ETF Shockwave: After DOGE and XRP Listings, All Eyes Shift to Pepeto

SPONSORED POST*

SEC Approves Standards That Could Lead to a Flurry of New Crypto ETFs

The SEC has approved a set of “generic listing standards” that aim to make it easier for spot crypto exchange-traded funds (ETFs) to be listed. Starting on September 19, 2025, the process for getting these ETFs approved is set to become faster and less complicated. Previously, each ETF had to go through a lengthy, detailed review process, involving filings from both the exchange and the fund managers under Section 19(b). Now, if an ETF meets simple criteria, such as having a regulated futures market for the underlying cryptocurrency, it can be listed more swiftly.

This new regulation simplifies the approval process, reducing the time it takes from several months to about 75 days, and lowers the costs and legal hurdles for fund issuers.

How More Spot ETFs Could Reshape the Crypto Market Including Ethereum Solana and XRP

This regulatory shift means more digital assets beyond just Bitcoin and Ethereum, such as Solana and XRP, could become eligible for ETFs if they meet rule criteria. This expansion will give investors greater access, attract more mainstream financial interest, and typically lead to increased capital inflows into the crypto industry.

Since ETFs are regulated products, they help build trust with both institutional and retail investors. The clearer regulatory environment tends to reduce perceived risks, which often drives up prices, improves liquidity, and boosts adoption of the cryptocurrencies involved.

With Pepeto already launching with key infrastructure like a demo exchange, a cross-chain bridge, and staking rewards, if future spot ETF regulations also include smaller or utility tokens, Pepeto could attract attention as a token backed by utility and a strong community.

Could Pepeto Benefit from the Growing ETF Trend?

Even if Pepeto does not directly become an ETF, the increasing momentum toward more spot ETFs can boost awareness and credibility for meme coins that offer more than just hype. Investors are increasingly seeking tokens with clear use cases, transparency, and a solid roadmap all qualities Pepeto currently emphasizes. This shift could lead to strategic partnerships, higher value appreciation, and easier access to capital for Pepeto.

The Pepe Hype, Dogecoin and Shiba’s Past, and Why Opportunities Match Up

In the crypto world, hype can quickly energize investors, but it’s durable infrastructure that keeps projects successful long term. Dogecoin, Pepe, and Shiba Inu generated massive returns thanks to their community strength, viral appeal, and perfect timing. However, most of those gains followed after broader adoption, increased exposure, and the building of trust.

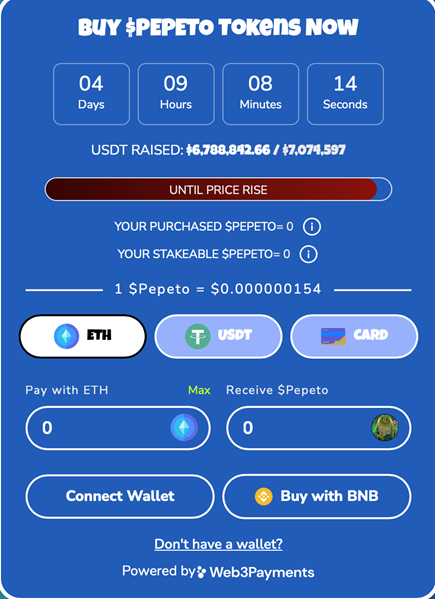

Today, with the presale raising millions, a live demo exchange showcasing ongoing development, and staking rewards soaring to 226%, Pepeto is positioned at an ideal intersection. It merges the viral branding (like the Pepe frog meme and community storytelling linked to the same max supply of 420 trillion) with strong technological execution. When you add in the SEC’s more progressive and faster ETF approval rules, there’s a real chance for Pepeto to benefit from both hype and structural tailwinds drawing attention from investors who earlier backed Shiba Inu, Dogecoin, and Pepe at their peaks.

Final Rush: Demand Builds as Pepeto Presale Nears Closing

With the SEC’s recent rule revision opening the door for more spot crypto ETFs, early-stage projects like $PEPETO are attracting increasing investor attention. While established tokens like Ethereum and Bitcoin gained from institutional access through ETFs, new contenders like Pepeto are positioning themselves for a similar breakout but at a much lower price point.

This scenario feels familiar to anyone who missed the early days of Shiba Inu or Dogecoin. Those who waited often found themselves jumping in after massive gains had already been made. As $PEPETO’s price increases with each presale stage, and with staking rewards now at 226%, the window for a low-cost entry is quickly closing.

Thousands of investors have already joined, and the recent exchange demo reveal across social media platforms sent interest soaring. With over $6.8 million raised so far, it’s clear this project is drawing serious backing.

History suggests that those who enter just before a major public listing often experience the greatest upside. The ETF era is beginning, and Pepeto could be one of the last meme-native tokens to enter at the floor price while early, don’t miss your chance to join before it’s too late.

Time to Act, Not Just Watch

Crypto short-term plays are not about luck, they’re about timing, capturing hype, and investing in the right coin before it skyrockets. Pepeto (PEPETO) To participate, visit https://pepeto.io and secure your presale allocation now before prices climb further. leading the way with its zero fee exchange, PepetoSwap platform, and viral traction, leads the charge with serious 100x potential.

Start by securing your Pepeto presale allocation now, before prices rise again. Then, stay active in the community as the project continues to expand.

The next meme wave is forming, and this time, it’s driven by real utility. Payment options include USDT, ETH, BNB, and card payments via MetaMask or Trust Wallet. Don’t wait the opportunity to get in early and profit is here, but it won’t last forever.

About Pepeto

Pepeto is an Ethereum-based meme coin project that combines speed, utility, and community culture into a growing crypto ecosystem. Backed by real tools, a working zero-fee demo exchange, and a transparent roadmap, it aims to bring lasting value to the meme coin space.

Presale is live now, and early investors are lining up to secure their spot ahead of launch.

Disclaimer:

The Pepeto presale is live. To participate, use the official website: https://pepeto.io. As the listing approaches, some unauthorized platforms may attempt to use the Pepeto name to mislead investors. Verification of sources is advised.

Pepeto Media Links:

X (Twitter): https://x.com/Pepetocoin

Instagram: https://www.instagram.com/pepetocoin/

TikTok: https://www.tiktok.com/@pepetocoin

*This article was paid for. Cryptonomist did not write the article or test the platform.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

a16z Targets $2 Billion Crypto Fund as Venture Capital Eyes Blockchain Recovery