When Amazon Crashed, "Decentralized" Blockchain went Down With it

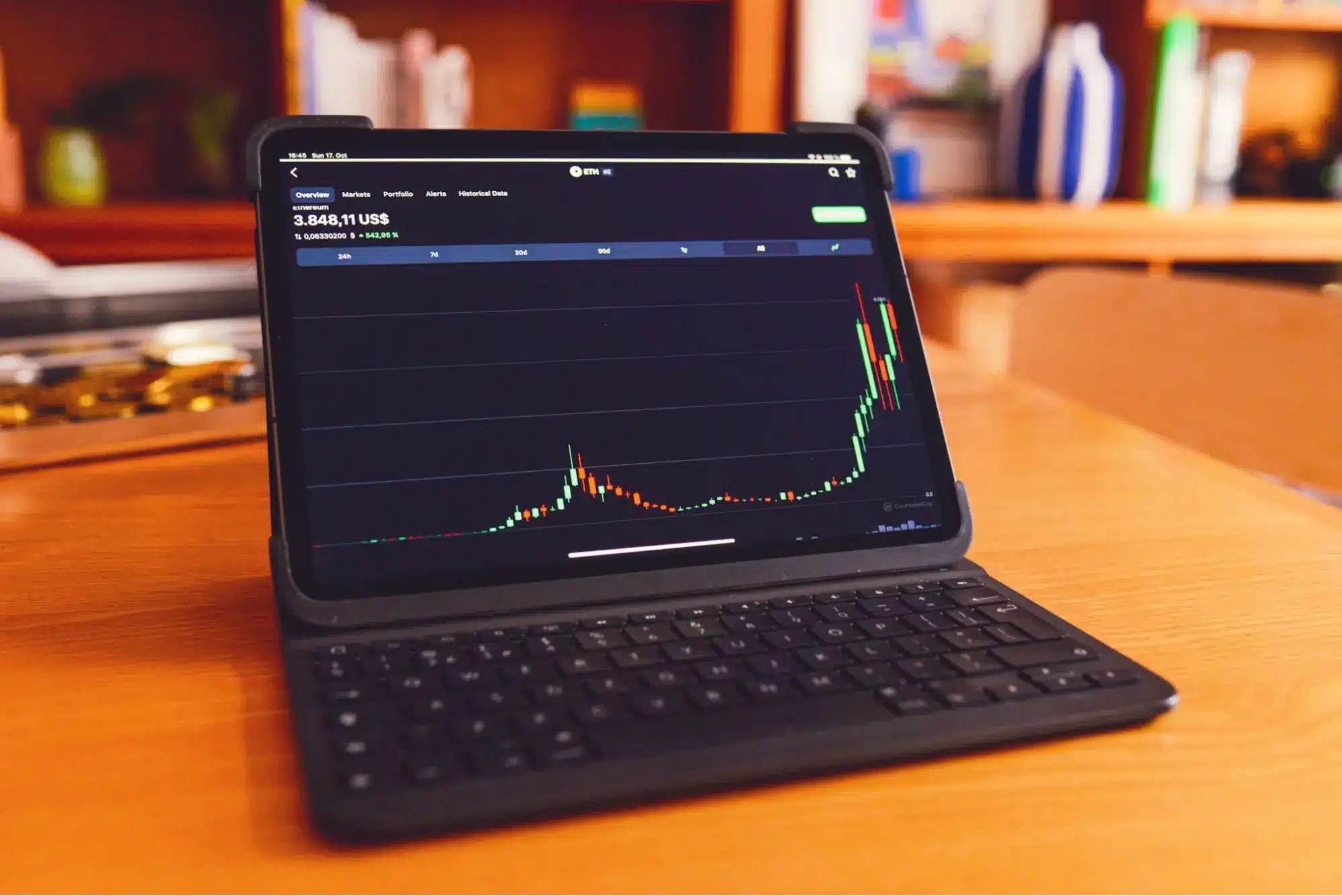

Amazon Web Services experienced a 14-16-hour outage on October 20, 2025. This disrupted Snapchat, Fortnite, and more. However, beyond the disruption, it further unveiled a grim truth about crypto: an industry that has been touted as decentralized is dependent on centralized infrastructure, which, when it goes down, can cost billions.

