ASTER, HYPE Lead Altcoin Recovery, BTC Bounces Above $100K: Market Watch

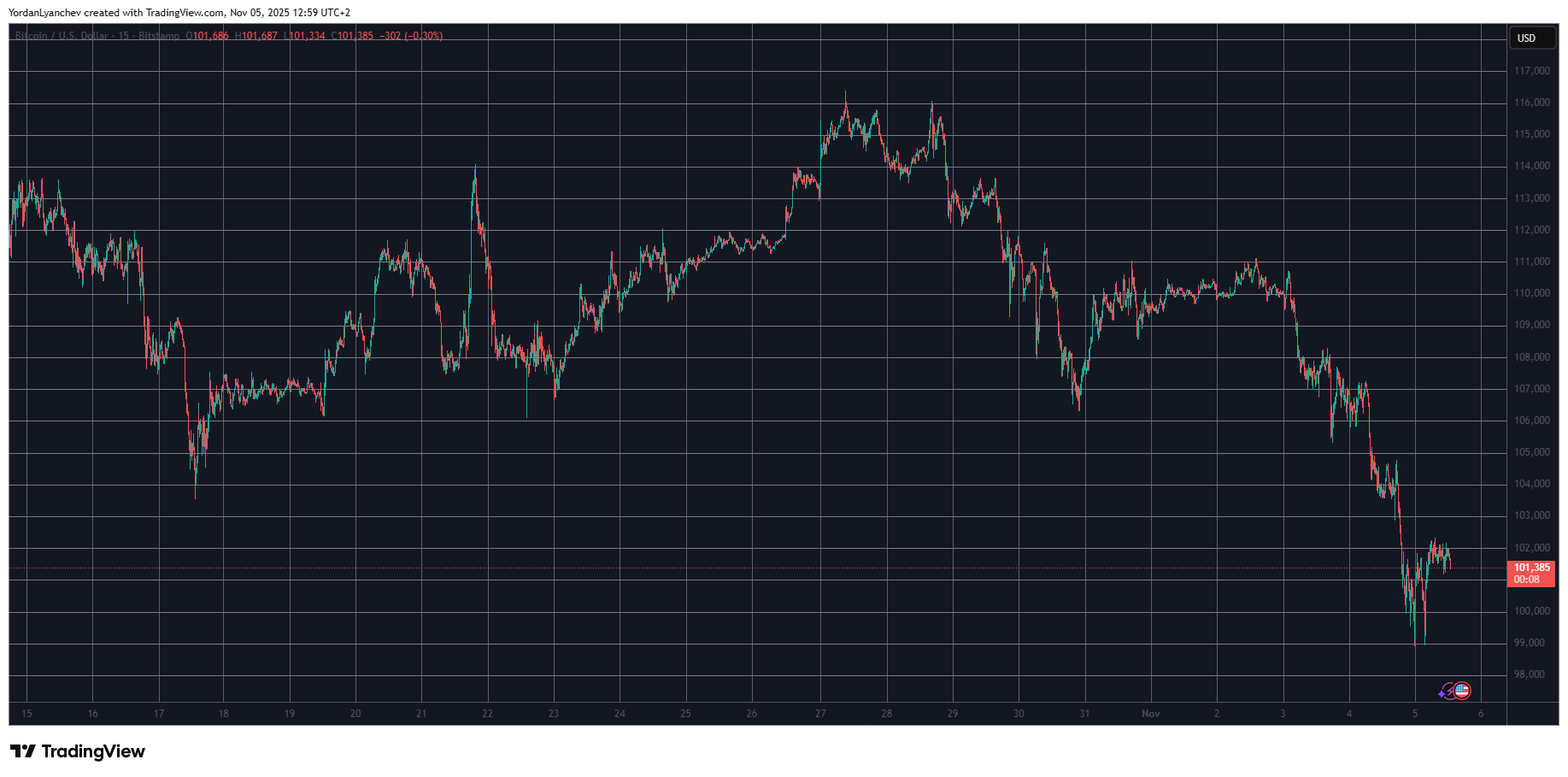

Bitcoin’s nosedive culminated yesterday with a massive price plunge to just under $99,000, which became its lowest level in almost five months.

Many altcoins followed suit, including ETH, which turned negative for the year. Now, though, a few of them have posted impressive increases, led by ASTER and HYPE.

BTC Bounces Above $100K

It was just a week ago when the primary cryptocurrency challenged the $116,000 resistance. After a couple of unsuccessful attempts, the asset was pushed south and tumbled below $107,000 after the US Fed cut the interest rates.

It recovered some ground by the weekend and stood between $110,000 and $111,000. Then came Monday, and all hell broke loose. BTC dumped to $104,000 and, after a minor bounce later that day, initiated another substantial leg down on Tuesday. The most impactful decline took place yesterday evening when bitcoin slumped below $100,000 and bottomed at just under $99,000.

This marked its lowest price point since mid-June, prompting analysts to speculate that the bear market has begun. The bulls finally intervened at this point and helped BTC rebound slightly to just over $101,000 as of press time.

Nevertheless, its market cap has suffered badly and is down to $2.020 trillion on CG. Its dominance over the alts, though, has increased further to 58.6%.

BTCUSD. Source: TradingView

BTCUSD. Source: TradingView

HYPE, ASTER on the Rebound

The altcoins were battered yesterday as well, including their leader. ETH plunged from $3,900 on Sunday to under $3,200 on Tuesday evening, thus erasing all gains charted in 2025. On a daily scale, ETH has neared $3,300, but it’s still the worst-performing larger-cap alt.

XRP, BNB, SOL, DOGE, ADA, LINK, BCH, and XLM are also in the red, while HYPE, ASTER, and BGB have charted 6-7% gains overnight.

The cumulative market cap of all crypto assets dumped by more than $400 billion from top to bottom in just two days before it rebounded to $3.450 trillion as of press time.

Cryptocurrency Market Overview Daily. Source: QuantifyCrypto

Cryptocurrency Market Overview Daily. Source: QuantifyCrypto

The post ASTER, HYPE Lead Altcoin Recovery, BTC Bounces Above $100K: Market Watch appeared first on CryptoPotato.

You May Also Like

No Longer Just a Token: Pi Network Is Quietly Building a Massive Digital Economy

Zoomex & UR Debut Transparent Multi-Currency Virtual Card