MetaMask Launches $30 Million LINEA Rewards Program

The announcement comes shortly after Consensys CEO Joseph Lubin confirmed that MetaMask’s own token, MASK, is in development and could launch sooner than expected.

What the Rewards Program Offers

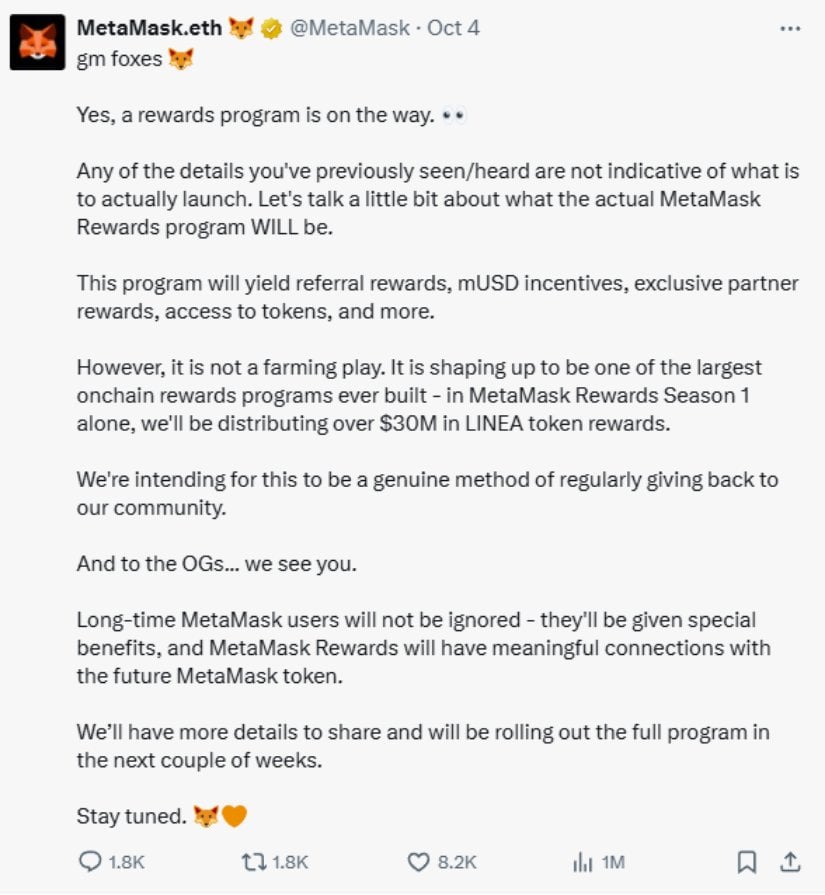

The MetaMask Rewards program will give users multiple ways to earn LINEA tokens during its first season. Participants can receive referral rewards, mUSD incentives, exclusive partner rewards, and early access to tokens.

MetaMask emphasized that this program isn’t designed for yield farming. Instead, they’re positioning it as “a genuine method of regularly giving back to our community.” Long-time MetaMask users will get special benefits, and the company stated the rewards “will have meaningful connections with the future MetaMask token.”

Source: @MetaMask

The program specifically aims to reward users who have been with MetaMask for years, not just those jumping in to farm rewards. This approach differs from many crypto incentive programs that primarily focus on attracting new liquidity.

Understanding LINEA Token

LINEA is the native token of Linea, an Ethereum Layer 2 network also developed by Consensys. The network launched its token in September 2025 with a token generation event that distributed 9.36 billion tokens to roughly 750,000 eligible wallets.

The token has an interesting economic model. Unlike most Layer 2 tokens, LINEA doesn’t serve as the gas token for the Linea network. Instead, 20% of all Linea transaction fees (paid in ETH) get burned at the protocol level. The remaining 80% is used to buy and burn LINEA tokens from the market, creating deflationary pressure.

The LINEA distribution allocated 85% of the total supply to the ecosystem, with no allocations going to team members or venture capitalists. This community-focused approach aligns with MetaMask’s rewards philosophy.

The Upcoming MASK Token

MetaMask co-founder Dan Finlay previously stated the token would be advertised directly inside the wallet, making it easily accessible to users. While Lubin didn’t provide a specific launch date, his comments indicate the team has concrete plans moving forward.

The connection between the current LINEA rewards and the future MASK token suggests MetaMask may be testing reward distribution mechanisms before launching its own token.

