Bitcoin Reclaims $91,000 as Stability Emerges Amid Market Panic

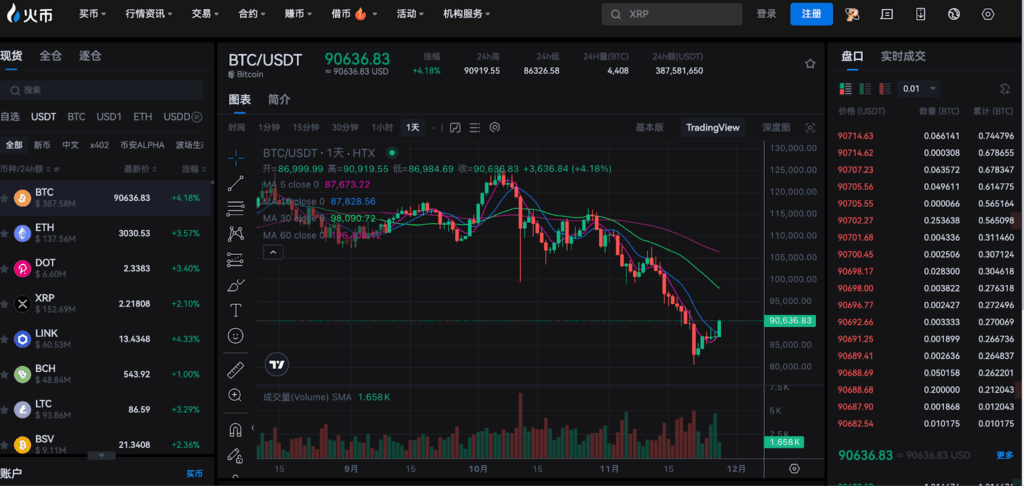

Volatility is no stranger to the digital-asset market, but every sharp drawdown forces the industry to re-evaluate its fundamentals. Bitcoin rose back above $91,000, gaining 4.18% over the past 24 hours. The late-November recovery offers a rare ray of optimism after BTC slid from early October’s $126,000 peak to below $81,000, a nearly 30% retracement. For the first time in weeks, signs of stabilization are beginning to appear.

According to HTX’s official spokesperson, Molly, the latest market correction is not a simple sentiment collapse. Instead, it reflects a three-layer repricing across macro conditions, capital flows, and market structure.

Early Stabilization After a Meltdown

Following several straight weeks of declines, Bitcoin has finally shown a constructive rebound. BTC climbed back above the $90,000 mark with a 4.18% gain in the past 24 hours. The recovery extended to other major assets in the broader market: ETH +3.15%; XRP +6.98%; BNB +2.03%; SOL +3.72%.

https://www.htx.com/en-us/trade

https://www.htx.com/en-us/trade

Despite the rebound, market sentiment remains fragile. According to Alternative, the Crypto Fear & Greed Index rose only slightly from 20 to 22, staying firmly in the Extreme Fear zone. Rebuilding investor confidence takes time.

Macro Outlook: A Data Vacuum and Policy Crosscurrents

Market analysts describe this week in the U.S. crypto market as a “tight at first but afterwards loose” period. Thanksgiving and Black Friday compress trading activity, forcing all major trading activities into Monday through Wednesday. A U.S. government shutdown-related data delay and the absence of October non-farm payrolls have increased market reliance on high-frequency labor data. Today’s report showed a decline in the weekly initial jobless claims, signaling that the labor market has not materially weakened. Markets broadly expect the Federal Reserve to cut rates in December, though some institutions argue the Fed still has room to pause.

A wave of Fed speeches ahead of the November 29 blackout period is likely to inject further short-term volatility. The probability of a 25 bp rate cut in December has jumped to 69.3%, sharply higher than last week’s 22%, indicating a significant shift in expectations.

Market Structure: Defensive Posture and Fear-Driven Pricing

The crypto market continues to digest the October drawdown. Bitcoin remains nearly 30% off its recent high, ETF funds experience net negative flows, and the Coinbase premium is weakening. All these signs point to a lower appetite for risk.

Options markets show easing stress. The 1-week put-call skew has fallen sharply from last Friday’s 11% (a 2025 high) to around 4.5%.

Technical indicators flag oversold conditions. Bitcoin’s 14-day RSI has dropped to 32, below the early-October level and near oversold territory. Implied volatility has reverted to April levels, suggesting traders are positioning for a potential breakout.

Broadly, BTC now sits in a late-stage decline phase where panic has cooled, but appetite for risk has not yet recovered. If incoming data continues to show softening consumption and employment, without triggering recession concerns, markets may enter a technical recovery. But with holiday liquidity at seasonal lows, the risk of short-term downward extensions remains.

Short-Term Outlook: Inflection Point and Opportunity

Bitcoin’s key support sits near $80,000, with resistance between $90,000-$95,000. The ability to decisively clear that upper band will determine whether the rebound becomes sustainable.

Current options skew suggests improving sentiment for upside scenarios. Short positions in BlackRock’s IBIT have also fallen sharply, signaling weakening bearish conviction. Although investors remain cautious, allocation is rotating away from simple price speculation toward strategies focused on capital efficiency, yield generation, and information-driven pricing. Capital rotation is already visible across stablecoins, perpetual futures, and other sectors.

Industry Perspective: Finding Opportunity in Panic

In the midst of heightened volatility, Molly emphasized that compliance and innovation should not be viewed as opposing paths. “This is not a binary choice. Multiple systems can evolve in parallel. Our long-term value lies in helping users identify trustworthy, high-quality assets.”

She added that the market sentiment is shifting from fear to hope. In an environment where the industry competes on marketing and hype, HTX’s differentiated approach is to compete with sincerity, not gimmicks. Every step of sincerity is meant to earn long-term trust from users.

Analysts expect crypto investments in 2025 to focus on platform ecosystems, AI–Web3 convergence, policy-driven opportunities, and longtermism. The crypto world has never lacked narratives, but what determines outcomes is the ability to capture consensus-driven upside.

Staying calm during volatility and identifying opportunity amid fear may well be the optimal strategy for the current environment. As global digital-asset markets evolve, exchanges remain the critical gateway connecting users, innovations, and the future of crypto ecosystems.

Disclaimer: This article does not constitute investment advice, nor does it represent an offer or solicitation to buy or sell any investment products.

You May Also Like

Campaign For A Progressive Income Tax In Colorado Faces Setback

The Adoption of Web3 in Europe: Current Status, Opportunities, and Challenges