MUTM Team Statement & Tokenomics

In every crypto cycle, certain assets capture market attention for their potential to lead long-term narratives. Ripple (XRP) has long been a major player, supported by institutional adoption and regulatory visibility.

But as the market evolves, analysts are increasingly comparing its future upside to that of emerging utility-driven projects. One name that’s gaining momentum is Mutuum Finance (MUTM), a DeFi lending protocol still in its presale stage, offering both a lower entry price and utility-based growth mechanics.

This comparison between XRP and MUTM highlights two very different stages of the market cycle: a mature large-cap token with limited explosive upside, versus a new protocol positioned to scale through adoption and structured tokenomics.

Ripple (XRP)

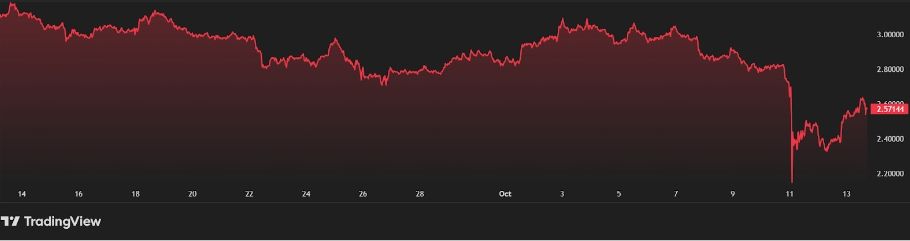

XRP is currently trading around $2.63, with a market cap exceeding $150 billion. It boasts high liquidity, broad exchange support, and a mature user base. However, the token has slipped roughly 15% over the past week, reflecting renewed selling pressure and uncertainty about its near-term momentum.

But with its massive circulation and entrenched market positioning, XRP faces structural constraints. Future upside is harder to come by: resistance zones are well-known around the $3 mark, and large holders frequently manage profit-taking at key levels. It’s also worth noting the regulatory overhangs and supply inflation: the token’s large base can dampen momentum unless there’s a strong catalyst.

Mutuum Finance (MUTM)

Mutuum Finance is an Ethereum-based decentralized lending and borrowing protocol designed to tie token demand directly to platform usage rather than speculation. At the core of its architecture is a dual lending market system that combines flexibility with risk management.

In the Peer-to-Contract (P2C) market, widely used assets such as ETH, USDT, and even blue-chip tokens like MATIC are supplied to shared liquidity pools. Lenders earn variable yields that shift dynamically with borrowing demand and pool utilization, while borrowers can tap into overcollateralized loans using these assets.

For instance, a user depositing $8,000 worth of ETH could borrow up to $6,000 in stablecoins at a 75% Loan-to-Value (LTV) ratio, balancing borrowing power with system safety.

On the other hand, the Peer-to-Peer (P2P) market targets tokens with higher volatility or lower liquidity profiles, such as PEPE, FLOKI, or SHIB. Here, lending agreements are set directly between participants, with the freedom to define loan amounts, interest rates, and repayment terms.

Borrowers can choose between variable rates that respond to liquidity shifts or stable rates that lock in predictable repayment costs.

To represent their deposits, lenders receive mtTokens—ERC-20 tokens minted at a 1:1 ratio to the underlying asset (e.g., depositing 12,000 USDT mints 12,000 mtUSDT). These mtTokens accrue interest automatically, typically generating APYs between 10% and 15%, depending on pool usage and market conditions.

This dual-market system allows Mutuum Finance to serve both mainstream DeFi participants and those dealing in niche assets, while maintaining efficient liquidity distribution and isolating risk between markets.

MUTM remains at the very beginning of its lifecycle — a stage that historically offers the greatest room for percentage-based upside. Currently priced at just $0.035 in Phase 6 of its structured presale, up from $0.01 in Phase 1, the token has already seen 250% appreciation for early buyers. Over $17.3 million has been raised so far and upwards of 17,000 investors have joined, underscoring rapidly growing awareness and participation.

Unlike XRP, which already commands a massive market cap north of $150 billion and trades at a much higher price point of $2.63, MUTM is still in its early growth stage with a tiny valuation by comparison.

This creates a far larger runway for potential expansion. While XRP’s size makes even 2x-3x moves increasingly difficult, early-stage projects like MUTM can scale far more aggressively if adoption accelerates as planned.

To illustrate the difference, consider a $700 allocation in each. If XRP were to rally from $2.63 to $3.50, that investment would grow to roughly $930 — a gain of just over 30%. By contrast, $700 invested in MUTM at $0.035 would secure 20,000 tokens.

If analysts’ short-term post-launch targets of $0.15–$0.20 are realized, that position would be worth $3,000–$4,000, a 4x–5.7x increase. This sharp contrast highlights why many investors are turning their attention to earlier-stage utility tokens like MUTM, which offer asymmetric upside potential that mature assets like XRP can no longer easily replicate.

Team Statement & Tokenomics

The MUTM team recently confirmed via an official X statement that V1 of its decentralized lending and borrowing protocol is scheduled to debut on the Sepolia testnet in Q4 2025.

This milestone marks a major step in Mutuum Finance’s roadmap, moving the project from fundraising into tangible product delivery. The initial rollout will include the core infrastructure needed to power a fully functional credit market: liquidity pools, debt tokens, and support for ETH and USDT as the first assets for lending, borrowing, and collateralization.

The testnet launch is significant because it provides investors and the wider community with clear visibility into the project’s development timeline. Many early-stage crypto projects run long presales without delivering a working product until months — or even years — after launch. Mutuum Finance, in contrast, is aligning token distribution closely with the rollout of its protocol.

This means that once MUTM lists, users would already have access to live mechanics such as supplying assets, earning yield, borrowing through overcollateralized positions, and interacting with debt tokens. By removing uncertainty and showing working components early, the project strengthens market confidence.

Moreover, the Sepolia testnet phase will allow for real-time testing of critical elements such as the interest rate model, liquidator bot, and price oracle aggregator in a safe environment. This ensures the protocol’s mechanisms can be refined before mainnet deployment.

It’s also an opportunity for the community and external developers to actively participate in testing, bug reporting, and providing feedback, a level of transparency and openness that many presales lack. This structured development approach is one of the key reasons analysts are watching Mutuum Finance closely as it moves toward launch.

What MUTM Is Building

To bolster trust, MUTM has completed a CertiK audit with a strong 90/100 score, demonstrating a high standard of smart contract security well ahead of launch.

The team has also introduced a $50,000 tiered bug bounty program to encourage independent developers to identify potential vulnerabilities before the mainnet goes live. Alongside this, a $100,000 community giveaway is underway, rewarding ten participants with $10,000 worth of MUTM each.

Mutuum Finance aims not just to launch another lending protocol, but to build a sustainable, demand-driven DeFi crypto ecosystem designed for long-term scalability.

Key upcoming features include stablecoin integration, which will anchor liquidity and provide a native unit of account; Layer-2 scaling to reduce fees and open access to broader user bases; and robust oracle systems to ensure accurate, tamper-resistant collateral pricing under all market conditions.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

:::tip This story was published as a press release by Cybernewswire under HackerNoon’s Business Blogging Program. Do Your Own Research before

:::

\

You May Also Like

Tennis Death Threats & Match Fixing: WTA Players Targeted

Swiss Crypto Bank Just Became the First Regulated Bank Inside the EU’s Blockchain Trading System