UK firm to build $2.4bn fertiliser plant in Egypt

A UK company plans to invest nearly $2.4 billion in a fertiliser plant in Egypt that will use household waste as feedstock.

London-based Polar Hydro Company intends to set up the project in Egypt’s Giza free zone to meet domestic fertiliser needs and export the surplus to Europe.

The facility will process and safely recycle solid household waste to produce biofuel and fertilisers, Egypt’s cabinet said on its Facebook account on Tuesday.

Minister of industry and transport Kamel Al-Wazir disclosed the project during a meeting of industry officials, during which he said the plant would help safely dispose of piles of waste in the area and create jobs for Egyptians.

“The ministers instructed officials to provide all kinds of support and facilitate procedures for the company so it will embark on the project as soon as possible,” the ministry said in a statement.

Egypt, the third-largest Arab economy, is seeking industrial investment to boost exports and ease a painful trade deficit.

Further reading:

- Limited hope for economic change as Egyptians vote

- Egypt’s quarterly GDP reaches three-year high

- Egypt reveals incentives to attract global miners

The country targets a 20 percent annual increase in exports through 2030 and is prioritising five sectors: tourism, manufacturing, agriculture, energy, and information/communications technology.

The statement said ministry officials would soon meet Polar Hydro representatives to discuss the project.

The cabinet said another UK-based company — Blue Skies Global, a fresh fruit producer and exporter — plans to build refrigerated storage spanning 10,000 square metres. The facility will serve the company’s two factories in the 10th of Ramadan City and handle products designated for export.

Egypt’s food exports grew by 11 percent year on year in the first 11 months of 2025, exceeding $5.8 billion, it added.

You May Also Like

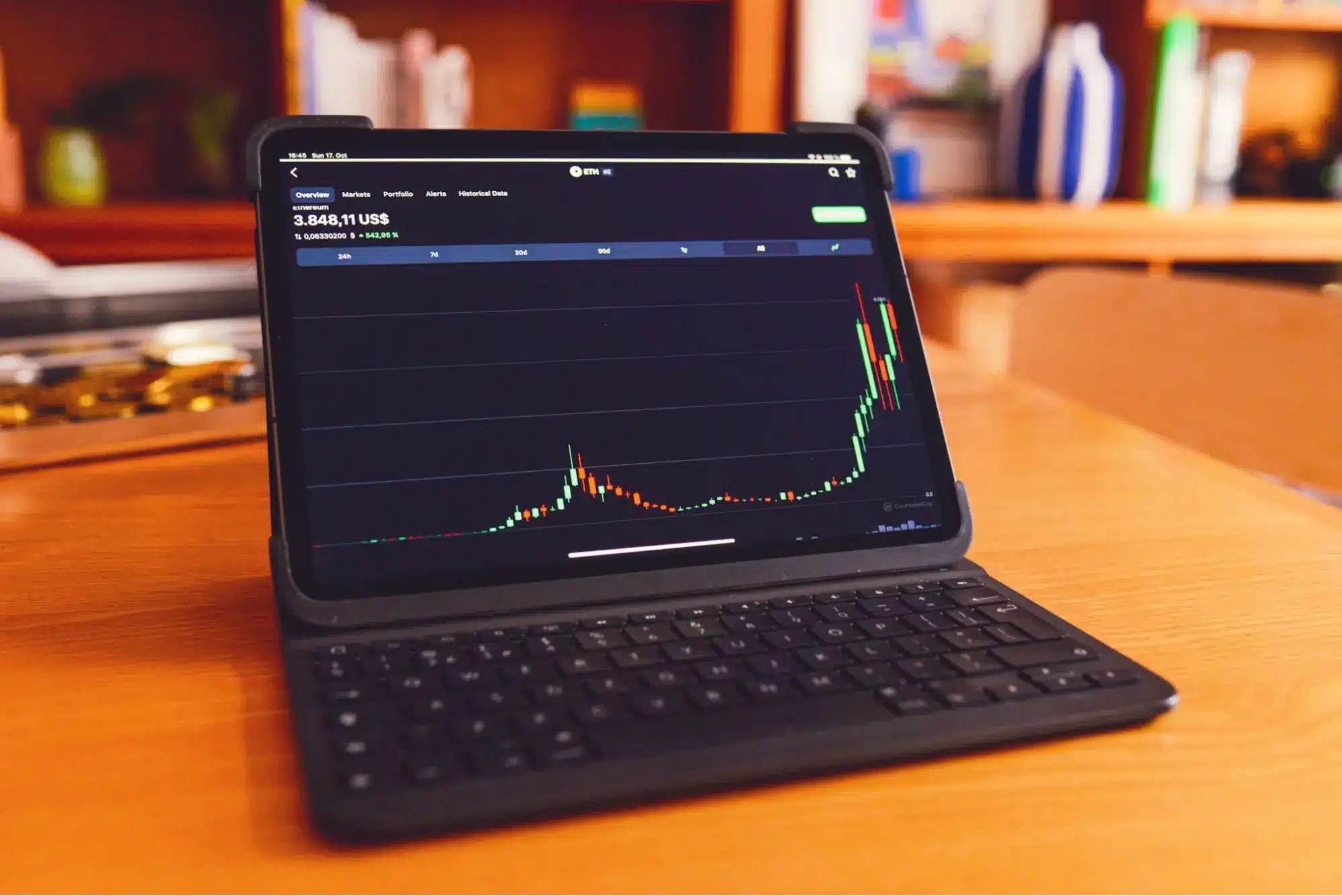

MakinaFi suffered an attack that resulted in the loss of approximately 1299 ETH, with some funds being preemptively processed by MEV.

Magic Eden co-founder sees 'speculation supercycle' ahead