Variant, Coinbase Ventures, Gemini and More Invest $5M in Solana Staking ‘Transformer’ Pye Finance

Pye Finance has revealed a $5 million seed round led by some of the major players in the space. The goal is to turn billions in locked SOL stakes into an active yield market.

Variant and Coinbase Ventures led this round, with participation from Solana Labs, Nascent, Gemini, and others, according to the press release.

Pye says that it’s building bond markets for validators and stakers on Solana (SOL). The platform enables validators to draw and keep stake. They can offer rewards across more than a thousand validators.

According to the team, they accomplish this by creating transferable, time-locked staking positions with transparent reward sharing.

Moreover, they argue that the approach opens up novel DeFi use cases. These include lending and restaking, as well as fixed-yield products for the $60 billion locked in staking.

Per Brian Long. CEO of Block Logic & Triton, “Stake Trading unlocks new possibilities for both stakers and validators which is much needed.”

According to Alana Levin, investor at Variant, Pye’s staking marketplace could “fundamentally change how staking operates on Solana. By allowing validators and stakers to better align their preferences – for example, enabling validators to offer higher yields in exchange for longer lockups – Pye creates a more efficient, transparent, and incentive-aligned staking ecosystem.”

Meanwhile, Pye is the product of Alberto Cevallos, co-founder of Bitcoin yield aggregator on Ethereum BadgerDAO, and Erik Ashdown, an exec with a background in structured products in traditional markets.

“Validators have become the underbanked layer of Web3,” Ashdown says. Pye is building a financial infrastructure that lets validators operate like asset managers, offering structured products and predictable returns.

Notably, this raise follows a closed alpha. The team plans to launch a private beta in the first quarter of 2026. Early access is currently available to validators and staking providers.

Passive Billions ‘Turning’ Into Active Yield Market

Staking is shifting from a passive yield mechanism into a programmable financial layer, the team says. Institutional stakers look for transparent reward structures, customizable terms, and the option to trade or borrow against locked positions.

Therefore, Pye says it’s turning validators from node operators into yield providers who can “compete on product offerings rather than just commission rates.” It’s creating the first onchain marketplace for time-locked staking positions on Solana, it adds.

With this, they claim, they’ll turn Solana’s billions in locked stake into an active, programmable yield market.

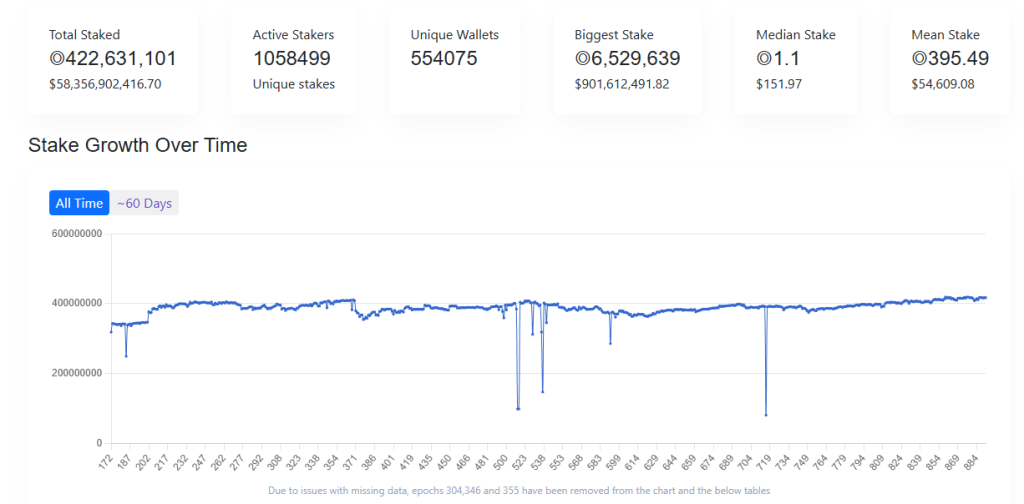

The total staked currently sits at 422.6 million SOL, or nearly $59 billion.

Source: solanacompass

Source: solanacompass

Notably, the team argues that these accounts have seen no updates in years and have no liquidity. Additionally, they lack customization and control over staking rewards.

At the same time, institutions and digital asset treasuries (DATs) are asking for a bigger piece of the reward pie, the Solana Foundation’s Delegation Program (SFDP) is seeing a cut, and smaller validators have to scramble to find ways to generate revenue or attract stakers.

Pye says its solution is an upgrade to Solana’s native Staked accounts. Validators gain control over their staking rewards and time locks. Validator agreements move onchain as ‘transferable locked stake’ – they are locked but can be traded on secondary markets. These are split into a Principal Token and a Rewards Token (RT).

“The aim is to enable validators to offer more flexible and dynamic products, tapping into additional revenue opportunities while delivering greater utility to stakers,” the press release says. “Without the ability to structure term-based deals, reward loyalty, or provide additional utility–such as better accounting, rewards forwarding, or other features–many validators are left vulnerable to sudden outflows that can destabilize operations.”

Dan Albert, Solana Foundation’s Executive Director, commented that Pye’s “tradeable, fixed-term positions at the validator level represent a major unlock for both rewards discovery and capital efficiency in proof-of-stake networks, and open up new opportunities.”

You May Also Like

Trump adviser demands Fed economists be 'disciplined' for arguing with presidential tactic

Trump admin appeals after judge orders slavery exhibit returned to Philadelphia museum