Can Zcash Go Even Higher? Galaxy Digital Drops Its Take

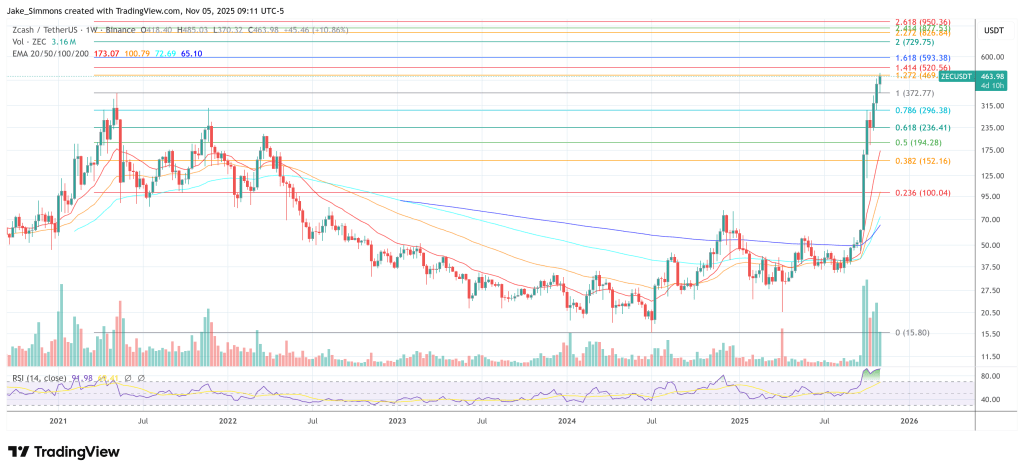

A new Galaxy Digital research note argues that Zcash’s startling comeback is not just a chart phenomenon but the visible edge of a broader privacy rotation—and that the coin’s fundamentals and user experience have changed enough to merit a market repricing. Published on November 4, 2025, the report asks why ZEC “has suddenly soared” and points to a confluence of cultural, market-structure, and product-level shifts that have pushed privacy from afterthought to headline feature. “After years of languishing, ZEC has surged ~8x in the past month,” Galaxy writes, a move that has “forced a fresh conversation about privacy as a feature.”

Why Is Zcash Skyrocketing?

Galaxy’s central contention is that Zcash’s technology is finally meeting consumers where they are. The team highlights Electric Coin Company’s Zashi wallet, launched in 2024 and iterated this year, which “abstracts away the complexity of the shielding UX,” and integrates NEAR’s intent layer to let users express outcomes—swap this into ZEC; pay that address—without manual bridging or multi-app choreography.

In Galaxy’s terms, NEAR Intents allow users to state the “intention (like ‘pay X amount of ETH to address y’)” while autonomous executors route liquidity and settle across chains, enabling flows into and out of Zcash’s shielded pools with minimal on-chain breadcrumbing. The report stresses that Zcash’s native view keys enable selective disclosure for audits and compliance, framing the new stack as both accessible and institution-compatible.

That usability shift lands alongside a visible on-chain change: for the first time in Zcash’s history, more than 30% of supply now sits in shielded pools, with Orchard hosting the majority of roughly 4.9 million shielded ZEC.

Galaxy’s analyst captures the privacy economics in a single line: “The larger the shielded pool, the harder it is to trace flows,” before adding the corollary—“A bigger anonymity set equals stronger privacy.” Transparent supply has fallen by nearly 3 million ZEC this year, from about 14 million to roughly 11.4 million, a redistribution that strengthens the very property Zcash was built to deliver.

The narrative shift is also being reinforced by market-structure signals. In what Galaxy calls the “clearest sign that Zcash is ‘so back,’” Hyperliquid listed ZEC perpetuals a few weeks prior to the note, expanding access and leverage for traders and lifting liquidity. Open interest reached roughly $115 million as of October 30, a mechanical tailwind that can translate into greater spot volatility on the way up—and down.

Importantly, the report refuses to pretend Zcash is unchanged under the hood. It places Zcash’s zk-SNARK-powered privacy in the lineage that began with Zerocoin and Zerocash, and then enumerates the protocol’s upgrade path—from Sapling (2018) to NU5/Orchard (2022) and NU6 (2024’s in-protocol lockboxes)—as the foundation for today’s UX. The research underscores that Zcash remains proof-of-work with a 21 million cap and ~75-second blocks, i.e., a monetary skeleton familiar to Bitcoiners but with encrypted transfers at the core.

Can ZEC Price Rally Further?

The cultural context matters here. Galaxy explicitly situates the rally amid a renewed debate that rhymes with Bitcoin’s earliest years: privacy as a right versus transparency as regulatory necessity. The note cites high-profile voices on both sides, including critics of “coordinated token pumps” and defenders who argue that “transparent crypto won’t survive a government crackdown,” while reminding readers that Satoshi himself acknowledged Bitcoin’s privacy limits. The upshot is not a verdict on regulators, but an observation that the market is repricing privacy as a first-class feature rather than a niche accessory.

Risks and frictions are not waved away. Galaxy points to Zcash’s relatively small node footprint—roughly 100–120 full nodes in recent counts—compared with Bitcoin’s tens of thousands and Monero’s thousands, and explains why: verifying shielded transactions is more resource-intensive, the multi-pool architecture adds complexity, and frequent network upgrades require operator vigilance. The technical roadmap is meant to address those constraints; the note flags Sean Bowe’s “Project Tachyon” as a prospective throughput and sync overhaul “without introducing a new shielded protocol,” an efficiency push Galaxy likens in spirit to Solana’s Firedancer.

Where does this leave the core question—can Zcash rally further? Galaxy does not offer a price target. Instead, it frames the upside case as contingent on whether today’s intent-driven UX and swelling anonymity set translate into durable, organic activity. The mechanics are straightforward: if more assets are brought into ZEC via NEAR Intents and shielded, the anonymity set continues to deepen; if Zashi’s integrations keep compressing user friction—on-ramping, swapping, and private payments—Zcash’s “privacy by design” becomes less of an ideal and more of a default behavior.

As Galaxy puts it, “Zcash is gaining visibility as its privacy stack finally reaches consumer-grade usability… As more ZEC gets shielded, the anonymity set grows and allows Zcash to become more private.”

But the same feedback loops can run in reverse. A thinner node set is more brittle in adverse conditions; leverage-led liquidity can unwind as fast as it forms; and the political economy of privacy—long Zcash’s biggest headwind—remains outside the protocol’s control. Galaxy’s conclusion, therefore, is deliberately narrow and empirical: the rally has already “succeeded in forcing the market to reprice privacy,” putting Zcash back in the arena after years on the sidelines.

Whether price strength persists will hinge less on narrative than on continued real usage of intents-based swaps, growing shielded supply, and tangible improvements to the network’s operational footprint.

At press time, ZEC traded at $463.98.

You May Also Like

Top 3 Price Prediction for Ethereum, XRP and Bitcoin If Crypto Structure Bill Passes This Month

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets