Pump.fun Debuts New Investment Arm Pump Fund

Pump.fun has launched Pump Fund, a new investment arm focused on startup projects built inside its ecosystem. The initiative replaces traditional venture capital selection with market-based token launches.

The first program is a “Build in Public” hackathon that will deploy $3 million across 12 projects. Each project will receive $250,000 at a $10 million valuation. Founders must launch a token and retain at least 10% of its total supply. Funding is tied directly to live market demand.

As per the series of posts on X, the hackathon is open to crypto and non-crypto projects. Teams are required to ship products quickly, communicate publicly, and attract users in real time. Submissions close on Feb. 18, with the first winners expected within 30 days.

Meanwhile, the PUMP token is up 30% in the past month and more than 1% in the past 24 hours, CoinMarketCap data shows. At press time, the altcoin trades at $0.002535, down 78% from its all-time high of $0.01214.

Market-Driven Funding Model

The structure removes judges and venture firms from the process. Projects raise capital by selling tokens to users, with price action, liquidity, and usage acting as the filter.

Pump.fun stated that organic demand will matter more than founder background or credentials. Selection will focus on real user traction, fast deployment, and the ability to survive beyond early speculation.

Interestingly, Pump.fun was a major driver of the meme coin cycle in 2024 and 2025. The platform has facilitated over 14 million token launches and generated more than $1 billion in revenue in under two years.

Its native token, PUMP, launched in July and raised over $1 billion within minutes. After reaching an all-time high in September, PUMP has fallen roughly 70% and trades near $0.0026 as of today.

Despite weaker sentiment, activity has not reduced with daily token launches recently moving above 30,000, a three-month high when updates to creator incentives were introduced

Revenue Optimistic

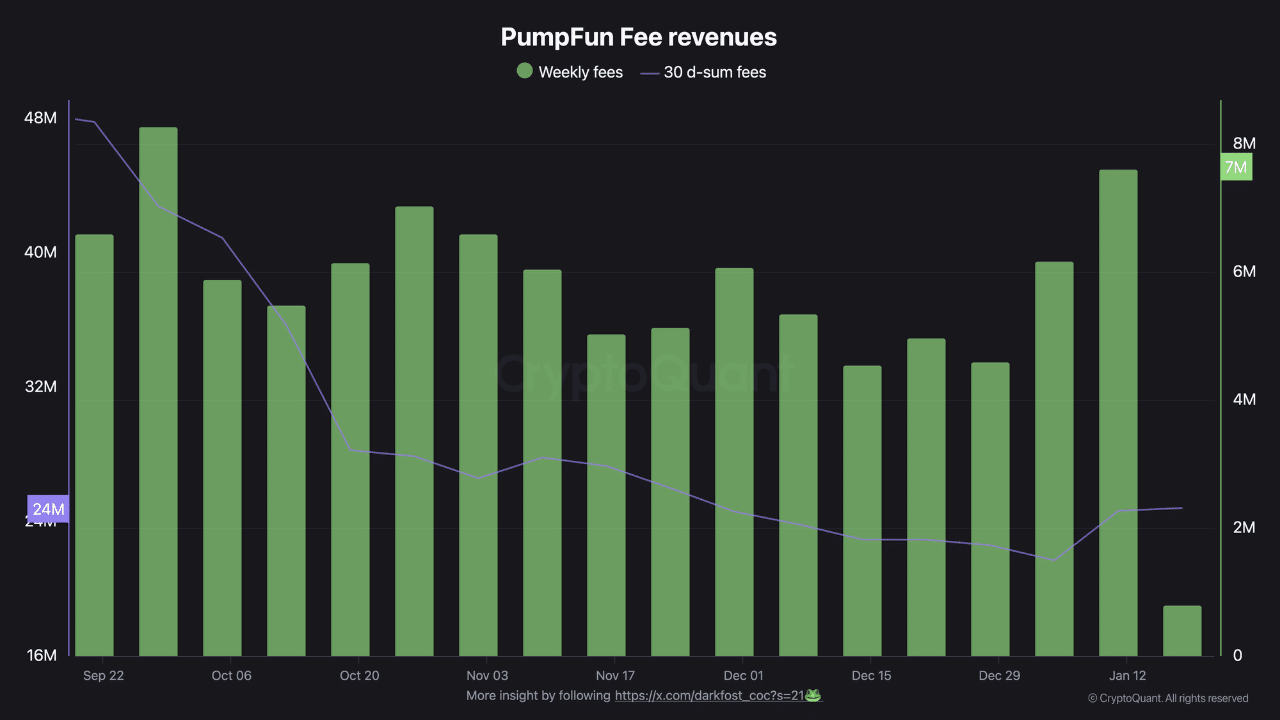

CryptoQuant data shows Pump.fun generated about $7.6 million in fees over the past week, the highest level since September 2025. This followed several weeks of stable revenue between $4 million and $6 million.

Pump.fun fee revenues | Source: CryptoQuant

The 30-day rolling revenue total rose from $21.6 million to $24.8 million. The increase came during a short meme coin rebound. Even with lower overall interest in meme coins, Pump.fun continues to capture bursts of volume.

nextThe post Pump.fun Debuts New Investment Arm Pump Fund appeared first on Coinspeaker.

You May Also Like

Republican knives come out for Kristi Noem: ‘I don’t think she walks away from this’

Kazakhstan to launch $350M national crypto reserve