XRP in-depth analysis: from technology to meme coin trading guide

Original author: Ignas | DeFi Research

Compiled by: Yuliya, PANews

In the current cryptocurrency market, a remarkable phenomenon is taking place: XRP has skyrocketed 3.5 times in just one month, and its market value has even surpassed Solana. This dramatic market performance once again confirms the unpredictability of the cryptocurrency market.

Although XRP has been controversial in the cryptocurrency community, market choices often transcend personal biases.

As the meme coin market flourishes, the XRP ecosystem could become an important battleground for a new round of speculative craze.

This article will deeply analyze the operating mechanism of XRP Ledger (XRPL), token trading methods, core concepts, and in-depth research directions.

What is XRPL?

XRP Ledger bills itself as a blockchain platform that pursues speed and efficiency.

However, in reality, it is not optimal in terms of speed, decentralization, and efficiency (especially efficiency, which is still controversial).

Unlike blockchains that use PoW or PoS, XRPL uses a federated consensus mechanism, where validators can reach transaction consensus without mining or staking.

The specific operating mechanism is as follows:

The entire network has more than 109 validators processing transactions, of which 31 trusted validators form the Unique Node List (UNL) for consensus. These validators include Arrington XRP Capital, Bifrost Wallet, Ripple, and XRPscan.

While any entity can theoretically run and issue UNL, this mechanism of relying on UNL actually brings centralization risks, because Ripple and the XRP Ledger Foundation largely control the selection of the default UNL. New validators usually need to be approved by Ripple Labs, which is the origin of the name "federated consensus".

XRP's transaction confirmation time is 3-5 seconds. In comparison, Solana is far ahead in terms of node number, transaction speed, and smart contract capabilities. However, XRP's transaction fee is almost zero, only 0.00001 XRP per transaction.

Trust Lines, Reserves and Rippling Mechanism

Wallet Activation and Reserve Requirements

When creating a wallet in the XRPL ecosystem, there are some unique requirements to be aware of:

An account activation requires at least 10 XRP as a base reserve. In addition, for each token held, the system requires an additional 2 XRP to be locked as an owner reserve. For example, if you hold 20 Meme coins, you need to lock an additional 40 XRP.

There is currently a governance vote underway to propose reducing these requirements by a factor of ten. Users can view the current specific requirements under the "base reserve" and "owner reserve" tabs in XRP Scan.

Trust Lines Mechanism Analysis

Trust Lines is the infrastructure used by XRPL to hold homogeneous tokens. According to Ripple's official documentation: "Trust lines enforce the rules of XRPL to ensure that others are not forced to hold unwanted tokens. This precaution is critical to achieving use cases such as XRPL's community credit."

The core values of Trust Lines are:

-

Preventing forced acceptance of spam tokens

-

Allows freezing and authorization controls to be implemented

-

Support "No Ripple flag" to prevent accidental balance adjustments

When a token issuer creates a token, its balance may become negative, indicating the amount issued, while the holder's balance is positive. For example, after the issuer sends 100 tokens, its trust line balance is -100, and the receiver's balance is +100.

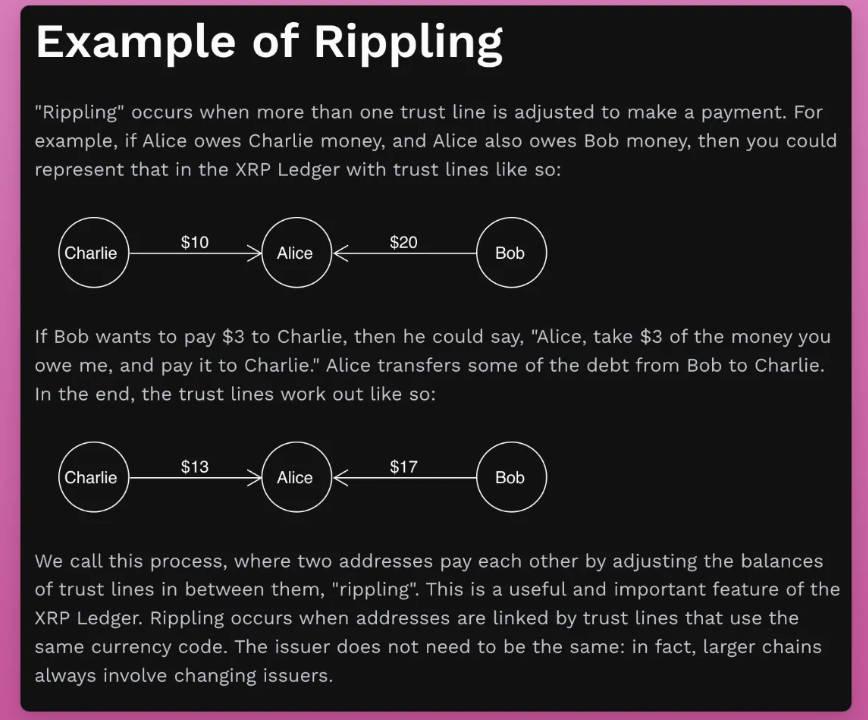

Rippling Mechanism Explained

Rippling (which is where the name Ripple comes from) takes this concept a step further by allowing token balances to flow automatically through connected accounts during the payment process. This is a passive exchange system that allows atomic settlement without the involvement of the issuer.