\ Coinbase was not left. Robinhood traders? All affected. AWS hosted 37% of the Ethereum network, 2,371 out of 6,408 nodes. This was characterized by one post-mortem as “cryptographically decentralized, operationally centralized - the worst of both.”

\ How bad was it? The cost of AWS downtime ranges between 5,000 and 9,000 dollars per minute to enterprises, according to estimates by the industry. In the crypto community, the outage in October caused losses that grew rapidly up to tens of millions. Unprocessed orders, frozen custody services, and market chaos only added to the damage.

\ However, there is something awkward about this: it was not a blockchain failure. The protocols kept running. Ethereum maintained consensus, and Solana (though it had experienced previous outages) was not affected by the crisis. The problem was not with the chains; it was the way users use them.

The Two-Provider Problem

Alchemy and Infura are the only major companies that process approximately 70 percent of Ethereum RPC traffic. The concentration is even higher in layer 2 rollups and other chains. Developers revert to trusted vendors when they require trusted blockchain connectivity. These vendors are capable of absorbing traffic spikes and delivering compliance services as well as 24/7 services.

\ Yair Cleper, co-founder of Magma Devs and contributor to Lava Network, puts it bluntly: "In short: convenience won over decentralization. The market rewarded easy SDKs, brand safety, and enterprise contracts—not openness or merit."

So (And So): When Cloud Failed, So Did Decentralization

The AWS outage in October was not a one-time occurrence. This was the second critical disruption of the month, the first one having taken place less than ten days ago. These breaches revealed how vulnerable the crypto infrastructure stack is.

\ Layer 2 networks maintained the perfect consensus during the time of the outage. Sequencers continued to receive orders. Blocks were being produced. Everything was technically "working." But users could not reach it. RPC endpoints and APIs, which are based on central servers, became bottlenecks.

\ Big RPC providers Infura, Alchemy, QuickNode, and so on run big clusters on AWS. Exchanges, custodians, and wallets are also based on AWS to compute and store. In case AWS collapses, the hope of decentralization collides with the centralization.

The Bootstrap Trap

New blockchains and rollups are facing an unsolvable dilemma. They are either forced to pay large charges of hundreds of thousands of dollars per year to existing offerings such as Infura or Alchemy, or rely on a network of community nodes that are not reliable enough to be used in production.

\ This "bootstrap trap" creates a vicious cycle. New chains can hardly attract developers when they lack reliable infrastructure. They cannot afford to incur an extra expense in the improvement of infrastructure without the developers. Consequently, a majority of chains collapse into the same central service providers, contributing to the further concentration issue.

\ "Small operators face a wall of friction," Cleper notes. "Demand is spiky. Without global Anycast, DDoS protection, and SRE coverage, costs crush you. Rollups default to 'safe' vendors that can tick compliance boxes. Even strong teams stay invisible because there's no neutral marketplace where great operators can prove their quality and get paid."

The Actual Cost of Centralization

The idea of centralization might be comfortable, but there are other effects that are concealed, leading to more losses than just an outage.

\ Performance tax: MEV bots and high-frequency traders must have a sub-4ms response time to be profitable. A single millisecond of latency might make a successful trade a failure and the user experience deteriorate.

\ Possible censorship risk: Both Infura and Alchemy blocked the RPC requests of Tornado Cash immediately upon its sanction in August 2022. Consequently, Ethereum users in nations under sanctions, such as Iran, have found it difficult to use services like OpenSea and MetaMask. Geofencing and sanctions can be imposed in a whole ecosystem by only a few controlled points.

\ Innovation freeze: Small players are not able to compete with large vendors in terms of paperwork and sales requirements. Diversity in infrastructure is reduced by a merit-based system where performance is rewarded, and not based on the enterprise. The market does lean towards the most prosperous vendors, who may not be the best technology.

\ Correlated failures: The AWS October outage demonstrated the extent to which concentration of the cloud may lead to a systemic risk. Validators suffer the penalty when the infrastructure collapses because centralized cloud providers are the cause of the error.

