Vantage Data Centers (VNTG) Stock: APAC Expansion Boosts Outlook Despite 2.87% Drop

TLDRs:

- Vantage’s $1.6B APAC expansion signals long-term growth despite a 2.87% stock decline.

- Johor campus acquisition positions Vantage to capture Singapore overflow demand.

- Asia-Pacific data center market growth fueled by AI infrastructure needs.

- Large-scale credit investment mirrors dot-com era infrastructure surge concerns.

Vantage Data Centers (VNTG) secured a US$1.6 billion investment to scale its operations in the Asia-Pacific region, a move that comes amid growing demand for data center capacity across Asia.

Funding was led by affiliates of GIC and the Abu Dhabi Investment Authority, reflecting strong institutional confidence in Vantage’s regional strategy.

As per A Wednesday announcement, he capital injection will enable Vantage to acquire a hyperscale data center campus in Johor, Malaysia, from the Yondr Group. Located in Sedenak Tech Park, the campus, designated JHB1, will add more than 300MW of IT capacity across three facilities. Once operational, expected in Q4 2025, this expansion will lift Vantage’s total APAC capacity to 1GW spanning Australia, Malaysia, Japan, Taiwan, and Hong Kong.

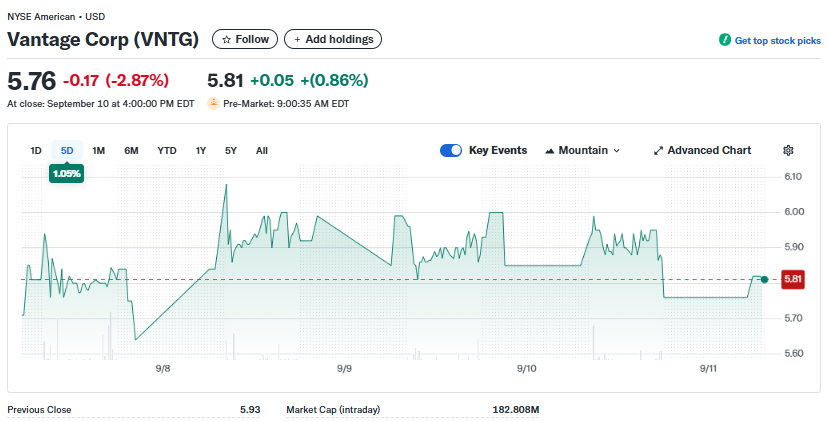

Despite this strategic milestone, Vantage stock dropped 2.87% on Wednesday, closing at $5.76, reflecting short-term market volatility rather than fundamental concerns about growth prospects.

Vantage Corp (VNTG)

Vantage Corp (VNTG)

Capturing Singapore Spillover Demand

The Johor campus acquisition underscores a deliberate strategy to capture overflow demand from Singapore. By situating the campus in the Johor-Singapore Special Economic Zone and leveraging dark fiber connectivity, Vantage can combine Singapore’s connectivity advantages with Malaysia’s lower operating costs and government incentives.

Analysts note that this approach reflects a broader Southeast Asian trend of hyperscalers expanding infrastructure cannot meet demand alone, creating opportunities for third-party developers.

Vantage’s 300MW+ campus is among the largest hyperscale facilities in the region, reinforcing the firm’s capacity to meet the explosive growth in AI-driven IT infrastructure.

APAC Market Growth Fueled by AI

The timing of Vantage’s expansion aligns with unprecedented growth in the Asia-Pacific data center market. Investments in the region reached $15.5 billion in the first half of 2025 alone, representing roughly 70% of cross-border capital flows.

Analysts forecast the market will expand from $31.89 billion in 2023 to $77.29 billion by 2030, growing at a 13.5% compound annual rate.

Much of this demand is driven by AI infrastructure requirements. A recent survey found that 72% of organizations in the region tie their data location strategy to AI initiatives, while 64% of IT leaders cite insufficient storage for AI datasets as a major constraint. Vantage’s expansion positions the company to capitalize on these trends, particularly in regions where digital infrastructure is in high demand.

Large-Scale Credit Investment Raises Questions

While the expansion highlights growth potential, it also reflects broader investor sentiment toward AI infrastructure. Vantage is benefiting from a $22 billion loan arranged by JPMorgan Chase and Mitsubishi UFJ Financial Group to finance large-scale projects.

Industry observers have drawn parallels to the dot-com era, noting that massive infrastructure investment often precedes proven revenue models.

OpenAI and other tech leaders have similarly emphasized the enormous capital required to support AI services, suggesting that the current boom may carry risks reminiscent of past technology cycles. Citigroup strategists warn that overbuilding and excessive borrowing in infrastructure-heavy sectors can lead to significant writedowns if demand projections fall short.

Looking Ahead

Despite the short-term stock drop, Vantage Data Centers’ strategic APAC expansion positions the company to meet rising AI-driven demand and secure a strong foothold in the region.

Investors and industry watchers will be closely monitoring operational progress at Johor and the broader Asia-Pacific market, balancing optimism about growth with caution over potential overcapacity risks.

The post Vantage Data Centers (VNTG) Stock: APAC Expansion Boosts Outlook Despite 2.87% Drop appeared first on CoinCentral.

You May Also Like

X Announces Higher Creator Payouts on Platform

A Netflix ‘KPop Demon Hunters’ Short Film Has Been Rated For Release