NFT sales show modest $77M, Ethereum NFT sales drop 13%

According to CryptoSlam data, NFT sales volume has inched up by 1.77% to $77.10 million, essentially flat from last week’s $77.04 million.

- NFT sales stay flat at $77M while buyers surge over 23% week-over-week.

- Guild of Guardians Heroes jumps 162% as Immutable blockchain soars.

- $X@AI BRC-20 NFT leads weekly sales with an $809K top transaction.

Market participation has continued to surge, with NFT buyers rising by 23.45% to 490,600 and sellers climbing by 15.36% to 403,483. NFT transactions dropped by 18.99% to 1,100,748.

This happened as the Bitcoin (BTC) price has dipped to the $89,000 level as consolidation continues. Ethereum (ETH) has sustained the $3,000 level, holding above this key psychological level.

The global crypto market cap now stands at $3.05 trillion, down from last week’s $3.09 trillion.

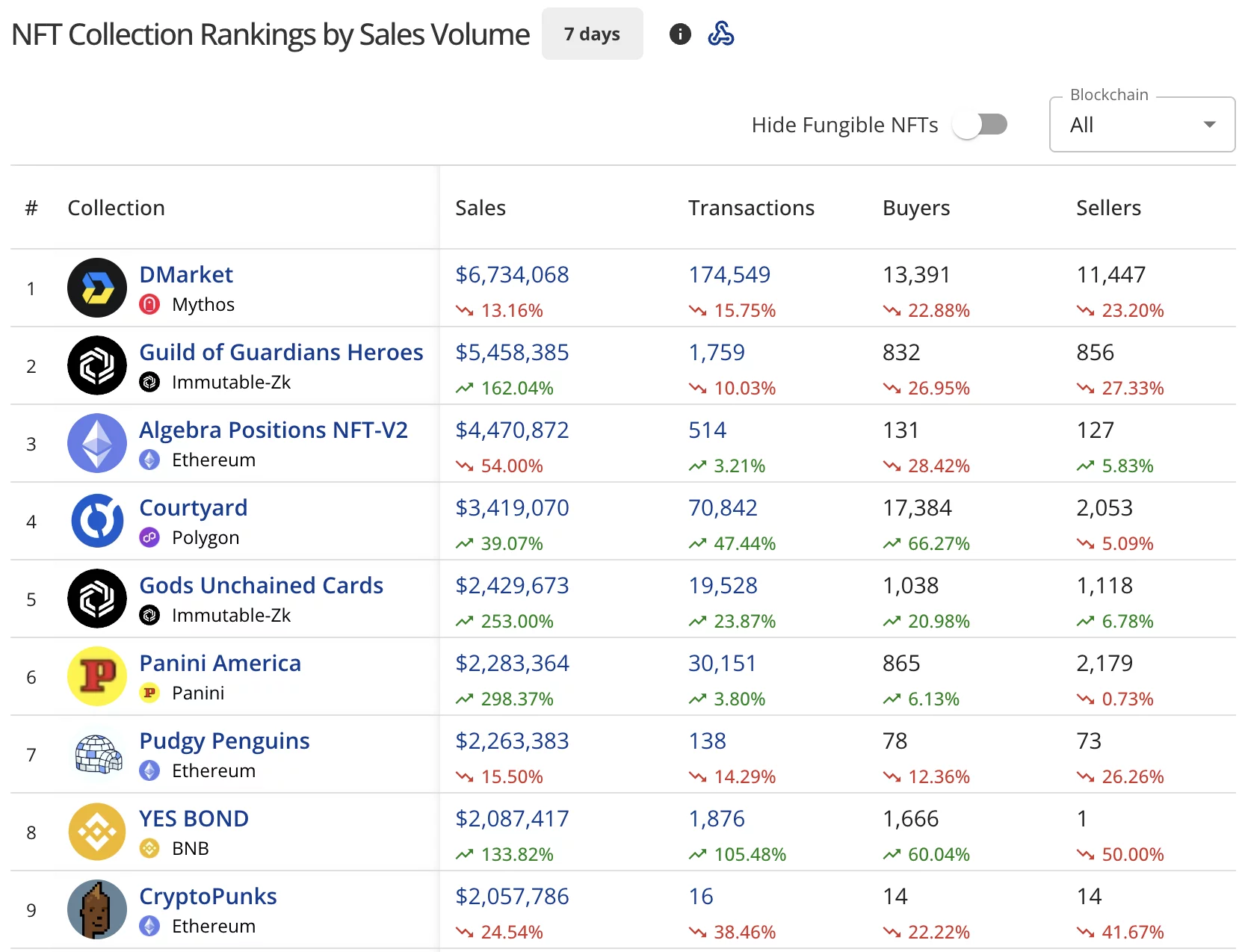

Guild of Guardians Heroes surges as rankings shuffle

DMarket on the Mythos blockchain has climbed to first place with $6.73 million in sales, down 13.16% from last week’s $7.77 million. The collection processed 174,549 transactions with 13,391 buyers and 11,447 sellers.

Guild of Guardians Heroes on Immutable-Zk surged to second with $5.46 million, exploding 162.04% from last week’s $2.04 million. The collection had 1,759 transactions with 832 buyers and 856 sellers.

Algebra Positions NFT-V2 on Ethereum dropped to third at $4.47 million, plunging 54.00% from last week’s $9.60 million. The collection saw 514 transactions with 131 buyers and 127 sellers.

Courtyard on Polygon (POL) secured fourth position with $3.42 million, up 39.07% from last week’s $2.45 million. The collection processed 70,842 transactions.

Gods Unchained Cards on Immutable-Zk entered the rankings at fifth with $2.43 million, soaring 253.00%. The collection recorded 19,528 transactions.

Panini America on the Panini blockchain placed sixth at $2.28 million, surging 298.37%. The collection had 30,151 transactions.

Pudgy Penguins dropped to seventh with $2.26 million, down 15.50% from last week’s $2.68 million. The Ethereum collection saw 138 transactions. YES BOND on BNB (BNB) entered at eighth with $2.09 million, up 133.82%.

CryptoPunks fell to ninth at $2.06 million, down 24.54% from last week’s $2.73 million. The collection had just 16 transactions with 14 buyers and 14 sellers.

