Crypto market crashes as Fear and Greed and Altcoin Season Index slips

The crypto market crash resumed today, Oct. 22, as the Fear and Greed Index slipped to the fear zone.

- The crypto market crash resumed ahead of the US inflation data.

- Bitcoin price moved to $106,825, down from this week’s high of $112,965.

- The Crypto Fear and Greed Index has moved to the fear zone.

Bitcoin (BTC) and most altcoins were in the red. BTC dropped to $106,825, down from this week’s high of $113,965. It has dropped by 14.6% from its highest point this year.

Most altcoins were in the red, with the top laggards being Aster (ASTER), MYX Finance, Celestia (TIA), and Dash, which all dropped by over 10% in the last 24 hours.

Crypto market crashes as Fear and Greed Index moved to 29

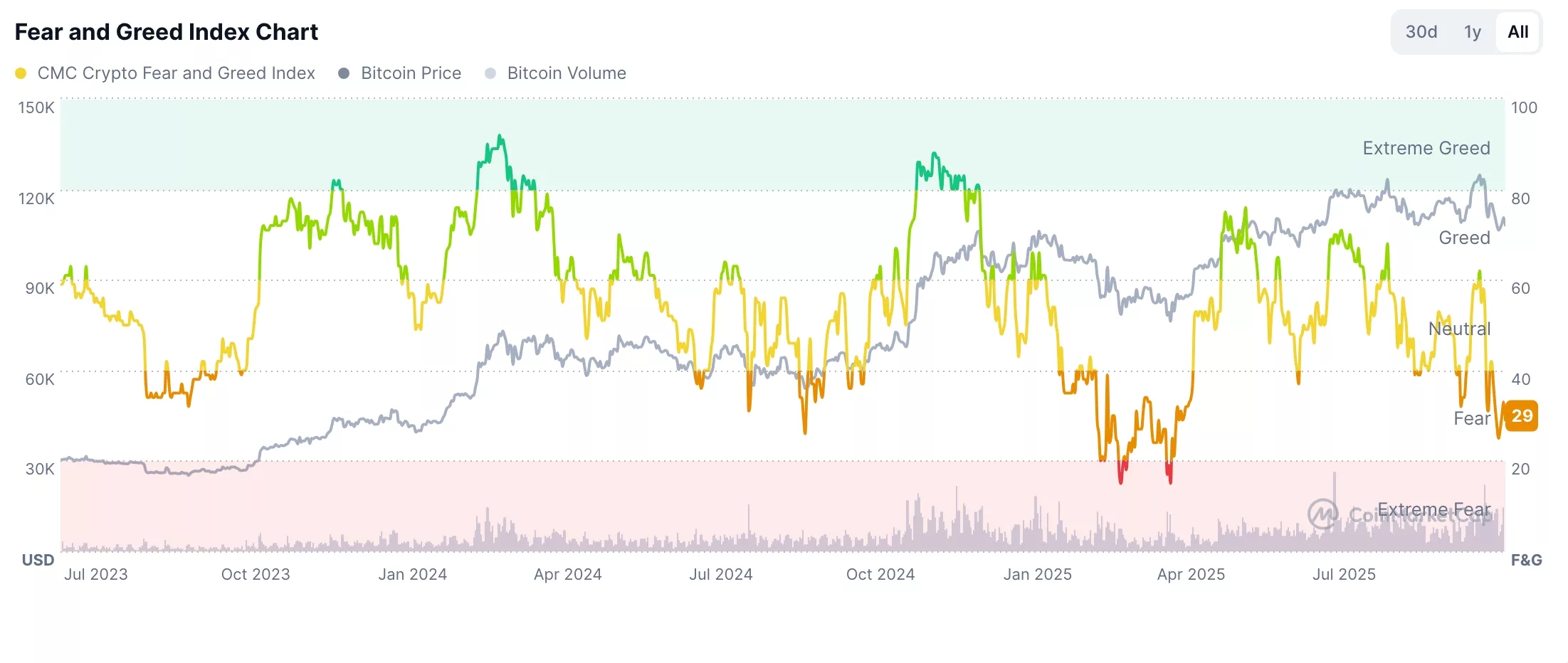

The crypto market crash happened as a sense of fear spread in the industry. The closely-watched Crypto Fear and Greed Index moved to the fear zone of 29, much lower than the year-to-date high of 85.

Crypto Fear and Greed Index chart | Source: CMC

Crypto Fear and Greed Index chart | Source: CMC

This is an important gauge that looks at several key gauges like volatility, activity in the derivatives market, price momentum, and social media activity. Crypto prices do well when there is a sense of greed in the industry.

