Why Citi Ventures’ BVNK Investment Could Be the Turning Point for Stablecoins

Citigroup’s venture capital arm, Citi Ventures, has made a bold bet on stable assets, investing in BVNK, a stablecoin infrastructure company. This move signals the platform’s shifting stance on crypto as it comes in contrast to Citi’s previous warnings about the risks associated with yield-bearing stablecoins. This BVNK investment also underscores the growing significance of these assets in the global financial ecosystem.

Citi Ventures’ BVNK Investment

According to a CNBC report, Citigroup’s Citi Ventures has made a strategic move that highlights its reversed stance on crypto, especially stablecoins. With an undisclosed BVNK investment, the platform intends to address the growing demand for fiat-backed assets. Citi Ventures Head Arvind Purushotham noted,

The exact investment amount from Citi remains undisclosed. But building on existing backing from investors like Coinbase and Tiger Global, BVNK’s valuation has reportedly exceeded $750 million, said co-founder Chris Harmse. He added, “You’re seeing an explosion of demand for building on top of stablecoin infrastructure.”

Citigroup’s Reversed Stance

Previously, Citigroup commented on the underlying risks of the increased adoption and use of stable assets. Executive Ronit Ghose posited that stablecoin interest payments might lead to a massive shift of funds from traditional banks, similar to the 1980s money market fund boom.

Other major financial institutions like the American Bankers Association and Bank Policy Institute had also raised similar concerns. They asked Congress to close a perceived loophole in the GENIUS Act that allows crypto exchanges to offer yields on third-party stablecoins.

According to Treasury estimates, this could lead to massive deposit outflows of up to $6.6 trillion from traditional banks, potentially disrupting the banking industry.

The platform’s latest BVNK investment signals its more optimistic approach to cryptocurrencies and stable tokens. The team even announced in July that the bank is exploring the issuance of its own stablecoin and developing custodian services for crypto assets.

CEO Jane Fraser noted that the firm aims to explore the “benefits of advancements in stablecoin and digital assets to our clients in a safe and sound manner by modernizing our own infrastructure.”

Citi’s Stablecoin Prediction

Citi’s Stablecoin Prediction

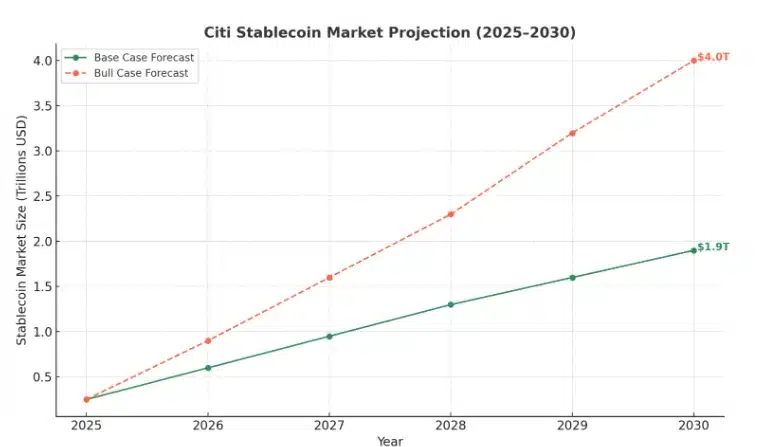

In September, the bank increased its stablecoin market forecast, projecting the sector to reach $4 trillion by 2030 in a bull case and $1.9 trillion in its base case, driven by rapid adoption over the past six months. This represents an upward revision from its previous estimates of $3.7 trillion and $1.6 trillion, respectively.

GENIUS Act Drives Stablecoin Boom

“US banks at the scale of Citi, because of the GENIUS Act, are putting their weight behind … investing in leading businesses in the space to make sure they are at the forefront of this technological shift in payments,” said Harmse.

He attributes the company’s strongest momentum to the US market, which has seen improved regulatory clarity with the passage of the GENIUS Act. This clearer oversight of stablecoins has boosted institutional confidence, making the US its fastest-growing market over the past 18 months.

Driven by this prevailing positive sentiment, Wall Street giants are increasingly entering the stablecoin market. JPMorgan Chase launched JPMD, a stablecoin-like token. Traditional financial institutions are accelerating their adoption of blockchain technology, with Bank of New York Mellon testing tokenized deposits and HSBC launching a similar service.

Conclusion

Citigroup’s BVNK investment signals a significant shift in its stance on crypto, highlighting the growing importance of stablecoins in finance. With clearer regulations and rising demand, major financial institutions are embracing blockchain technology and stablecoin innovation.

Frequently Asked Questions

Why did Citi Ventures invest in BVNK?

Citi Ventures invested in BVNK to take advantage of growing demand for stablecoin infrastructure along with blockchain-based settlement solutions.

What does Citigroup’s BVNK investment say about Citigroup’s stance on crypto?

It is a signal that Citigroup has shifted from earlier apprehensiveness, towards a more optimistic mindset regarding stablecoins and digital assets.

How has regulation influenced Citigroup’s entry into stablecoins?

The clearer definitions of oversight defined in the GENIUS Act has created clarity and provided more confidence for institutional capital. As a result, Citigroup has now crossed the line with other banks in allocating funds toward stablecoin innovation.

Glossary

- Stablecoin: A type of cryptocurrency pegged to a stable asset like the US dollar to minimize volatility.

- BVNK: A fintech company providing infrastructure for stablecoin issuance, payments, and settlements.

- Citi Ventures: The venture capital arm of Citigroup that invests in innovative financial and technology startups.

- GENIUS Act: A US regulation providing clearer oversight for stablecoins, aimed at fostering safer adoption in the financial system.

Read More: Why Citi Ventures’ BVNK Investment Could Be the Turning Point for Stablecoins">Why Citi Ventures’ BVNK Investment Could Be the Turning Point for Stablecoins

You May Also Like

MYX Finance price surges again as funding rate points to a crash

Fed Day Dry Powder: Cryptoquant Analyst Tracks $7.6B Stablecoin Pile on Exchanges