The Race to Fix What’s Broken

The issue was brought to the fore as the October outage further advanced the development of decentralized alternatives. A number of projects are building permissionless RPC infrastructure, which uses quality metrics to route traffic rather than enterprise contracts.

\ Lava Network recently published its mainnet, which had passed more than 100 billion requests on its testnet with more than 40 different chains. The protocol is used by industry leaders such as Fireblocks, NEAR, Arbitrum, and Starknet, which organize the independent node operators via continuous quality scoring.

\ "Lava Public RPC makes blockchain access behave like a utility: one endpoint for developers, many verified operators behind the scenes," explains Cleper. "Latency, error rates, and correctness are tracked 24/7. Best performers get more traffic; degraded ones get throttled until healthy again."

\ The protocol has further announced an enterprise-grade RPC platform to facilitate the adoption of stablecoins by banks and companies with deep integrations with Fireblocks' technology platform. Operators are rewarded LAVA tokens according to verified work, which are successful responses, multiplied by quality score, region, and type of request.

\ But Lava is not the only one that is addressing the problem of centralization. The competition is increasing with various providers trying various directions of decentralization:

Pocket Network continues to advance its token-based incentivization model and recently collaborated with Kleomedes to offer decentralized RPC services to 14 chains of Cosmos. Ankr operates more than 800 nodes in a decentralized network, has competitive prices, and allows community holders to use their native token to affect development. Chainstack has found a niche with its Hybrid Cloud functionality, which allows enterprises to run their specific nodes within their own cloud environment - an important feature to a team with high compliance requirements.

\ What brings the alternatives together is the shift in single-vendor control. They all attempt to solve one and the same problem: they want to make access to the blockchain resilient enough that, in the case of the next great outage, it does not suffer.

The Merit-Based Future

The future requires that infrastructure be based on performance, rather than incumbency. The quality-of-service scoring systems continuously measure latency, error, and correctness of data. Operators that perform better in terms of service, receive more traffic, and rewards, the operators whose performance decreases are automatically throttled.

\ This provides an anti-fragile access layer, a layer that becomes more resilient with the addition of additional operators without coordinated control. For new rollups and chains, this model addresses the bootstrap problem: a chain is allowed to expose endpoints of public RPC on day one without buying capacity from a single vendor.

\ When there are specialized node operators in that stack who have passed the conformance tests, they are added to the pool and start earning by serving production traffic. The more it is used, the greater the number of operators that come to enhance coverage and resilience.

Lessons From October

The October 2025 stress test had some harsh lessons for the industry:

- Technical decentralization is not enough: If, during a cloud outage, users do not have access to your network, then the statement about decentralization becomes empty. Decentralization is actually demonstrated by its availability.

- Access layer is more significant as compared to protocol design: Ethereum remained decently decentralized when AWS went offline, but the 37 percent of nodes on AWS led to serious access issues. Such networks as Layer-2 discovered that perfect consensus is pointless when the users are unable to submit transactions.

- Multi-cloud is now not optional: Organizations that depend on an individual vendor have to confront the reality of vendor lock-in.

- Reliability should not be compromised with cost optimization: Those teams that skimped on infrastructure redundancy failed to deliver to the customers when it was required most. The damage to reputation frequently surpasses the short-term loss of money.

The Road Ahead

The size of the Web3 market is projected to reach 6.15 billion dollars in 2025 with an annual growth rate of 38.9 percent over the next 10 years. This is fuelled by the expansion of the metaverse, the adoption of AI, and the explosion in the demand for decentralized applications - each of which demands a robust infrastructure as its base.

\ The incident of the outage in October clarified one thing: that explosive growth on centralized infrastructure is a house of cards. To deploy blockchain and realize its purported goal of decentralization, the access layer has to be as distributed as the networks on which it runs.

\ Cleper frames the challenge simply: "Infrastructure shouldn't be something you trust; it should be something you verify. We built Lava so that access to blockchain becomes a public good, not a private gateway."

\ The question is whether the industry will learn from October's wake-up call before the next outage strikes.

You May Also Like

MakinaFi suffered an attack that resulted in the loss of approximately 1299 ETH, with some funds being preemptively processed by MEV.

Magic Eden co-founder sees 'speculation supercycle' ahead