These Metrics Signal $100 Was the Local Bottom

Solana price action suggests a potential bottom around the $100 area across multiple timeframes, setting the stage for a longer-term rebound that could target the $260 zone if key hurdles are cleared. The decline from a high near $127 shaved about 25% off the price before buyers stepped in at support around $100. In the near term, momentum indicators hint at a gradual re-acceleration: the four-hour RSI has climbed to the mid-30s from oversold territory near 18, while the daily RSI remains deeply oversold around 29, a level that has historically preceded rebounds. With bulls eyeing a V-shaped recovery, traders are watching for convincing breaks through resistance bands that have historically paused pullbacks.

Key takeaways:

SOL must break several resistances before $260

- The four-hour chart is showing a potential bottoming pattern, hinting at a possible acceleration if the price can stay above critical support and push through immediate supply hurdles.

- First resistance sits in the $113–$115 zone, where several trendlines converge and selling pressure could intensify as the price reclaims momentum.

- A second barrier lies in the $125–$130 area, defined by a confluence of the 50-day EMA and the 50-day SMA, which has historically acted as stubborn resistance for SOL.

- Clearance of these zones could open the way to the neckline around the $150 mark, setting up a trajectory toward higher levels and a potential longer-term upside target around $260.

- On the bigger picture, the weekly perspective shows that the 50-week moving average sits roughly in the $140–$160 range, a region that has historically postponed rallies even when shorter-term momentum improves.

In a broader view, Solana’s on-chain activity has begun to show renewed vigor. The network’s total value locked (TVL) climbed to 73.4 million SOL on Monday, which translates to about $7.5 billion at prevailing rates. This marks an 18% week-over-week rise and echoes a renewed appetite for Solana-based projects and DeFi protocols. The last time TVL reached similar daily high-water marks in SOL terms, activity on the network surged alongside price gains that followed later in the year.

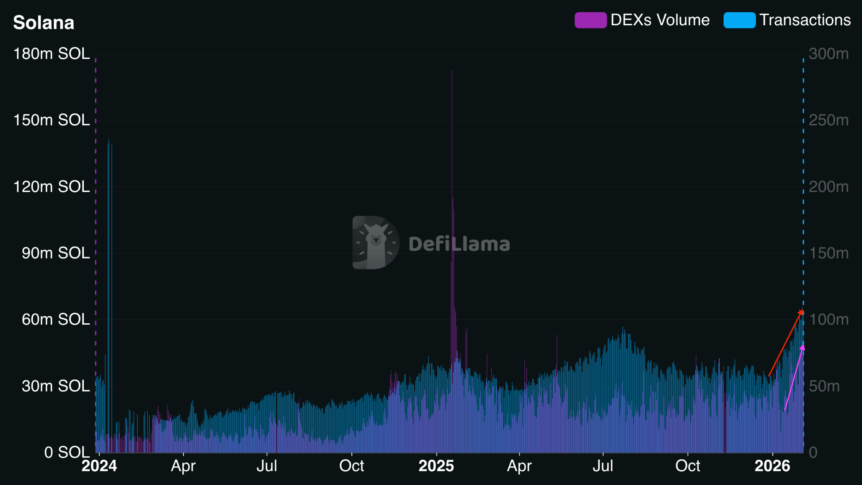

Solana network total value locked, SOL. Source: DefiLlamaThe daily transaction count rose to a two-year high, clocking in at approximately 109.5 million transactions. At the same time, the daily DEX volume reached about $51.3 million SOL, with weekly DEX trading volume climbing to 264.8 million SOL for the week ended Sunday. Daily active addresses surged roughly 115% in late January, a jump that analysts often associate with improving price action in SOL.

Solana number of transactions and DEX volume. Source: DefiLlama

Solana number of transactions and DEX volume. Source: DefiLlama

The chart narrative remains nuanced. A return toward the $120–$150 band could be feasible if the 20-day EMA at around $106 is reclaimed as support, a scenario highlighted in market commentary that noted the potential for a test of the nearby supply bands before a broader rally unfolds. If traders manage to secure that foothold, the next milestone would be a sustained break above the $150 neckline, which would improve the odds of a move toward the mid-$200s and beyond. This is particularly relevant given that a longer-term upswing would require not only a technical breakout but continued healthy on-chain activity and ecosystem development.

From a macro vantage point, Solana’s progress comes as part of a broader re-prioritization across crypto markets, where liquidity is gradually returning and risk appetite shows tentative signs of revival. While the near-term path remains contingent on whether SOL can convincingly clear its first resistance bands, the confluence of improving on-chain metrics and a constructive price pattern provides a framework for optimism among SOL participants.

Solana’s market dynamics and why it matters

Beyond the price action, the evolving on-chain picture matters because it underpins the sustainability of Solana’s ecosystem. Higher TVL and increased network activity suggest that developers and users continue to deploy and interact with Solana’s DeFi and NFT applications. For investors, this signals that the network is not merely experiencing a recovery in price but also in fundamental engagement, which can help sustain upside in a multi-month horizon.

Investors watching for catalysts should consider both price structure and on-chain momentum. If SOL can reclaim the $106 level and push through the $113–$115 resistance band, the odds of testing the $125–$130 hurdle rise. A decisive break beyond that zone—ideally accompanied by continued growth in TVL and daily active addresses—could set up a longer-term trajectory toward previously observed highs and the target around $260. However, countercurrents such as broad market weakness, regulatory headlines, or shifts in liquidity could compress gains or trigger renewed volatility.

Why it matters for the ecosystem

For developers and users within Solana’s ecosystem, a sustained price and on-chain activity recovery can re-energize funding cycles, NFT markets, and the deployment of new decentralized applications. A rebound that aligns with improving on-chain metrics could attract new liquidity to Solana-based projects, potentially accelerating adoption and network effects. Conversely, a prolonged stall near resistance bands or a regression to the $100 support could delay momentum and slow the pace of development activity.

Ultimately, the health of the Solana network hinges on a combination of technical validation and real-world usage. The interplay between price patterns, moving-average resistances, and on-chain engagement will continue to shape the near-term trajectory and determine whether the bullish thesis gains traction or remains a conditional scenario contingent on broader market strength.

What to watch next

- Hold above $100 support on a closing basis to maintain the potential for a rebound towards higher resistance bands.

- Reclaim of the 20-day EMA around $106 as support would add conviction for a move toward $113–$115.

- Clearance of the $113–$115 zone followed by the $125–$130 area would open a path toward the $150 neckline.

- Monitor the weekly MA zone of $140–$160 as a longer-term resistance barrier that could delay a breakout.

- On-chain metrics to watch: TVL (targeting continued strength in SOL-denominated value), daily transactions, active addresses, and DEX volumes for signs of sustained engagement.

Sources & verification

- SOL price movement and RSI context, including the move off a $100 support and the 4-hour/ daily RSI readings documented in price analysis references.

- DefiLlama data for Solana TVL, daily transactions, and DEX volumes (TVL: 73.4 million SOL ≈ $7.5B; daily transactions: ~109.5 million; daily DEX volume: ~$51.3M; weekly DEX volume: ~264.8M SOL).

- On-chain activity note: daily active addresses rise by approximately 115% in late January.

- Market commentary on the potential impact of reclaiming the 20-day EMA around $106 and the subsequent test of short-term resistance bands.

This article was originally published as These Metrics Signal $100 Was the Local Bottom on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

Cloud mining is gaining popularity around the world. LgMining’s efficient cloud mining platform helps you easily deploy digital assets and lead a new wave of crypto wealth.