Why Is Avalanche (AVAX) Up Today?

TL;DR

- AVAX soared by double digits following Anthony Scaramucci’s endorsement and Avax One’s ambitious $700M accumulation plan.

- Analysts and traders see more upside, with predictions ranging from $50 to over $100.

The Top Performer

The cryptocurrency market continues to struggle after the violent correction observed on September 22, with most leading digital assets maintaining their levels from yesterday or registering mild declines.

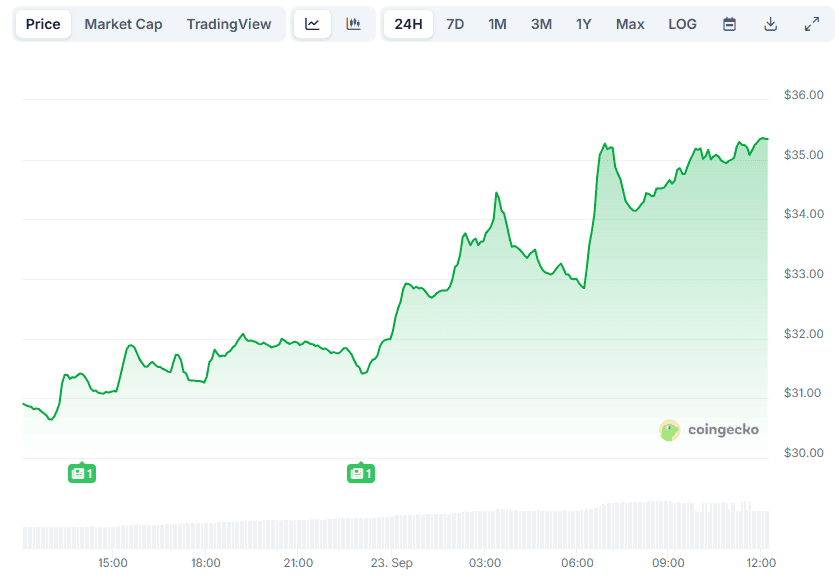

However, Avalanche (AVAX) defied the ongoing trend by posting a 15% pump on a 24-hour scale. As of press time, it trades above $35, while its market capitalization jumped to approximately $15 billion. This makes AVAX the 13th-biggest cryptocurrency, surpassing Hyperliquid (HYPE), Chainlink (LINK), and other well-known altcoins.

AVAX Price, Source: CoinGecko

AVAX Price, Source: CoinGecko

The catalyst for that price rally appears to be Anthony Scaramucci, who has shown support for the blockchain protocol. The former White House official will lead the strategic advisory board of the Nasdaq-listed AgriFORCE Growing Systems. The company will rebrand as Avax One and aims to accumulate over $700 million in AVAX tokens.

In an interview with CNBC, the American argued that layer-1 blockchain protocols, such as Avalanche, Solana, and Ethereum, will be “the future of tokenization,” which might explain why he stepped into that role.

Subsequently, Scaramucci praised Avalanche for its multi-chain architecture, describing it as “a Swiss army knife of layer-1s that allows a lot of flexibility.”

Further Gains Ahead?

Analysts like Broke Doomer and Jesus Martinez believe AVAX has no intention to slow down its pace anytime soon. The former thinks the token “is looking good to buy right now,” while the latter predicted a rise to a multi-year high above $100.

The X user Henry outlined that whales have shifted their focus on AVAX and are “gambling like they know something that we don’t.” Specifically, he revealed the case of two mysterious investors who have spent substantial sums to open long positions.

According to CryptoDoc (Gem Hunter), AVAX may surpass $50 in the near future. “We HODLing AVAX till Q4,” the analyst added.

The post Why Is Avalanche (AVAX) Up Today? appeared first on CryptoPotato.

You May Also Like

Tether CEO Delivers Rare Bitcoin Price Comment

Zepto Life Technology Launches Plasma-Based FungiFlex® Mold Panel as CLIA Reference Laboratory Test