6 Cryptos to Watch October 2025: Blazpay ($BLAZ) Leads as the Top Presale ICO with 100x Potential

The crypto market in 2025 is heating up, and presale ICO projects are once again catching fire with investors looking for explosive growth. With talk of a crypto resale with a 100x return, early-stage opportunities are drawing the most attention. While giants like Bitcoin and Solana continue to lead in adoption, the real excitement lies in projects that combine fresh utility with scarcity-driven tokenomics.

At the center of this trend is Blazpay ($BLAZ) – a project redefining what an ICO can deliver. With AI-powered features, multi-chain compatibility, and unified Web3 services, it is being called one of the best presale opportunities in crypto this year. Let’s look at Blazpay alongside other top projects like Bitcoin, Solana, Sui, Fantom, and Flare.

1. Blazpay ($BLAZ) – ICO With Real-World Utility

Unlike the average ICO or presale project that launches with little more than marketing hype, Blazpay has already established a robust, utility-driven ecosystem that sets it apart. The platform integrates conversational AI, allowing users to simplify complex DeFi actions such as trading, staking, transfers, and portfolio management through intuitive, natural-language commands.

Blazpay also delivers unified services, combining payments, NFTs, staking, and advanced portfolio management within a single, seamless interface. This consolidation reduces friction, making DeFi accessible to both newcomers and experienced users.

Further distinguishing itself, Blazpay offers multi-chain support across more than 20 blockchains, enabling cross-chain swaps, bridging, and DeFi interactions without limitations. This level of interoperability ensures liquidity and functionality are available across diverse ecosystems, giving users unparalleled flexibility and positioning Blazpay as a standout presale token in 2025.

Its presale starts at just $0.006, giving investors a rare chance to get in before the price jumps by 25% in Phase 2. With over 1.2M active users and 10M+ processed transactions, Blazpay combines adoption with scalability, making it a strong candidate for crypto resale with 100x return in 2025.

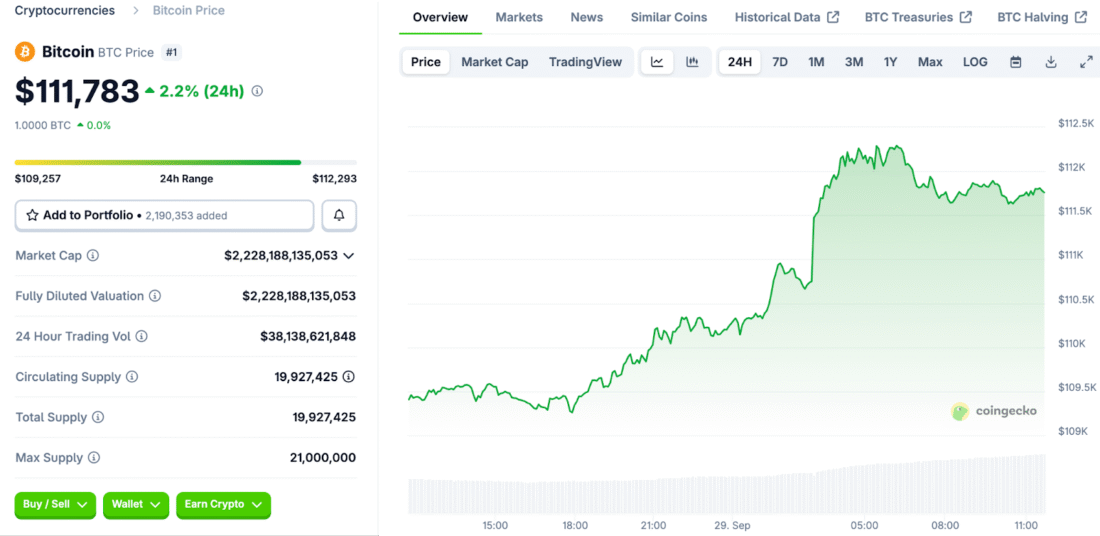

2. Bitcoin (BTC) – THE KING OF CRYPTO

Bitcoin (BTC), the king of crypto, remains the most dominant digital asset in the world. Priced today at approximately $111,783 USD, it has seen minor daily fluctuations, but its yearly range shows just how much upside and volatility remain: from lows of $58,895.21 to highs of $124,457.12.

