What is RECALL? Quick Overview

RECALL is a decentralized skill-market token launched to power the RECALL ecosystem, which focuses on ranking, evaluating, and rewarding the best AI agents. At its core, RECALL was designed to address the problem of information fragmentation and centralized gatekeeping in the AI space. Unlike traditional AI marketplaces, RECALL leverages a reputation protocol and community-driven incentives to create a more transparent and decentralized system for both developers and users. The platform enables users to back, rank, and discover AI agents, aligning incentives so that if the AI you support wins in RECALL competitions, you earn RECALL rewards.

The Beginning: How RECALL Started

RECALL was conceived by Michael Sena, a co-founder and Chief Strategy Officer, who identified the challenge of centralized control over AI model discovery and evaluation while working in the blockchain and AI sectors. The initial RECALL concept was formalized in a whitepaper that outlined the vision for a community-driven, on-chain arena where users could evaluate and rank AI agents. Sena assembled a team of RECALL experts in blockchain, AI, and decentralized governance, overcoming early challenges such as technical hurdles in building a transparent reputation protocol and securing initial funding. Through innovative use of on-chain ranking and staking mechanisms, the team created a RECALL solution that empowers the community to collectively fund and judge AI merit, shifting the paradigm from centralized to decentralized AI evaluation.

Timeline: RECALL's Major Milestones

RECALL's journey began with its testnet launch and RECALL community formation, followed by a successful private funding round that attracted notable investors from the blockchain and AI industries. A critical milestone was the deployment of the RECALL Rank reputation protocol, which enabled transparent ranking of AI agents across domains such as crypto trading, coding, and personal assistance. The public RECALL launch introduced ongoing competitions where developers build agents for specific tasks and users back their favorites. Following its listing on MEXC, RECALL achieved strong community support and active market participation, confirming market confidence in its vision to transform AI discovery and monetization.

Tech Evolution: How RECALL Keeps Improving

RECALL's technology has evolved from its initial proprietary RECALL reputation protocol to a robust, on-chain architecture that supports transparent agent ranking and decentralized funding. The original RECALL protocol focused on transparency and community curation, implementing features that allow users to stake RECALL on AI agents and participate in competitions. Key RECALL upgrades have included enhancements to the ranking algorithm and integration of new staking mechanisms, improving both scalability and user engagement. Strategic partnerships with leading AI developers and blockchain infrastructure providers have accelerated the development of collaborative features, cementing RECALL's position as a technical innovator in the decentralized AI evaluation space.

What's Next? RECALL's Future Plans

Looking ahead, RECALL is focused on mainstream adoption and ecosystem expansion within the AI and blockchain landscape. The upcoming RECALL protocol update will introduce advanced ranking features and deeper integration with complementary AI technologies, enabling more sophisticated agent evaluation and RECALL reward mechanisms. The team envisions expanding RECALL into new market segments such as enterprise AI solutions and cross-chain interoperability, representing significant growth opportunities. Long-term, RECALL aims to become the standard for decentralized AI discovery and funding, guided by principles of decentralization, transparency, and user empowerment.

Ready to Trade RECALL? Start Here with MEXC

From its origins addressing information fragmentation and centralized AI gatekeeping to becoming a pioneering force in decentralized AI evaluation, RECALL's evolution showcases the innovative vision of its founders. To start trading RECALL with confidence, check out our 'RECALL Trading Complete Guide' for essential RECALL fundamentals, step-by-step processes, and risk management strategies. Ready to put your RECALL knowledge into action? Explore our comprehensive guide now and begin your RECALL learning journey on MEXC's secure trading platform.

Description:Crypto Pulse is powered by AI and public sources to bring you the hottest token trends instantly. For expert insights and in-depth analysis, visit MEXC Learn.

The articles shared on this page are sourced from public platforms and are provided for informational purposes only. They do not necessarily represent the views of MEXC. All rights remain with the original authors. If you believe any content infringes upon third-party rights, please contact service@support.mexc.com for prompt removal.

MEXC does not guarantee the accuracy, completeness, or timeliness of any content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be interpreted as a recommendation or endorsement by MEXC.

Latest Updates on Recall

View More

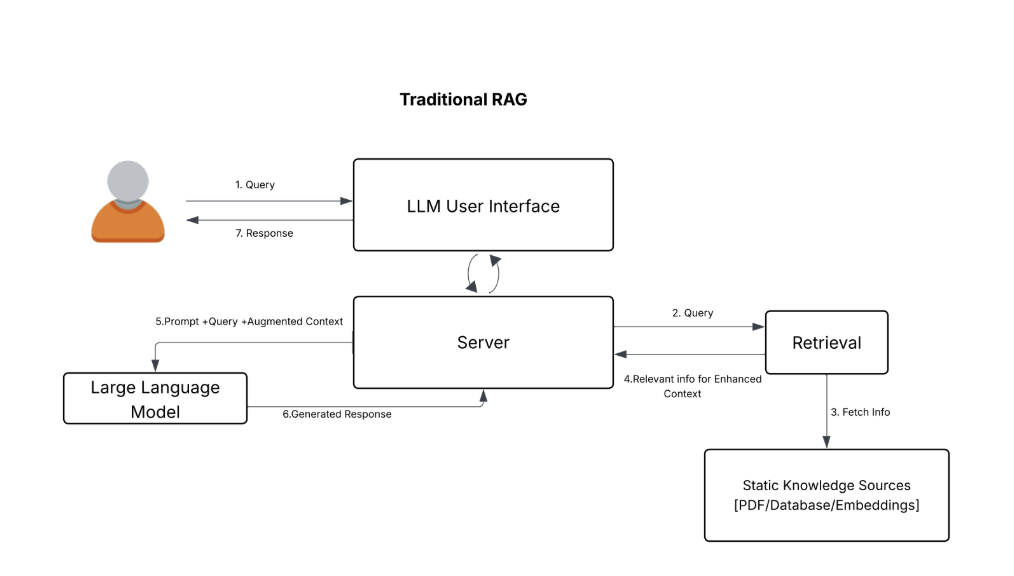

Traditional RAG, Agentic RAG and Multi-Agent workflows

AI ready, recall ready: operational priorities for 2026

Ex-wives of tech leaders recall uneasy visits to Jeffrey Epstein’s private island

HOT

Currently trending cryptocurrencies that are gaining significant market attention

Crypto Prices

The cryptocurrencies with the highest trading volume

Newly Added

Recently listed cryptocurrencies that are available for trading