MetaMask’s mUSD Stablecoin Integration

MetaMask also recently launched mUSD, its own stablecoin issued through Bridge, a company owned by Stripe. The mUSD stablecoin is backed 1:1 by liquid dollar-equivalent assets and is available on both Ethereum and the Linea Layer 2 network.

The rewards program includes mUSD incentives, integrating the stablecoin into MetaMask’s broader ecosystem strategy. Users will be able to hold, swap, transfer, and bridge mUSD within MetaMask. The company plans to enable spending with the MetaMask Card at Mastercard-accepting merchants by year-end.

Market Response and Strategic Impact

Following the announcement, LINEA’s price increased by approximately 2.31% with trading volume surging over 50% to reach $244 million in daily activity. The market response suggests genuine interest in the program despite some critical reactions on social media.

Code for the rewards system was merged into MetaMask’s GitHub repository about three weeks before the announcement, indicating the team has been preparing this launch for some time.

The rewards program arrives at a strategic moment. Swift recently announced a partnership with Consensys and over 30 major banks to build blockchain-based infrastructure for cross-border payments, potentially using Linea. This institutional interest adds credibility to the Linea ecosystem.

Additionally, the cryptocurrency wallet space is becoming more competitive, with traditional payment companies like PayPal expanding into multi-chain stablecoin offerings. MetaMask’s rewards program positions it to maintain market leadership by incentivizing continued user engagement.

The Road Ahead

MetaMask has over 100 million total users worldwide, with approximately 30 million monthly active users, giving it substantial reach for a token distribution program. The combination of LINEA rewards, the upcoming MASK token, and mUSD stablecoin integration suggests Consensys is building an interconnected ecosystem around MetaMask.

However, the company hasn’t disclosed specific eligibility criteria, anti-sybil measures, or whether certain jurisdictions will face restrictions. These details will likely emerge as the full program launches in the coming weeks.

Users interested in participating should watch for official announcements through MetaMask’s wallet interface and verified social media channels. The company cautioned that any pre-market trading of MASK tokens is unaffiliated with Consensys and likely fraudulent.

What This Means Moving Forward

MetaMask’s $30 million commitment represents a significant investment in community rewards and sets a precedent for how established Web3 platforms can give back to loyal users. By connecting current LINEA rewards with the future MASK token, MetaMask is creating a bridge between present incentives and long-term platform participation.

The program’s success will likely influence how other crypto wallets approach user retention and token distribution in an increasingly competitive market.

You May Also Like

The Role of Blockchain in Building Safer Web3 Gaming Ecosystems

- Immutable Ownership of Assets Blockchain records can be manipulated by anyone. If a player owns a sword, skin, or plot of land as an NFT, it is verifiably in their ownership, and it cannot be altered or deleted by the developer or even hacked. This has created a proven track record of ownership, providing control back to the players, unlike any centralised gaming platform where assets can be revoked.

- Decentralized Infrastructure Blockchain networks also have a distributed architecture where game data is stored in a worldwide network of nodes, making them much less susceptible to centralised points of failure and attacks. This decentralised approach makes it exponentially more difficult to hijack systems or even shut off the game’s economy.

- Secure Transactions with Cryptography Whether a player buys an NFT or trades their in-game tokens for other items or tokens, the transactions are enforced by cryptographic algorithms, ensuring secure, verifiable, and irreversible transactions and eliminating the risks of double-spending or fraudulent trades.

- Smart Contract Automation Smart contracts automate the enforcement of game rules and players’ economic exchanges for the developer, eliminating the need for intermediaries or middlemen, and trust for the developer. For example, if a player completes a quest that promises a reward, the smart contract will execute and distribute what was promised.

- Anti-Cheating and Fair Gameplay The naturally transparent nature of blockchain makes it extremely simple for anyone to examine a specific instance of gameplay and verify the economic outcomes from that play. Furthermore, multi-player games that enforce smart contracts on things like loot sharing or win sharing can automate and measure trustlessness and avoid cheating, manipulations, and fraud by developers.

- Cross-Platform Security Many Web3 games feature asset interoperability across platforms. This interoperability is made viable by blockchain, which guarantees ownership is maintained whenever assets transition from one game or marketplace to another, thereby offering protection to players who rely on transfers for security against fraud. Key Security Dangers in Web3 Gaming Although blockchain provides sound first principles of security, the Web3 gaming ecosystem is susceptible to threats. Some of the most serious threats include:

Vitalik Buterin Challenges Ethereum’s Layer 2 Paradigm