monthly BTC options expiry. The anticipated post-expiry rally faded as bearish momentum persisted, driven by robust macroeconomic data and looming regulatory concerns targeting key crypto treasury companies.

The U.S. Commerce Department reported Friday that the Personal Consumption Expenditures (PCE) price index increased by 2.7% in August compared to the previous year, aligning with economists’ projections. Persistent inflationary pressures continue to prompt the Federal Reserve to maintain a cautious stance regarding interest rate cuts.

Bitcoin struggles amid rising gold and positive economic indicators

Market participants have tempered their expectations for a reduction in interest rates to 3.75% or lower later this year, according to futures markets. The CME FedWatch tool indicates a 67% implied probability of two 0.25% rate cuts before year-end, down from 79% a week prior. As gold prices surged to $3,770 on Friday—just half a percent shy of its record high—investors turned attention toward traditional assets seen as safe havens amid rising macroeconomic uncertainty.

Implied odds for Dec. 10 US Fed meeting. Source: CME FedWatchThe S&P 500 experienced gains on Friday after reports showed U.S. consumer spending grew by 0.6% for August. Economists had anticipated a slowdown in spending due to rising prices and concerns over an weakening labor market, according to Yahoo Finance.

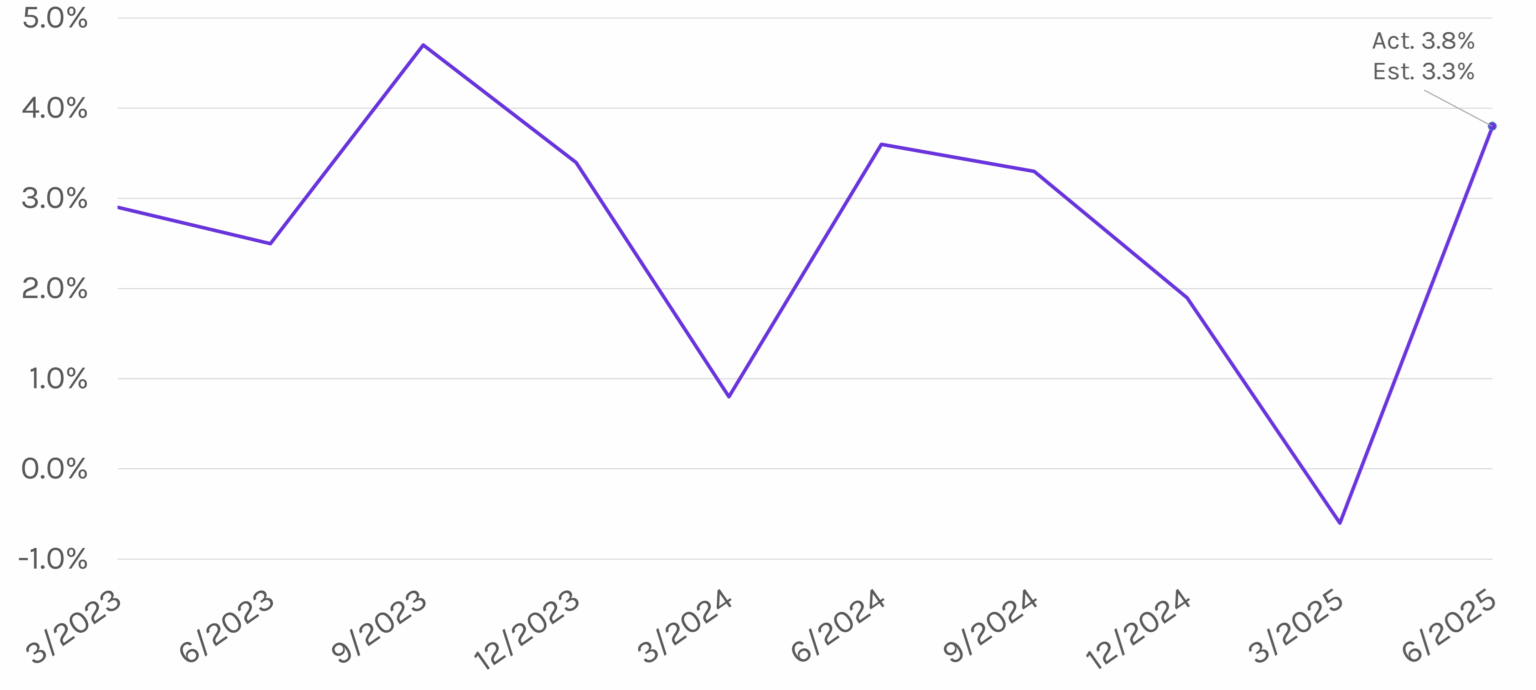

US annualized gross domestic product (GDP) growth. Source: DerivativePath

US annualized gross domestic product (GDP) growth. Source: DerivativePath

Such resilient economic growth tends to bolster stock markets by supporting corporate earnings and reducing perceived risk, even as trade tensions escalate with new tariffs, including a 100% duty on certain pharmaceuticals introduced by the U.S. government.

Regulatory headwinds and lack of transparency disrupt Bitcoin’s momentum

Largest Bitcoin holdings by public companies. Source: Bitbo.io

Largest Bitcoin holdings by public companies. Source: Bitbo.io

Increasing regulatory scrutiny adds further pressure on Bitcoin’s price. A recent Wall Street Journal report revealed that several crypto treasury firms have been contacted by U.S. regulators regarding unusual trading activity preceding corporate disclosures. Concerns over compliance with securities laws and the prohibition against disclosing material nonpublic information have sparked speculation about potential investigations.

Former SEC enforcement attorney David Chase noted, “It’s typically the first step in an investigation. Whether it leads to a full inquiry, nobody knows.” Meanwhile, traders remain frustrated by the lack of concrete steps regarding the U.S. Strategic Bitcoin Reserve, first announced in March but yet to see any actionable progress or audits of the government’s holdings.

In conclusion, Bitcoin’s recent price action is being shaped by macroeconomic tailwinds supporting equities, coupled with mounting regulatory uncertainties and an opaque stance on U.S. crypto reserves. These factors collectively dampen investor enthusiasm, keeping the world’s leading cryptocurrency under pressure despite favorable underlying macro trends.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of any organization or publication.

—

If you need further modifications or focus areas, please let me know.

This article was originally published as Why Bitcoin Dropped Below $110K — The Surprising Reasons Revealed on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

The Channel Factories We’ve Been Waiting For

Successful Medical Writing from Protocol to CTD Training Course: Understand International Guidelines and Standards (Mar 23rd – Mar 24th, 2026) – ResearchAndMarkets.com