2025’s Best Crypto Presale Accelerates with $274K Whale Buy – Bitcoin Hyper Amps Up

But it’s not all great news for Bitcoin. The inevitable rush of new users onto the Bitcoin network is going to cause even worse scalability issues for a blockchain that’s already struggling to handle its current average number of transactions – a problem that neither Ethereum nor Solana has.

There’s plenty of evidence to suggest that Bitcoin Hyper will grow alongside $BTC as it trends upwards, not least the amount of community support $HYPER has already received as a presale. We’ve just seen a whopping $274K whale buy in the last 12 hours, adding to $HYPER’s $22.3M presale.

Read on, and we’ll delve into exactly how the Bitcoin Hyper Layer-2 is revolutionizing the Bitcoin network forever, making it one of the top crypto presales to consider in 2025.

Why is Bitcoin so Slow?

The Bitcoin network isn’t as fast as other blockchains because it prioritizes ensuring transaction security. Whenever a transaction is made, it’s added to a block, which needs to be validated by the majority of the network before it’s committed to the blockchain. This process usually takes around ten minutes.

However, each block can only be so big. This places a hard cap on the number of transactions that the Bitcoin network can process simultaneously, estimated to be 7 to 10 transactions per second. By comparison, Ethereum can support hundreds per second, and Solana can support thousands.

For long-term traders, it’s not as much of an issue. You’re buying $BTC for the long haul, so slow processing speeds aren’t a problem if it means you’ve got rock-solid security guarantees. If you’re at the mall trying to pay for a coffee in Bitcoin, an hour-long wait is unacceptable.

Source: serokell.io

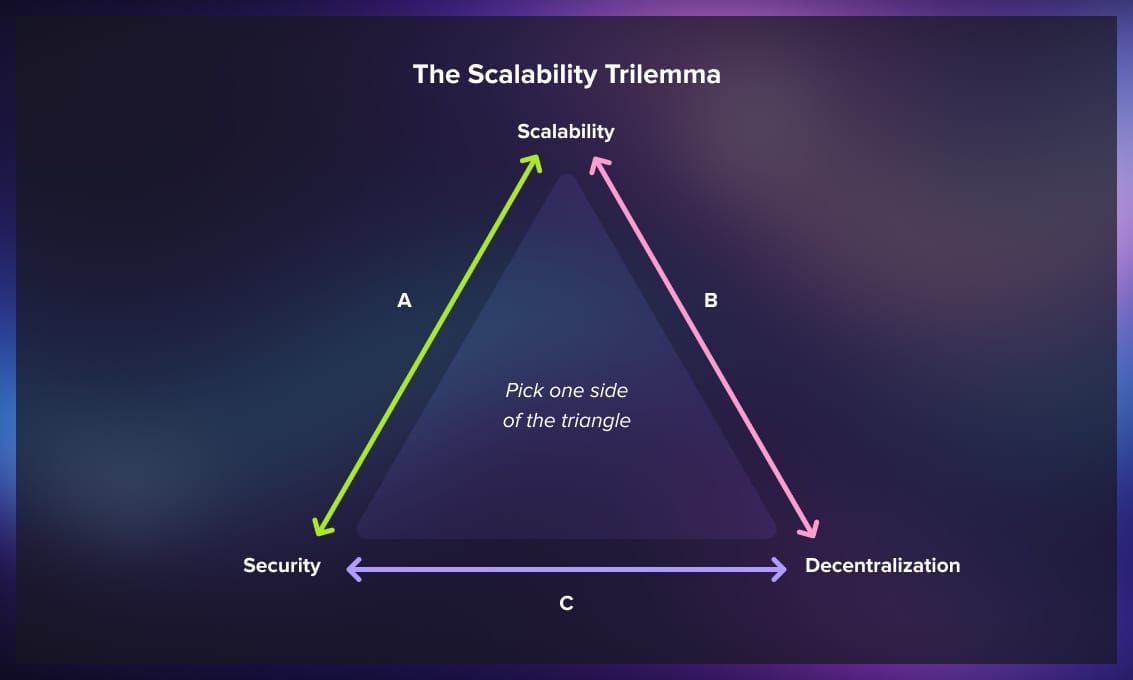

It’s not easy to solve this problem, either. There’s a school of thought among blockchain developers that you can make a decentralized blockchain quick or secure, but not both. However, Bitcoin needs scalability to join the rest of the crypto revolution and fulfill its real potential as the dominant cryptocurrency.

Bitcoin Hyper could be the solution. The Bitcoin blockchain is already extremely secure, so Bitcoin Hyper focuses on increasing the speed of the network by using Solana as the basis for a Layer 2 that utilizes parallel processing to handle transactions more efficiently. Let’s check out how it works.

How does $HYPER solve these issues?

