SEC Halts QMMM Trading After 2,000% Stock Surge Following Crypto Treasury Announcement

TLDR

- The SEC suspended trading of QMMM Holdings stock for 10 days until October 10 due to potential manipulation via social media promotions

- QMMM shares jumped over 2,000% in one month after the company announced plans to buy Bitcoin, Ethereum, and Solana in early September

- The regulator alleges unknown persons used social media to artificially inflate the stock price and volume

- QMMM planned to initially spend $100 million building a crypto treasury, similar to over 200 companies that announced crypto strategies this year

- The SEC and FINRA are investigating unusual trading activity in several crypto treasury companies before their public announcements

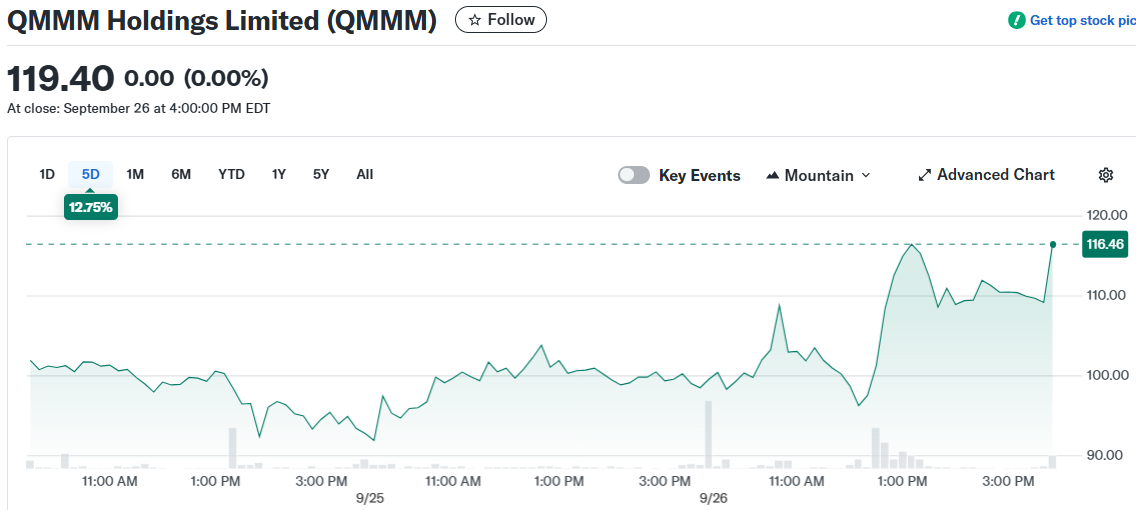

The Securities and Exchange Commission halted trading of QMMM Holdings on Monday after the company’s stock surged more than 2,000% following its announcement of a crypto treasury strategy. The trading suspension will last until October 10.

QMMM Holdings Limited (QMMM)

QMMM Holdings Limited (QMMM)

The regulator cited potential manipulation of the stock through social media. Unknown persons allegedly made recommendations to investors on social platforms to purchase QMMM shares. The SEC stated these promotions appear designed to artificially inflate the stock’s price and volume.

QMMM Holdings, a Hong Kong-based digital advertising firm, announced on September 9 that it would buy and hold Bitcoin, Ethereum, and Solana. The company planned to initially spend $100 million on cryptocurrency purchases. It also said it would build a crypto analytics platform.

The stock closed at $119.40 on Friday before the trading halt. Shares started the month around $6.50. QMMM surged from $11 to an all-time high of $207 in a single day after its crypto announcement.

Carl Capolingua from Market Index told reporters that SEC trading suspensions are rare. The penalties can be severe if the regulator links the stock promotion to company employees or management. Consequences can include large fines or jail time.

Broader Regulatory Scrutiny

The trading halt follows a Wall Street Journal report from Thursday. The report stated that the SEC and the Financial Industry Regulatory Authority contacted several crypto treasury companies. Regulators were examining unusually high trading volumes and price gains ahead of public announcements.

SEC rules prohibit companies from selectively disclosing nonpublic information. Those with advance knowledge could use that information to gain unfairly or avoid losses before wider public disclosure. Over 200 companies announced crypto treasury plans this year.

Capolingua said QMMM’s crypto strategy likely is not the main focus of SEC scrutiny. The alleged illegal stock promotion is the primary issue. The crypto pivot may have attracted some investors but does not appear to be under investigation.

Trading Activity Patterns

Tony Sycamore from IG Australia warned investors against these types of investments for crypto exposure. He described such moves as risky plays that are not appropriate investment strategies.

The SEC and QMMM Holdings did not immediately respond to requests for comment. The stock will remain suspended from trading until October 10 while the investigation continues. QMMM joins a growing number of companies that have adopted crypto treasury strategies in recent months.

The post SEC Halts QMMM Trading After 2,000% Stock Surge Following Crypto Treasury Announcement appeared first on CoinCentral.

You May Also Like

Is Doge Still The Best Crypto Investment, Or Will Pepeto Make You Rich In 2025

One Of Frank Sinatra’s Most Famous Albums Is Back In The Spotlight