What could $1,000 in Hyperliquid, XYZVerse, and Ondo Finance be worth by 2035?

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

A $1,000 investment spread across Hyperliquid, XYZVerse, and Ondo Finance today could unlock major gains by 2035, driven by market momentum and community strength.

Table of Contents

- XYZ prepares for exchange listings as presale surges past $14m

- Hyperliquid surges forward

- Ondo slides in downward move

- Conclusion

Imagine turning a modest investment today into considerable wealth by 2035. Hyperliquid, XYZVerse, and Ondo Finance are three innovative platforms that could offer significant returns over the next decade. This article delves into how a $1,000 investment spread across these assets might grow, exploring potential future values and the factors that could influence them.

XYZ prepares for exchange listings as presale surges past $14m

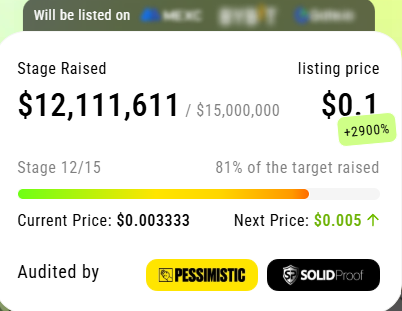

XYZVerse (XYZ), one of the most talked-about memecoins of 2025, is turning heads with its bold presale trajectory, aiming to leap from just $0.0001 to a projected $0.10. With over $14 million already raised and the token price now sitting at $0.003333, XYZVerse is halfway to its ambitious goal.

As the presale enters Stage 13, the next price jump to $0.005 gives early investors another chance to lock in discounted access before the token hits the open market. The team has hinted at major centralized and decentralized exchange listings post-presale, building anticipation for what could be one of the summer’s biggest launches.

XYZVerse is more than just another memecoin; it’s a call to arms for those with a champion’s mindset. With branding rooted in sports culture, competitive drive, and relentless ambition, XYZ speaks directly to thrill-seekers and profit chasers.

At the heart of XYZVerse is XYZepe, the project’s meme mascot and symbolic fighter in the crypto ring. As it battles for top rankings on CoinMarketCap, many are wondering: could XYZ become the next Dogecoin or Shiba Inu?

What sets XYZVerse apart is its deep commitment to community. The team has allocated a staggering 10% of the total supply, 10 billion XYZ tokens, to community airdrops. That makes it one of the largest memecoin airdrop campaigns ever, rewarding those who engage early and stay active.

Combined with deflationary tokenomics, ongoing token burns, and a clear exchange roadmap, XYZ is positioning itself for a strong debut and sustained momentum. The strategy is simple: reward the loyal, hype the moment, and push for long-term gains.

Hyperliquid surges forward

Hyperliquid (HYPE) has seen significant movement recently. Over six months, the coin’s price surged 62.14%. In the last month, HYPE jumped 49.47%. However, the past week saw a slight dip of -3.958%, suggesting a minor correction.

Currently, HYPE trades between $35.87 and $45.27, near its 10-day and 100-day moving averages of $40.34 and $41.44. The RSI is 48.88, close to neutral, indicating neither overbought nor oversold conditions. The stochastic oscillator is at 66.65, suggesting moderate momentum.

Looking ahead, the nearest resistance is at $49.37. If HYPE breaks through, it could target the second resistance at $58.77, a potential increase of around 30%. On the downside, the nearest support is at $30.57, and a drop to the second support at $21.17 would mean a decrease of about 40%. Given the strong recent growth and moderate indicators, there’s potential for HYPE to continue upward if it can overcome resistance.

Ondo slides in downward move

Ondo (ONDO) has faced a tough market recently. In the past week, its price dropped by 16.60%. Over the last month, it declined by 21.91%, and in the past six months, it fell by 57.05%. Currently, ONDO is trading between $0.72 and $0.89, reflecting a significant decrease from previous levels.

The technical indicators show a mixed outlook. The Relative Strength Index (RSI) sits at 42.94, suggesting that the coin isn’t oversold yet but is approaching that territory. The 10-day Simple Moving Average (SMA) is $0.75, slightly below the 100-day SMA of $0.79. This indicates a short-term bearish trend. The MACD level is negative at -0.006124, which might point to continued downward momentum.

Looking ahead, the nearest support level is at $0.65. If the price dips below this, it could slide to the second support at $0.48, a significant drop from current levels. On the upside, the nearest resistance is at $0.99. Breaking through this could see ONDO aiming for the second resistance at $1.16, which would be a substantial increase of over 30%. Traders will be watching these levels to see if ONDO can reverse its downward trend.

Conclusion

While HYPE and ONDO show promise, XYZVerse stands out, blending sports and meme culture to aim for 20,000% growth and community-driven success by 2035.

To learn more about XYZVerse, visit its website, Telegram, and X.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

You May Also Like

Bitcoin ETFs Outpace Ethereum With $2.9B Weekly Surge

CME Group to launch options on XRP and SOL futures