Jimmy Song: Why Fiat Arguments About OP_RETURN Must End

Jimmy Song, a notable Bitcoin developer and industry advocate, has criticized the decision by Bitcoin Core developers to remove the OP_Return data size limit in the upcoming Bitcoin Core 30 upgrade. He denounces this move as reflective of a “fiat” mentality, implying a departure from Bitcoin’s core principles of decentralization and security.

Song pointed out that the Core team’s decision to eliminate the current 80-byte cap on OP_Return—used for embedding non-monetary data—ignores significant resistance from the Bitcoin community and node operators. He emphasized that the debate is rooted in definitional issues around what constitutes spam on the network, suggesting that non-monetary data embedded in Bitcoin now falls into a gray area.

He further argued that the claim of ambiguity around spam is a stalling tactic aimed at avoiding a discussion on the long-term implications of removing these limits. The debate over OP_Return’s unrestricted data size has been ongoing for nearly six months and echoes the historical Bitcoin block size wars of 2015-2017, which led to the creation of Bitcoin Cash (BCH). Some community members fear that this decision could spark a similar split in the network.

Node Runners Respond with Exodus to Bitcoin Knots

The unilateral removal of the OP_Return data limit has caused a notable shift among node operators. An increasing number are migrating to Bitcoin Knots, an alternative implementation of Bitcoin node software that enforces stricter data limits to support decentralization. This migration reflects growing concern over network centralization and data bloat.

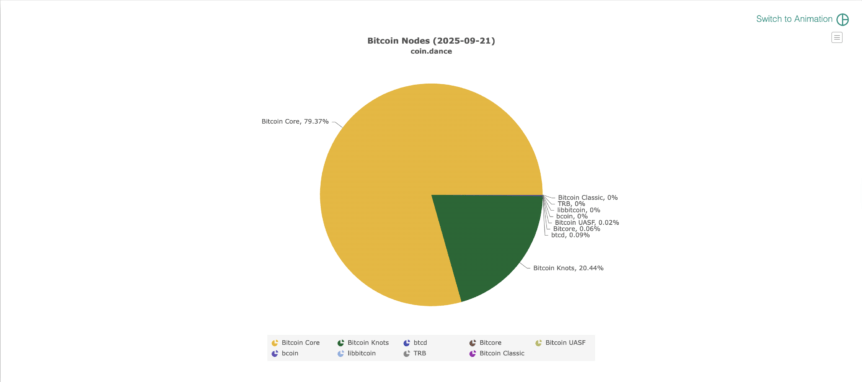

A breakdown of different node software implementations on the Bitcoin network. Source: Coin Dance

A breakdown of different node software implementations on the Bitcoin network. Source: Coin Dance

Since February 2024, Bitcoin Knots nodes have surged from roughly 1% to approximately 20% of all active nodes—a tenfold increase in less than a year. Advocates argue that maintaining data size constraints is vital for preserving Bitcoin’s decentralization and allowing anyone to operate a node with affordable hardware.

Compared to other blockchain platforms that generate much larger data volumes—often requiring costly specialized hardware—Bitcoin’s lean design keeps running a full node accessible to retail users, thus promoting a more decentralized network. This setup minimizes the risk of centralization, where a small group of entities could influence or compromise consensus rules.

Related: Long-term security and the sustainability of Bitcoin’s economic model remain pivotal issues as debates around protocol upgrades unfold, shaping the future of cryptocurrency and blockchain regulation.

This article was originally published as Jimmy Song: Why Fiat Arguments About OP_RETURN Must End on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Top 4 Tokens Turning IP Rights Into Investable Assets

Fed Decides On Interest Rates Today—Here’s What To Watch For