Zcash (ZEC) Explodes 100% as Privacy Coin Demand Surges Amid Uptober Rally

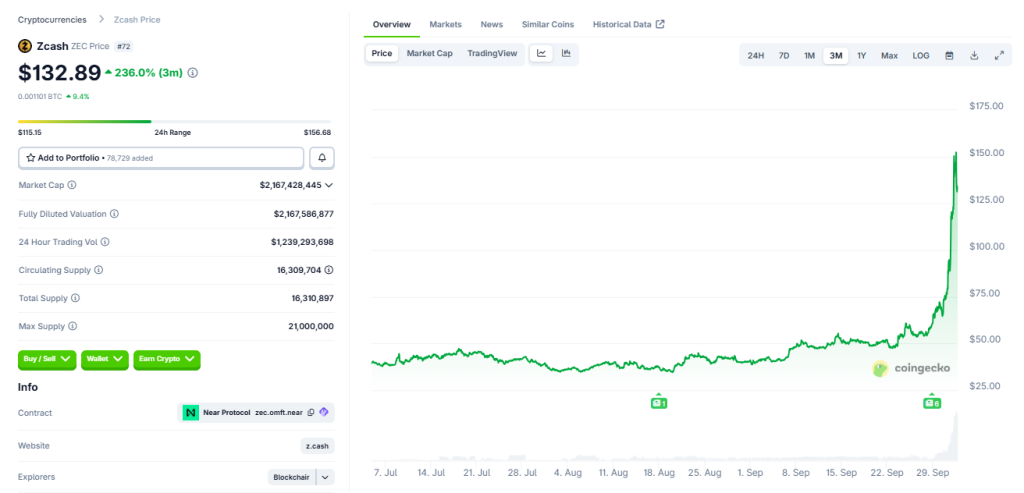

Zcash (ZEC) has more than doubled in price in the past week, as demand for privacy coins climbs during the broader “Uptober” rally. The coin jumped from around $50 to over $130 on October 3, reaching $135.54 at its peak, according to CoinGecko.

The latest rally pushed ZEC to its highest level since April 2022, though it remains nearly 96% below its 2016 all-time high of $3,193.

Source: CoinGecko

Source: CoinGecko

Over the past 24 hours, ZEC gained 21.5%, making it the best-performing digital asset among major tokens. On a seven-day basis, its price has climbed to 133.2%, leading the broader privacy coin sector.

The rally has been accompanied by a sharp increase in activity, with trading volume up 1,150% to $292 million. Shielded transactions, Zcash’s signature privacy feature, rose 15.5% month-on-month, indicating active user demand rather than purely speculative inflows.

zk-SNARK Momentum Pushes Zcash Market Cap Above $1.8B

Market participants attribute the move to renewed attention to zk-SNARK technology, the zero-knowledge proof system that underpins Zcash’s shielded transactions. The technology allows users to prove a transaction occurred without disclosing details such as the sender, recipient, or amount.

Zcash, originally forked from Bitcoin’s codebase, offers both transparent and shielded transactions, appealing to users who want the option of privacy in an era of tightening oversight.

The surge also coincided with broader discussions around digital surveillance and central bank digital currencies (CBDCs).

On X, prominent entrepreneur Naval Ravikant described Bitcoin as “insurance against fiat” and Zcash as “insurance against Bitcoin,” suggesting that ZEC offers protection against the transparent nature of the leading cryptocurrency.

Mert Mumtaz, CEO of Helius and a former Coinbase engineer, argued that privacy is non-negotiable as centralized stablecoins and CBDCs expand, calling a crypto ecosystem without private money “a dystopian nightmare.”

Institutional sentiment added to the momentum. Grayscale announced that its Zcash Trust is now open for private placement, giving accredited investors exposure to the asset in a structure similar to its Bitcoin and Ethereum products.

The announcement helped lift confidence among traditional investors, with ZEC’s market cap rising from $700 million earlier in September to more than $1.8 billion.

Zcash’s development team has also been active. The Zcash Foundation recently laid out an 18-month roadmap that includes NU7 upgrades and audits for Zcash Shielded Assets (ZSAs).

These steps are designed to improve scalability, security, and interoperability, potentially boosting throughput.

Cross-chain integrations such as ZEC swaps on THORSwap have further extended its utility, allowing users to interact seamlessly with assets like Bitcoin and Ethereum in decentralized finance settings.

The rally has increased attention across the privacy coin sector. Monero (XMR), the largest privacy coin by market capitalization, traded at $330.12 with weekly gains of 13.6%.

Dash (DASH) rose 61.4% over the past seven days to $32.95, while Beldex (BDX), Decred (DCR), and Zano (ZANO) also recorded weekly gains. Even so, Zcash’s outsized move and zk-SNARK maturity set it apart from rivals.

At press time, ZEC trades above $130 with a market capitalization of $1.8 billion, making it the 82nd-largest cryptocurrency.

EU to Ban Privacy Coins Under New AML Rules by 2027

The European Union is moving forward with a ban on privacy-preserving cryptocurrencies as part of its new Anti-Money Laundering Regulation (AMLR), which will take effect in 2027.

The rules prohibit banks, financial institutions, and crypto asset service providers from handling anonymity-enhanced tokens such as Monero and Zcash, as well as anonymous crypto accounts.

Article 79 of the AMLR explicitly bars the maintenance of anonymous accounts or services that allow transaction anonymization. The framework covers not only privacy coins but also other financial products designed to obscure ownership or transfers.

While the core rules are final, regulators are still working on implementation details through delegated and implementing acts under the European Banking Authority.

Dubai has already enacted similar restrictions. Its Virtual Assets Regulatory Authority (VARA) outlawed privacy coins in February 2023, barring both issuance and related activities.

VARA, which oversees all virtual asset providers in the emirate, defined anonymity-enhanced tokens as assets that block traceability on public ledgers. Firms that fail to comply face fines of up to AED 50 million ($13.6 million) or a percentage of annual revenue.

Globally, privacy tools remain under heavy scrutiny. In the U.S., prosecutors have pursued high-profile cases against Tornado Cash and Samourai Wallet, accusing their founders of transmitting illicit funds through untraceable mixing services.

The trend shows a growing regulatory push to curb anonymity in digital assets, even as privacy advocates warn of risks to financial freedom.

You May Also Like

Spain to Follow UK with Plans to Ban Social Media for Under 16s