Typus Finance’s Unaudited Contract Loses $3M, 3rd Major Sui Exploit in 2025

Typus Finance—a perpetuals and options decentralized exchange on the Sui Network—suffered a major exploit on October 15, losing over $3 million in tokens. This is the third major exploit on the Sui SUI $2.62 24h volatility: 3.4% Market cap: $9.48 B Vol. 24h: $1.40 B DeFi ecosystem in 2025, preceded by the Cetus Protocol hack in May and the Nemo Protocol exploit in September.

A postmortem published on October 16 details the exploit, the event timeline, and the root cause, which involves an unaudited TLP contract and an oracle vulnerability regarding a lack of authority checks. Overall, the attacker drained $3.44 million worth of SUI, USDC, xBTC, and suiETH, according to the document. Precisely, Typus lost 588,357.9 SUI, 1,604,034.7 USDC, 0.6 xBTC, and 32.227 suiETH.

While a significant exploit, only the TLP contract was affected. Funds deposited in the SAFU and DeFi Options Vaults remain secure. The team asserts that they have received active support from the Sui Foundation, Mysten Labs, MoveBit, SlowMist, and Hypernative—now working on an “asset recovery plan.”

Third Major Exploit on Sui in 2025

Before Typus Finance, two other DeFi protocols building on the Sui blockchain suffered major exploits this year.

First, CETUS Protocol—the primary decentralized exchange on Sui—suffered a major hack in May 2025, losing more than $220 million in assets, as Coinspeaker reported. In its postmortem, Cetus admitted that it was relaxed in its approach regarding vigilance, according to Cointelegraph.

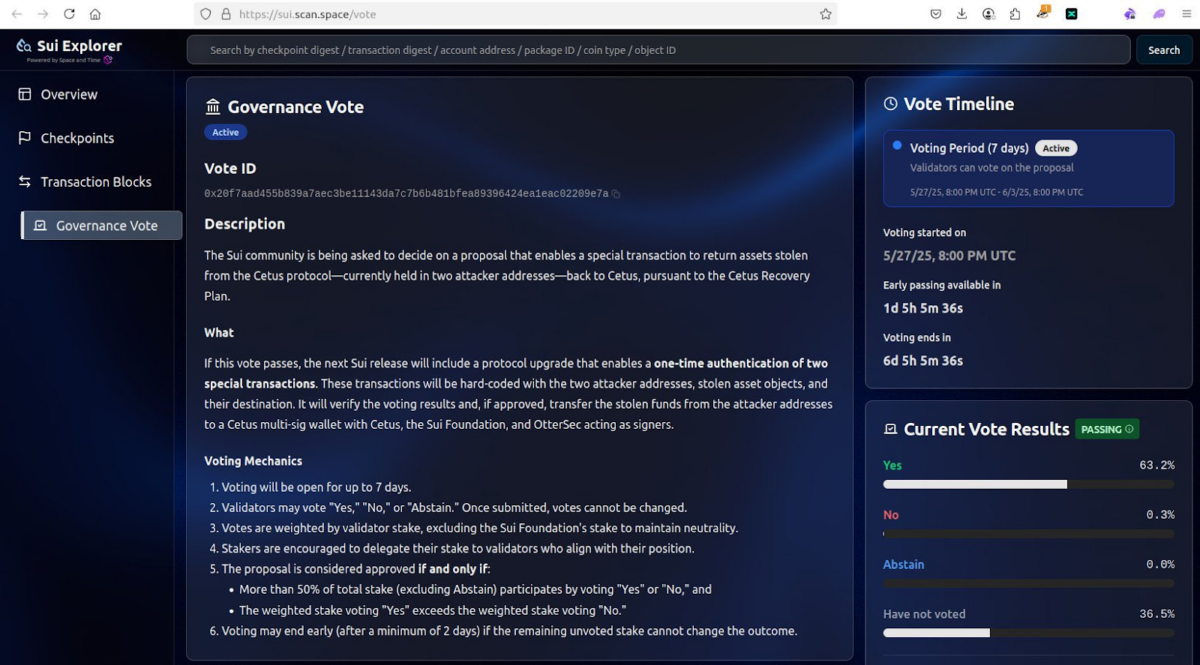

What followed was a highly controversial governance vote that allowed the Sui Foundation, Cetus, and OtterSec to seize the stolen funds from the attacker’s Sui account that they had previously decided to freeze. This seizure effectively broke Sui’s cryptographic security by creating a special private key with universal signing capacity.

Governance Vote | Source: Sui Explorer

Most recently, in September, Sui-based yield protocol Nemo was exploited for $2.4 million in USDC, according to a report from CoinDesk.

Commentators on X now criticize Typus for what some are calling “negligence” for both the lack of a proper audit and the use of an oracle without a proven track record, instead of using more consolidated products like Chainlink LINK $17.75 24h volatility: 2.1% Market cap: $12.37 B Vol. 24h: $908.65 M .

These events have fueled uncertainty in a market that is still struggling to recover from the unprecedented $19 billion liquidations from October 10’s crash. As Coinspeaker reported earlier today, another $540 million in liquidations amid sell-out expectations regarding Mt. Gox repayments.

nextThe post Typus Finance’s Unaudited Contract Loses $3M, 3rd Major Sui Exploit in 2025 appeared first on Coinspeaker.

You May Also Like

Iranian Parliament Speaker Says He Will Never Seek a Ceasefire

STABLE surges 14% – Here’s how shorts can trigger another rally