XRP Price Slips to $2.16 as Whale Activity Hits 3-Month High — What’s Really Happening?

The post XRP Price Slips to $2.16 as Whale Activity Hits 3-Month High — What’s Really Happening? appeared first on Coinpedia Fintech News

As crypto markets compress, Bitcoin price heads towards the crucial support at around $90,500. Meanwhile, the XRP price also plunges below $2.2 in times when the whales have suddenly become active. The crypto extended its short-term decline on Tuesday, trading near $2.16, even as on-chain data revealed a sharp surge in large whale transactions. The unusual divergence between falling prices and rising smart-money activity has pushed the XRP price into a critical decision zone for traders.

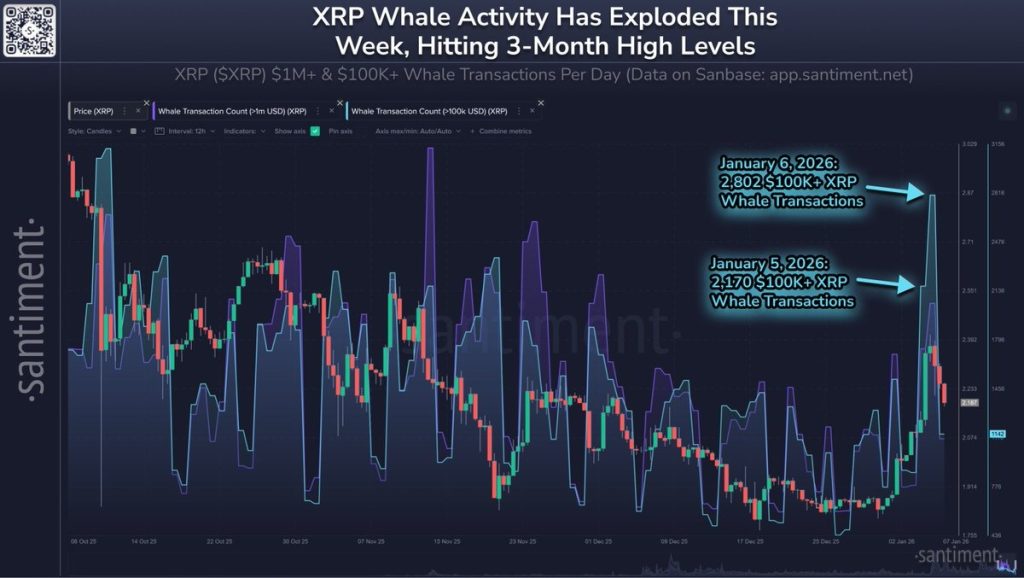

XRP Whale Activity Explodes Despite Falling Price

The XRP price broke out of descending consolidation earlier this year. This move appears to have triggered the whales, who have carried out huge transactions. The whale activity surged sharply even as prices continued to slide, highlighting a growing divergence between large-holder behaviour and market direction that suggests active positioning rather than a simple reaction to falling prices.

Source: X

Source: X

On-chain data from Santiment shows that XRP transactions worth over $100,000 surged to 2,802 on January 6, up sharply from 2,170 on January 5. This marks the highest daily whale transaction count in nearly three months. Typically, rising whale activity accompanies strong price moves. This time, it did not. Instead, XRP continued to slide below $2.20, suggesting that large holders are actively repositioning while the price remains under pressure.

Why Does XRP Price Remain Unaffected?

As the market sentiments turn bearish, the XRP price faced a rejection from the local highs close to $2.4. The bears dragged the levels below $2.13 by inducing huge selling pressure during the last trading day. As a result, the price that began the day’s trade on a bearish note is believed to maintain a strong descending trend. Now the question arises whether the bulls could defend the support at $2?

After the failed attempt to breach above the rising trend line, which has been a strong support throughout 2025, the rally seems to have turned in favor of bears. The constant decline in the OBV validates the bearish claim, hinting towards a possible move not only below $2 but also below $1.8. However, the 50-day MA at $2.02 could act as a strong base, and if the market dynamics recover, a strong rebound could be possible, driving the price beyond the 200-day MA at $2.38.

Two Scenarios Traders Are Watching Closely

A surge in whale transactions during a declining market often signals strategic positioning, not panic. Large investors tend to act early. They accumulate or distribute when liquidity is available, not when price momentum becomes obvious. When whale activity rises while price falls, the market usually enters a compression phase before a decisive move. However, the direction of that move depends entirely on price response, not the activity itself.

Accumulation Scenario: Smart Money Absorbing Supply

If XRP holds above $2.05–$2.10, the recent whale activity may indicate accumulation.

In this scenario, large holders absorb selling pressure from weaker hands while price drifts lower or moves sideways. Once supply dries up, XRP could attempt a recovery toward the $2.40–$2.55 range.

Distribution Scenario: Whales Selling Into Liquidity

If XRP continues to reject the $2.20–$2.25 resistance zone, the surge in whale transactions could reflect distribution rather than accumulation. In that case, large holders may be using elevated activity to exit positions while demand remains fragile. A sustained move below $2.00 would significantly weaken the bullish thesis and expose XRP to deeper downside pressure.

What Traders Should Watch Next

XRP’s decline toward $2.16, combined with a surge in whale activity, signals a critical positioning phase rather than a resolved trend. Large holders are clearly active, yet price confirmation remains absent. Until XRP reclaims the $2.20–$2.25 zone, downside risk toward $2.00 cannot be ruled out. For now, the market is watching whether smart money is quietly absorbing supply or distributing into weakness. Direction will follow once price reacts.

You May Also Like

Trump ally raises eyebrows with startling admission on Fox News: 'Cover-up isn't new'

South Korean Prosecutors Sell 320 Bitcoin for $21.5M After Hacker Returns Stolen Funds