Investors have never moved on from the $20 billion liquidation that happened earlier this month. Over 1.6 million traders were liquidated in the biggest such event on record.

As a result, many traders who were wiped out have continued to remain on the sidelines since then.

Traders are also waiting for the upcoming US inflation report, which will come out on Friday. This will be the only official report that will come out this month because of the government shutdown. A higher-than-expected inflation report will lower the odds of interest rates.

Additionally, there are ongoing jitters on trade after a report said that Donald Trump and his administration was considering restrictions on software sales to China. This could be a negotiating tactic as Trump prepares for his meeting with Xi Jinping.

Altcoin Season Index crash

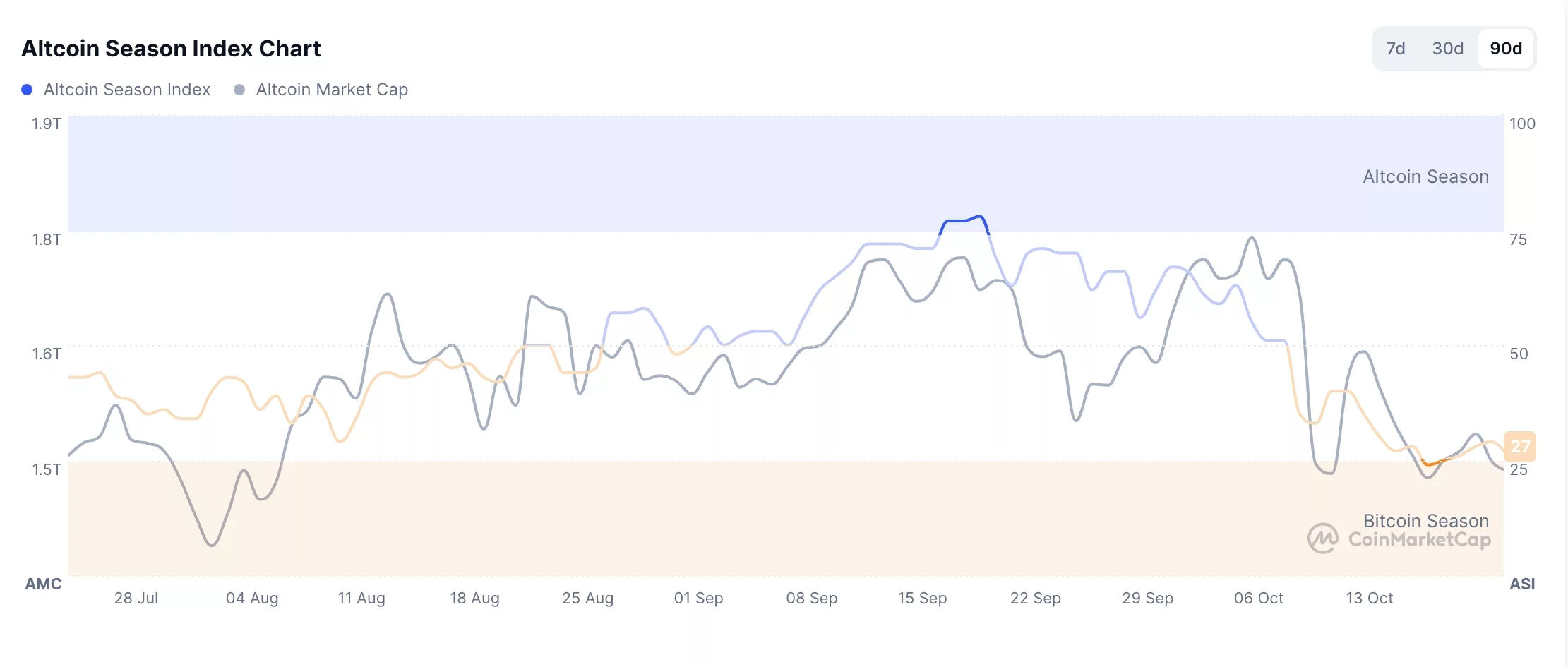

The ongoing crypto market crash is being fueled by altcoins, many which have plunged by over 50% from their highest levels in September. The top laggards in the last 90 days were tokens like FET, Pi Network, Dogwifhat, Virtuals Protocol, Kaspa, Celestia, and Pepe.

Altcoin Season Index chart | Source: CMC

Altcoin Season Index chart | Source: CMC

Altcoins have underperformed Bitcoin because many of them are highly speculative. Also, Bitcoin often drives the narrative in the crypto industry. Many tokens rally when it rises modestly, and plunges when it drops slightly.

You May Also Like

Will Bitcoin Soar or Stumble Next?

BDACS unveils KRW-backed stablecoin KRW1 on Avalanche