For example: if Alice owes Bob $10, and Bob owes Charlie $10, the rippling mechanism allows Alice to pay Charlie directly while automatically adjusting the balances on all trust lines.

This design is similar to a double-entry accounting system and is primarily used for:

-

Achieve efficient net settlement

-

Backed by Real Assets (RWA)

-

Stablecoin trading

-

Tokenized Commodities

-

Cross-border payments

This design gives asset issuers greater control. In particular, in terms of compliance requirements, authorized Trust Lines issuers can enable the "Require Auth" flag to limit token ownership to approved accounts. This makes XRPL particularly suitable for assets that require strict KYC/AML supervision.

Although this centralized control may draw criticism from supporters of decentralization, it is precisely the unique advantage of XRPL in specific application scenarios.

After understanding how Rippling works, users can choose to enable or disable this feature according to their needs:

Enable Rippling Fit:

-

Users who wish to use their account as part of a payment routing

-

Accounts acting as intermediaries, such as market makers or exchanges (it is not yet clear whether fees can be earned through this feature)

Disable Rippling Fit:

-

Users who do not want their balance to be used for payment routing

-

Ordinary users who want to protect their assets from unexpected adjustments

It is important to note that every time a trust line is established (such as establishing a connection with the issuer of a meme coin), 2 XRP needs to be locked in the wallet as a reserve.

XRPL’s Technical Evolution: From Hooks to EVM Sidechains

Compared with Ethereum's EVM, Solana's SVM, or Aptos' Move VM, XRPL takes a different technical route. It uses a Hooks system based on WebAssembly, which is a lightweight transaction logic program.

Hooks System

Hooks are XRPL’s unique answer to smart contracts. Interestingly, they are currently running on the Xahau network (a fork of XRPL) rather than the XRPL mainnet. Hooks can add additional logic before and after transactions, such as:

-

Stop fraudulent payments

-

Automatically save XRP

-

Adding carbon offsets to transactions

It is worth mentioning that Uniswap v4 also uses a similar hooks mechanism to add additional functions before and after transactions and support features such as limit orders.

EVM Sidechain: Expanding the XRPL Ecosystem

Although XRPL already has native AMM functionality that supports liquidity provision and cross-token transactions, Ripple is developing an EVM sidechain to enable more efficient capital flows with other chains and DeFi applications.

Key Features

-

Currently in testing phase

-

Expected to be launched in a few months

-

XRP will be used as a gas token

-

Using Axelar as a cross-chain bridge solution

Community controversy

The XRPL community is divided on the technical route:

-

Some people hope to implement the Hooks function in the main network

-

Doubts about the necessity and role of EVM sidechains

It is worth noting that the bridge between EVM and XRPL is powered by Axelar. If this ecosystem develops smoothly, Axelar may become a major beneficiary.

Future Outlook

XRPL is moving towards modularization, which represents an important technological turning point. The development trend of the EVM sidechain will be a focus worthy of attention, which may bring new application scenarios and development opportunities for XRPL.

These technological innovations will bring more possibilities to XRPL, especially in the field of DeFi. As the ecosystem continues to develop, we may see more innovative application scenarios emerge.

A Complete Guide to Trading Meme Coins on XRP

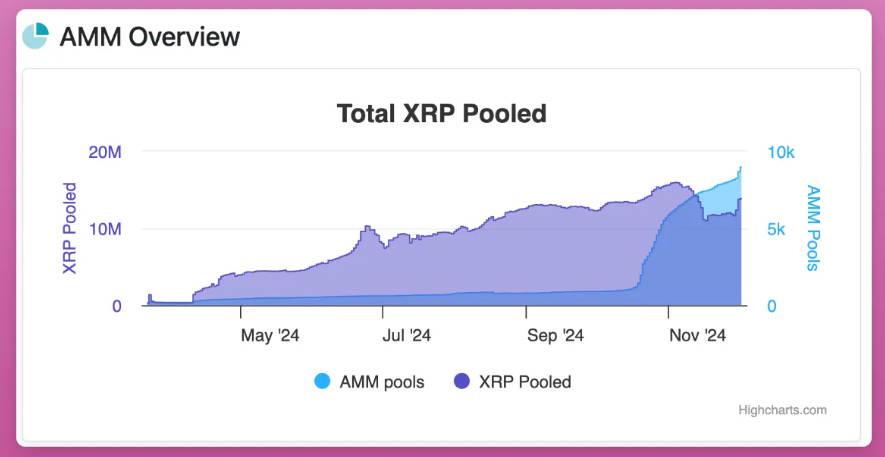

XRPL has a built-in AMM (automatic market maker) function and is currently mainly used for Meme coin transactions.