- Market capitalization: $2.22 trillion

- Circulating supply: 19.9 million BTC out of 21 million

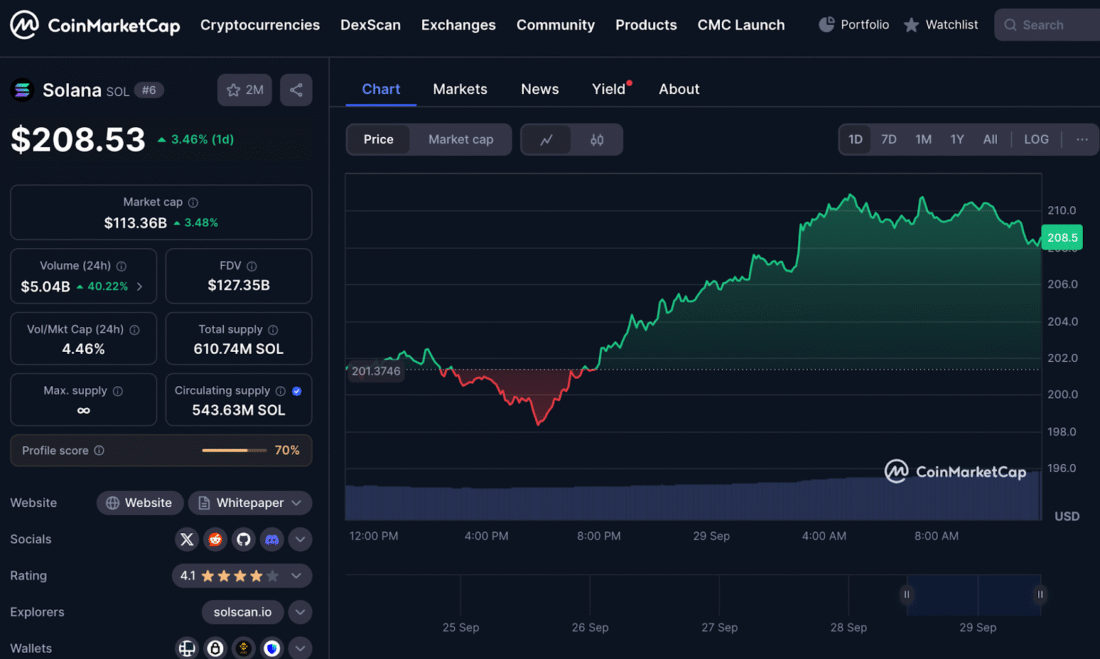

3. Solana (SOL) – Speed & DeFi Adoption

Solana (SOL) continues to dominate the conversation around speed and scalability. Currently priced around $208.53 USD, Solana’s network has grown dramatically, with block capacity increases enabling surging transaction volumes.

- Market capitalization: $97.37 billion

- 24-hour trading volume: $5.04 billion

- Yearly price range: $96.59 – $294.33

4. Sui (SUI) – High-Speed Layer 1 With Growing Momentum

Sui has quickly positioned itself as one of the most exciting Layer 1 blockchains in the market. Known for its lightning-fast transactions and scalable infrastructure, it has already attracted major VC funding and high-profile partnerships that signal long-term confidence in its future. Developers are increasingly choosing Sui for Web3 apps, NFTs, and DeFi, making it a serious player in the next wave of blockchain adoption.

That said, while Sui’s growth potential is undeniable, it still may not deliver the kind of 100x returns early-stage presale ico projects like Blazpay are offering right now. For investors chasing the biggest gains, Sui looks like a solid long-term hold, but Blazpay’s presale offers the rare chance to catch exponential upside before the rest of the market catches on.

5. Fantom (FTM) – Sonic Upgrade Ignites a Fresh Wave of Growth

Fantom is staging a strong comeback with its highly anticipated Sonic upgrade, built to supercharge speed, scalability, and overall network efficiency. Once one of the hottest DeFi chains, Fantom is working to reclaim its spot among the top Layer 1 ecosystems and early signals suggest it’s regaining traction fast. With developers and projects circling back, Fantom’s ecosystem could be gearing up for a powerful second act.

However, Fantom’s more established market position makes it less speculative compared to new presale ico projects like Blazpay, which offer investors the thrill of early entry and the possibility of crypto presale with 100x return. For steady growth, Fantom is a contender. But for those chasing the kind of life-changing upside only fresh presales can deliver, Blazpay remains the clear frontrunner.

6. Flare (FLR) – Unlocking Smart Contracts for Non-Programmable Assets

Flare is carving out a unique niche in the blockchain space by enabling smart contract functionality for assets like Bitcoin and XRP, which were previously non-programmable. This innovation massively expands the utility of legacy cryptocurrencies, giving them new life within DeFi and Web3 ecosystems. With interoperability at its core, Flare is setting itself up as a bridge between established digital assets and the fast-growing smart contract economy.

While adoption is still in its early stages, the potential is undeniable. If Flare can secure wider developer and institutional traction, its upside could be substantial. Still, compared to fresh presale ico opportunities like Blazpay, where investors can position themselves at the ground floor of a project with crypto presale with 100x return potential, Flare looks like a longer-term bet.

Conclusion: Why Blazpay Stands Out

While Bitcoin, Solana, Sui, Fantom, and Flare each bring their own strengths to the market, none of them combine AI, multi-chain usability, and early-stage entry prices like Blazpay ($BLAZ). For investors scanning the horizon for the best presale opportunities in crypto, Blazpay’s ICO offers a real chance at a crypto resale with 100x return in 2025.

Don’t miss Phase 1: Secure Your Blazpay Allocation Here.

Join the Community:

- Website – blazpay.com

- Twitter – @blazpaylabs

- Telegram – t.me/blazpay

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.

The post 6 Cryptos to Watch October 2025: Blazpay ($BLAZ) Leads as the Top Presale ICO with 100x Potential appeared first on Live Bitcoin News.

You May Also Like

Zwitserse bankgigant UBS wil crypto beleggen mogelijk maken

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets