Top U.S. Regulator Dismisses Stablecoin ‘Bank Run’ Threat as Market Soars Past $300B

The head of the U.S. Office of the Comptroller of the Currency (OCC), Jonathan Gould, has rejected fears that stablecoins could trigger a sudden banking crisis, describing the risk of a deposit run as overstated and unlikely to occur without warning.

Speaking at the American Bankers Association (ABA) Annual Convention in Charlotte on October 19, Gould told attendees that any large movement of deposits linked to stablecoins “would not happen in unnoticed fashion” and “would not happen overnight.”

His comments come amid growing friction between federal regulators and traditional banking groups over the rise of stablecoins, digital tokens pegged to fiat currencies such as the U.S. dollar.

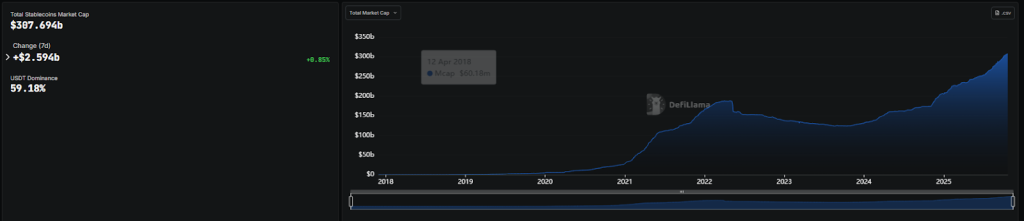

The market has expanded sharply this year, rising from $205 billion in January to over $307 billion, according to DeFiLlama. Tether’s USDT controls roughly 59% of the market, followed by Circle’s USDC.

Source: DeFiLlama

Source: DeFiLlama

The rapid expansion has intensified calls from the banking industry for tighter oversight.

What “Loophole” in the GENIUS Act does the Banking Lobby Warn of?

In August, the American Bankers Association and over 50 state banking groups urged Congress to close what they called “loopholes” in the GENIUS Act, the new federal stablecoin law signed in July by President Donald Trump.

The groups warned that the law allows stablecoin issuers to indirectly pay yield through affiliates, which they claim could lead to massive deposit outflows from the banking system.

In a joint letter, the Bank Policy Institute, Consumer Bankers Association, Independent Community Bankers of America, and Financial Services Forum said yield-bearing stablecoins could drain as much as $6.6 trillion from traditional banks, citing estimates from the U.S. Treasury.

They argued that such outflows could push up interest rates, reduce loan availability, and raise borrowing costs for households and businesses.

“Payment stablecoins should not pay interest the way highly regulated and supervised banks do,” the letter stated, emphasizing that stablecoin issuers do not lend or invest in securities to generate returns.

OCC’s Gould Downplays Crisis Fears, Urges Smaller Banks to See Stablecoins as Opportunity, Not Threat

However, Jonathan Gould dismissed the idea of an imminent threat, noting that stablecoin adoption could instead benefit smaller banks by providing new ways to compete in digital payments.

He said the OCC closely monitors such activity and would act swiftly if necessary. “If there were to be a material flight from the banking system, I would be taking action,” Gould said, adding that highly placed officials and trade associations would also step in.

He urged community banks to view stablecoins as a competitive tool, not a threat, suggesting they could help smaller institutions challenge the dominance of Wall Street giants in the payments market.

He also added that the OCC is working on rulemakings tied to the GENIUS Act and is “very conscious of the statutory deadlines that Congress has given us.”

“Payment stablecoin connectivity might be a possibility for community banks to break some of the dominance that exists right now among the very largest banks in the payment system in America,” Gould said, pledging to ensure there are “safe and sound” ways for banks to participate.

Stablecoins Face Crossfire: Banks Warn, Regulators Reassure, Adoption Grows

The OCC’s stance contrasts sharply with the warnings issued by major banking associations and foreign regulators.

Earlier this month, the European Systemic Risk Board, chaired by European Central Bank President Christine Lagarde, cautioned that multi-issuer stablecoin models could destabilize the EU’s financial system, while the Bank of England announced plans for temporary caps on stablecoin holdings to protect credit availability.

In the U.S., the debate has also drawn strong responses from crypto platforms. Coinbase recently published a detailed rebuttal to claims that stablecoins threaten financial stability, calling the “deposit erosion” narrative a myth designed to defend banks’ $187 billion annual payment processing revenues.

The exchange argued that stablecoin usage actually strengthens the U.S. dollar’s global role and found “no meaningful correlation” between stablecoin adoption and deposit flight from community banks over the past five years.

Meanwhile, Standard Chartered has warned that over $1 trillion could flow out of emerging-market banks into stablecoins by 2028 as adoption accelerates globally, accounting for up to 10% of the U.S. money supply.

The bank said stablecoins are increasingly serving as dollar-based savings tools in countries facing high inflation and weak local currencies.

Despite the ongoing debate, stablecoin integration into mainstream finance is accelerating. Coinbase, Circle, Ripple, and Paxos are all seeking federal banking charters to issue or manage stablecoins under OCC supervision.

Japanese giant Sony also joined that list this month, applying to establish “Connectia Trust,” a U.S. national crypto bank that would issue a dollar-pegged token under OCC regulation.

While banks continue to warn of risks, Treasury Secretary Scott Bessent has taken a more optimistic stance, saying digital dollars could expand access to U.S. currency worldwide and boost demand for Treasuries.

You May Also Like

Bitcoin Whales Cash Out $120M – Is the Next Rally About to Begin?

Fed forecasts only one rate cut in 2026, a more conservative outlook than expected