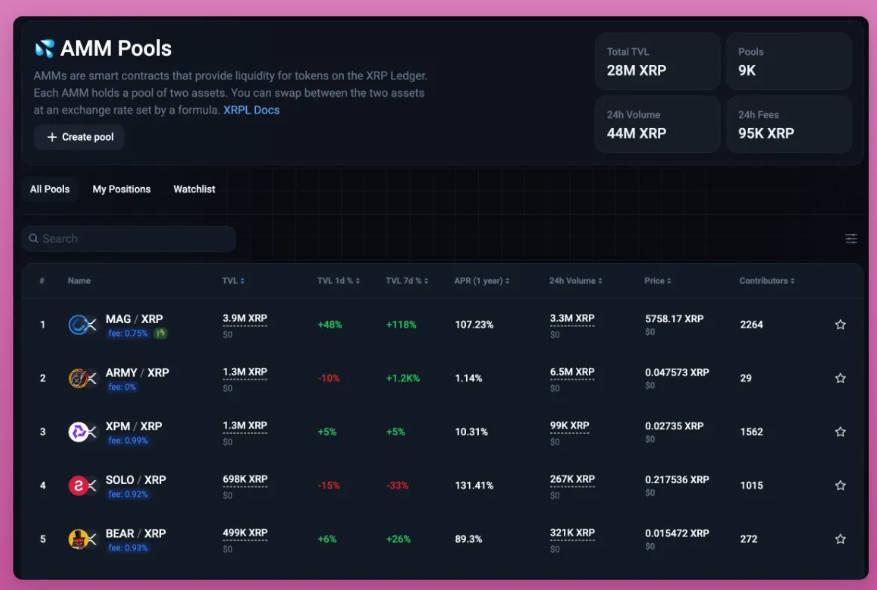

About 14 million XRPs are deposited in the AMM pool. Although the TVL is relatively low, the trading volume continues to rise due to the Meme coin craze. (You can view the pool lock-up amount through XRP Scan.)

Getting Started

1. Wallet selection

-

Visit the First Ledger website to create a wallet via Telegram, or create it directly in your browser and save your keys locally.

-

Alternatively, try the Xaman wallet on mobile. It works well and you can import keys between both wallets to see which one works better for you.

2. Get XRP

Buy from a centralized exchange or use the Simpleswap cross-chain bridge.

3. Trading Platform

-

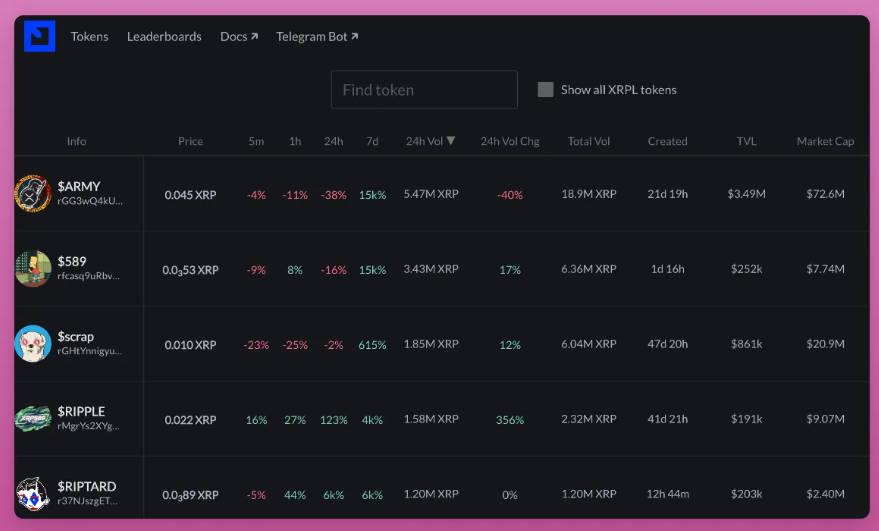

The First Ledger token list is updated in real time and can be sorted by 24h trading volume, market value, number of holders and creation time.

-

xMagnetic (Advanced Platform) provides token discovery, liquidity provision and data analysis functions, and is recommended to be used with the Xaman wallet.

-

Sologenic DEX can be used as an alternative trading platform, but the user experience may not be as good as the above platforms. It is recommended to use Xaman wallet together with xMagnetic.

Risk Warning

Most Meme coins are controlled by a few wallets, and it is common for 10 wallets to hold more than 40% of the supply. Pump.fun is really needed on XRPL to make token issuance more fair. Pay attention to early projects, pay attention to transaction volume, check the distribution of holders, and be cautious about new coins.

Investing in Memecoin requires caution, risk control and sufficient research. Remember: you must understand the fundamentals of the project before trading and avoid impulsive investment.

You May Also Like

SEC urges caution on crypto wallets in latest investor guide

Crucial Fed Rate Cut: October Probability Surges to 94%