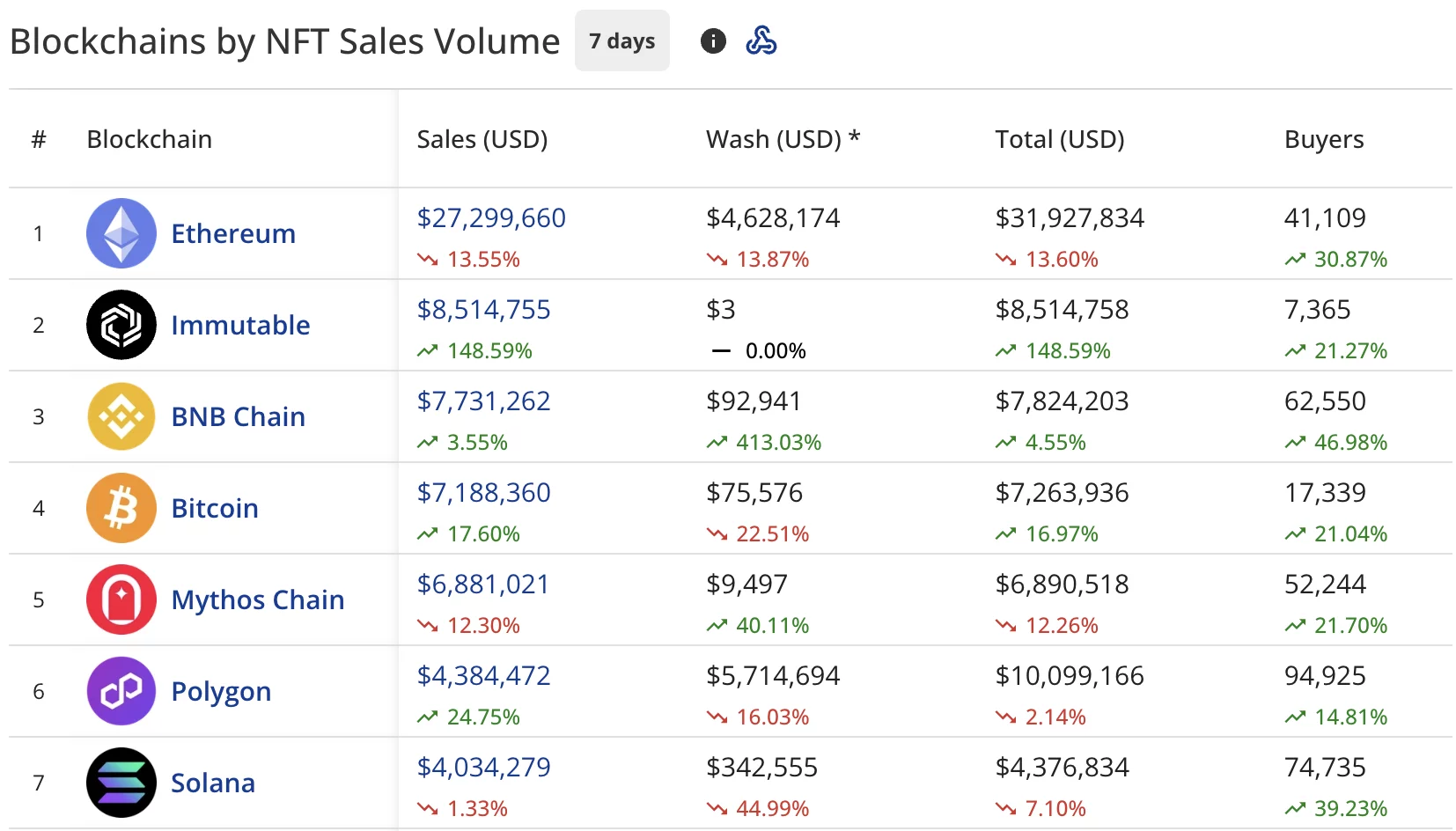

Immutable surges to second as Ethereum declines

Ethereum maintained first position with $27.30 million in sales, down 13.55% from last week’s $31.86 million.

The network recorded $4.63 million in wash trading, bringing its total to $31.93 million. Buyers jumped 30.87% to 41,109.

Immutable (IMX) exploded to second place with $8.51 million, surging 148.59% from last week’s $3.35 million. The blockchain had 7,365 buyers, up 21.27%.

BNB Chain held third with $7.73 million, up 3.55% from last week’s $7.30 million. The blockchain recorded $92,941 in wash trading, with buyers soaring 46.98% to 62,550.

Bitcoin secured fourth position at $7.19 million, up 17.60% from last week’s $6.27 million. The network saw 17,339 buyers, up 21.04%.

Mythos Chain dropped to fifth with $6.88 million, down 12.30% from last week’s $7.91 million. The blockchain attracted 52,244 buyers, up 21.70%.

Polygon placed sixth at $4.38 million, up 24.75% from last week’s $3.42 million. The blockchain recorded $5.71 million in wash trading, with buyers rising 14.81% to 94,925.

Solana (SOL) landed in seventh with $4.03 million, down 1.33% from last week’s $4.30 million. The network had 74,735 buyers, up 39.23%.

Bitcoin BRC-20 NFT tops sales chart

A $X@AI BRC-20 NFT led individual sales at $809,337.16 (8.7195 BTC), sold two days ago, marking the highest-value sale of the week.

CryptoPunks #1925 placed second at $547,161.69 (195 ETH), sold four days ago.

Three additional CryptoPunks rounded out the top five:

- CryptoPunks #6615 sold for $153,356.75 (47.99 ETH) two days ago

- CryptoPunks #309 sold for $134,530.52 (42 ETH) two days ago

- CryptoPunks #5203 sold for $111,158.93 (35 ETH) a day ago

You May Also Like

The Channel Factories We’ve Been Waiting For

MoneyGram launches stablecoin-powered app in Colombia