Here’s What XRP Price Would Be If Its Market Cap Reached Elon Musk’s Net Worth

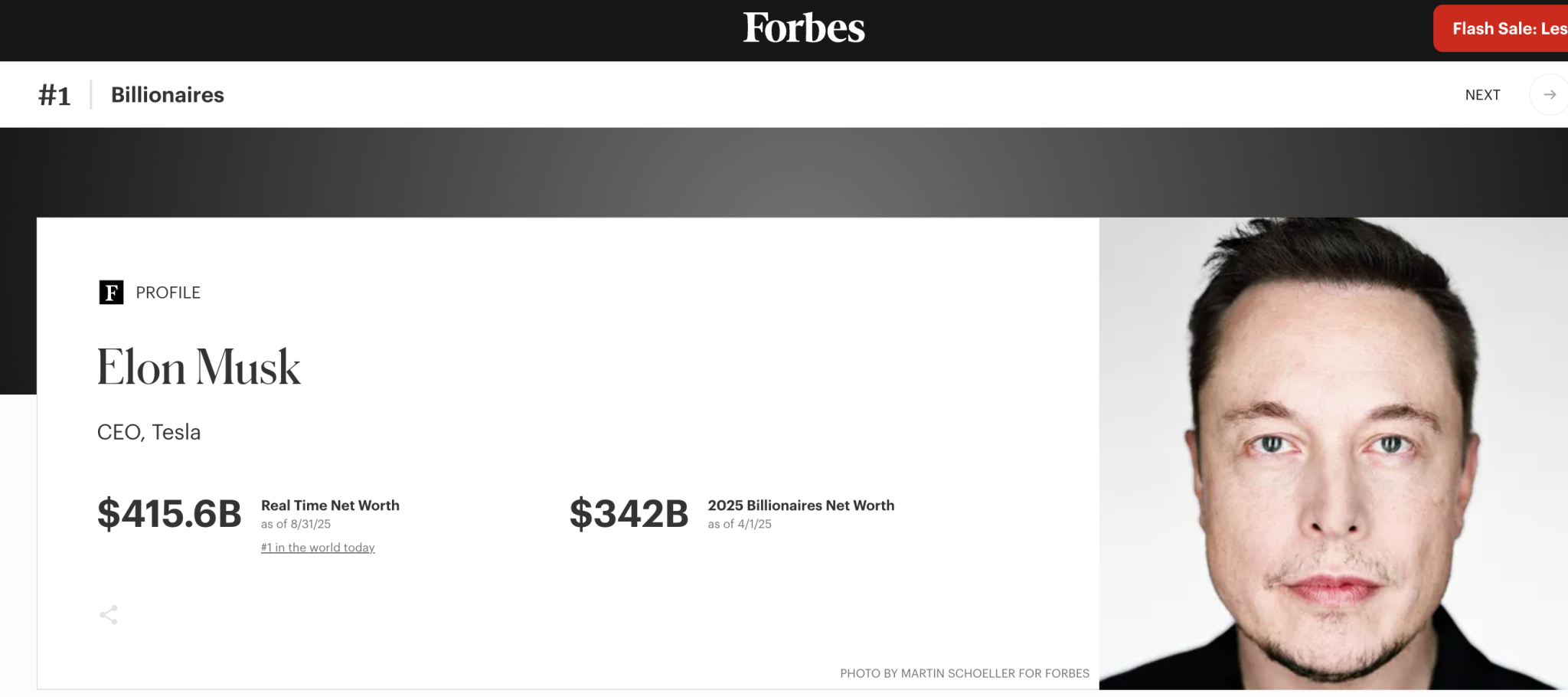

XRP stands to gain massively if its valuation rises to the level of the current richest man in the world—Elon Musk. Currently, XRP boasts a market capitalization of $168 billion with a price of $2.90, making it the third-largest cryptocurrency. The only cryptos ahead of XRP are Ethereum and Bitcoin, with market caps of $537 billion and $2.17 trillion, respectively. Many believe XRP is significantly undervalued at its current position. They continue to project future valuations where XRP would be worth much more. Based on this popular sentiment within the XRP community, this article explores the potential valuation of XRP if its market cap were to match Elon Musk’s net worth. XRP and Elon Musk’s Net Worth According to Forbes, Elon Musk’s real-time net worth is $415.6 billion, making him the richest person in the world. Notably, Musk accumulated his wealth through seven companies he co-founded, including SpaceX, Tesla, and xAI. He owns about 12% of Tesla (excluding options), although over half of that is pledged as loan collateral. Musk also holds a 42% stake in SpaceX, which was valued at $350 billion in late 2024. In 2022, he acquired Twitter (now X) for $44 billion, though its value had dropped nearly 70% as of August 2024. Additionally, Musk owns 54% of xAI, which was valued at $50 billion in November 2024. It’s worth noting that Tesla is one of the top 11 public companies holding crypto, with a Bitcoin portfolio exceeding $1.2 billion. Given X’s planned rollout of payment integration features, speculation has emerged within the XRP community that XRP could potentially be adopted as the underlying blockchain. As TRIBLU Founder Joshua Dalton tweeted in June, Elon Musk “will do anything” to make XRP the chosen one. However, Musk himself has not shown any clear interest in XRP. In October last year, he did mention XRP publicly—but only in response to a question during a Trump campaign event. Nonetheless, the XRP community continues to push for Musk to endorse the coin. What Would XRP Price Be at Musk’s Net Worth? Currently, Musk’s net worth of $415.6 billion is roughly 2.5 times larger than XRP’s market valuation of $168 billion. Given XRP’s circulating supply of 59.48 billion tokens, a market cap equivalent to Musk’s net worth would result in an XRP price of approximately $7 per token.  Elon Musk Net worth | Forbes Considering XRP’s all-time high of $3.84, this projected price would mark a historic new peak. Notably, XRP only needs to soar by 150% from its current position to reach $7 price and match Musk's wealth. When Could XRP Reach This Level? According to several analysts and voices within the crypto community, the $7 price point could materialize this year. For instance, widely followed crypto commentator Mario Nawfal predicted that XRP could reach $10 by December. Interestingly, this valuation would give XRP a market cap that far exceeds Musk’s current net worth. Another community member, Alex Cobb, believes a $22 price is achievable by December. This price would give XRP a valuation of $1.3 trillion, setting it to rival the valuations of Facebook and Saudi Aramco.

Elon Musk Net worth | Forbes Considering XRP’s all-time high of $3.84, this projected price would mark a historic new peak. Notably, XRP only needs to soar by 150% from its current position to reach $7 price and match Musk's wealth. When Could XRP Reach This Level? According to several analysts and voices within the crypto community, the $7 price point could materialize this year. For instance, widely followed crypto commentator Mario Nawfal predicted that XRP could reach $10 by December. Interestingly, this valuation would give XRP a market cap that far exceeds Musk’s current net worth. Another community member, Alex Cobb, believes a $22 price is achievable by December. This price would give XRP a valuation of $1.3 trillion, setting it to rival the valuations of Facebook and Saudi Aramco.

You May Also Like

Meteora: JUP stakers will be eligible for MET token airdrops

Optopia and EDITH Join Forces to Drive Real-World AI Compute On-Chain