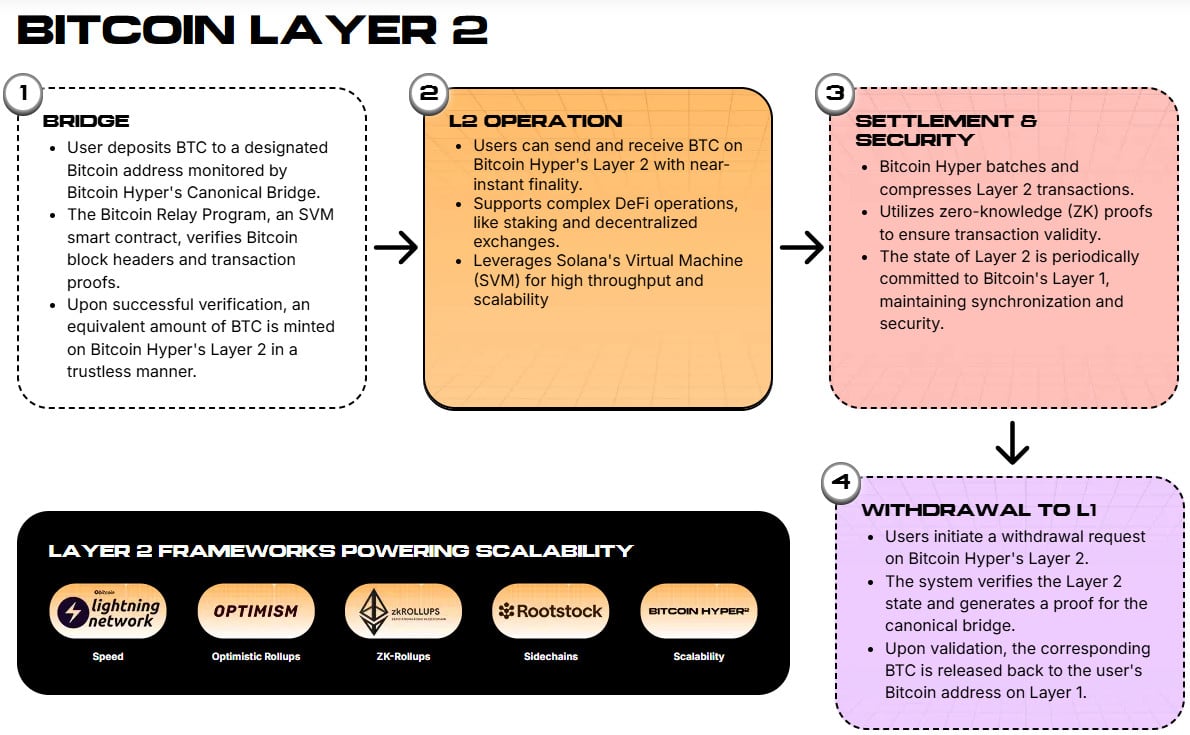

The Bitcoin Hyper Layer-2 acts as a temporary ledger that records trades made using $BTC on the network and periodically commits them back to the Layer-1. This way, the total number of transactions made on the Layer-1 is reduced, taking strain off the Bitcoin Blockchain.

Inevitably, more users will get into Bitcoin as the price of the coin increases. Bitcoin Hyper acts as an essential pressure valve for the Bitcoin blockchain, allowing for $BTC transactions between accounts that can be processed nearly instantly while maintaining synchronization with Layer-1.

The Bitcoin Hyper infrastructure allows for easy onboarding and withdrawal of $BTC

The two layers are joined together using a Canonical Bridge. To transfer $BTC to the Bitcoin Hyper network, all you have to do is send the amount you want to use to the Canonical Bridge address. You receive an equivalent amount of wrapped $BTC which the Canonical Bridge mines for you.

For more information on how Bitcoin Hyper works, you can check out our Bitcoin Hyper review.

Why is $HYPER Set to Rise?

It appears that the recent rise and retraction of Bitcoin were merely setting the stage for a new rally, as evidenced by its jump to over $126K. More than ever, Bitcoin needs a way to handle greater transactions without compromising on security, as the rise of $BTC will attract more users.

As a result, analysts expect a flood of interest in Bitcoin Hyper when it is released. That bodes well for $HYPER, the official utility token of the Bitcoin Hyper network. As more capital flows in, the token is expected to perform better.

There are a few ways that holding $HYPER adds extra utility to the Bitcoin Hyper:

- Reduced fees when you trade on crypto or run smart contracts

- Access to the Bitcoin DAO to vote on future proposals for the blockchain

- Staking rewards for long-term growth of your $HYPER

- Access to exclusive features on Web3 smart contracts running on Bitcoin Hyper

Given the multitude of ways you can utilize the token, $HYPER should be in high demand when it is released. Our price prediction for $HYPER suggests that we’ll see at least $0.03 for $HYPER by the end of 2025, but this could go as high as $0.2 if Bitcoin’s rally continues through to the end of the year.

Our optimistic scenario suggests a potential 10x increase from the current price of $0.013075. However, it’s essential not to get too excited – we believe a crypto downturn may occur in 2026, so don’t be surprised if $HYPER is affected as well.

Our price prediction graph suggests a great long-term upshot for Bitcoin Hyper

In the long term, we believe that $HYPER could reach a value of up to $1.20 if the project is successful and the developers can attract DeFi applications onto the Bitcoin Hyper blockchain, making Bitcoin a true competitor with other Web3 blockchains.

Any $HYPER you buy now can be staked for 53% in rewards per annum, but time’s running out. It’s a dynamic presale, so the longer you wait, the worse these rewards will become – and the higher the price for $HYPER. If you need more help, you can check out our how to buy Bitcoin Hyper guide.

Visit the official site to buy Bitcoin Hyper today.

You May Also Like

STRC Stock Surge: How Much Bitcoin Can Saylor Buy?

Forward Industries Bets Big on Solana With $4B Capital Plan