Changelly Review 2025: Scam or Legit? Here’s Why Millions Trust It

The post Changelly Review 2025: Scam or Legit? Here’s Why Millions Trust It appeared first on Coinpedia Fintech News

Overall Rating (2025): ★ 4.4 / 5

Founded in 2015, Changelly is an instant crypto exchange and aggregator that lets users swap, buy, and sell digital assets without storing funds on the platform. Operating in 170+ countries and serving over 10 million users, it focuses on crypto swaps, fiat on- and off-ramps, and API integrations for wallets and businesses.

Crypto exchanges are an important part of any in vestor’s journey, and we want to guarantee that when you exchange your coins and tokens you won’t have your money or data stolen. Changelly has had some scam accusations in the past, so we have set out to test if they’re a scam or legit.

This review evaluates Changelly’s safety, reliability, and usability based on hands-on testing and user feedback.

Overview of Changelly

Changelly is an instant crypto exchange that supports both crypto-to-crypto swaps and fiat-to-crypto purchases. For crypto swaps, Changelly sets a fixed service fee, while fiat transactions are routed through external providers that offer their own rates and payment methods. The platform focuses on speed and simplicity rather than advanced trading features.

| Legal Name | Changelly |

| Platforms | Web, mobile |

| Year Founded | 2015 |

| Features | Crypto-to-crypto, crypto-to-fiat, fiat-to-crypto swaps |

| Fees | 0.25% for swaps, varies for purchases |

| Account Creation | Not required |

| Supported Cryptos | 1,000+ cryptocurrencies across 185 blockchains |

| Fiat | 100+ fiat currencies |

| Customer Service | 24/7 human support: live chat via web or mobile, email |

Core Features

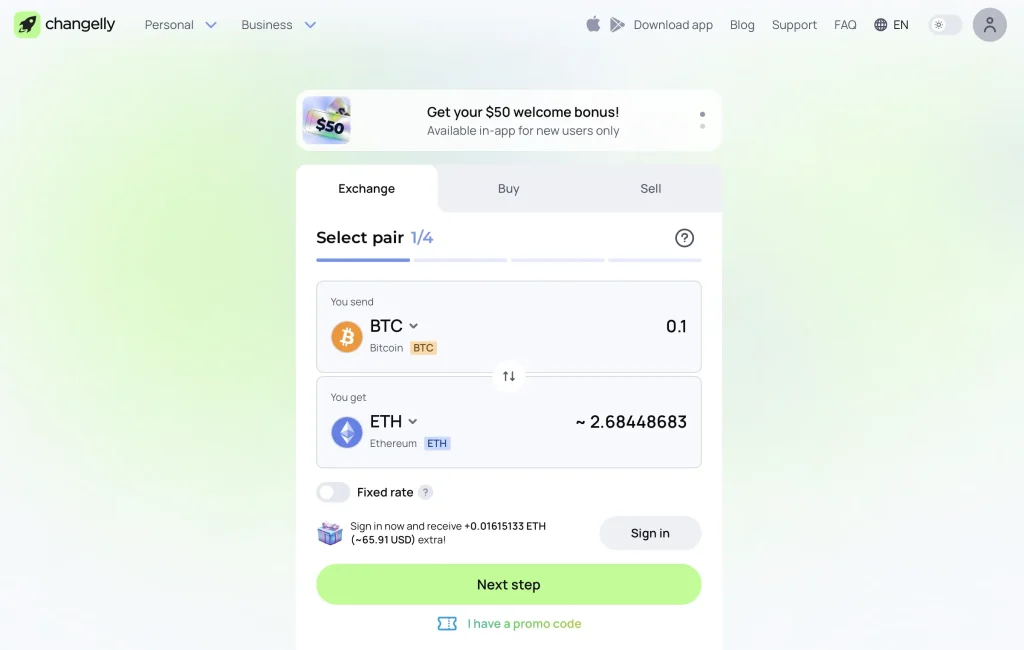

- Crypto Swaps: 1,000+ coins supported, operates across 185 blockchains, floating and fixed rate options.

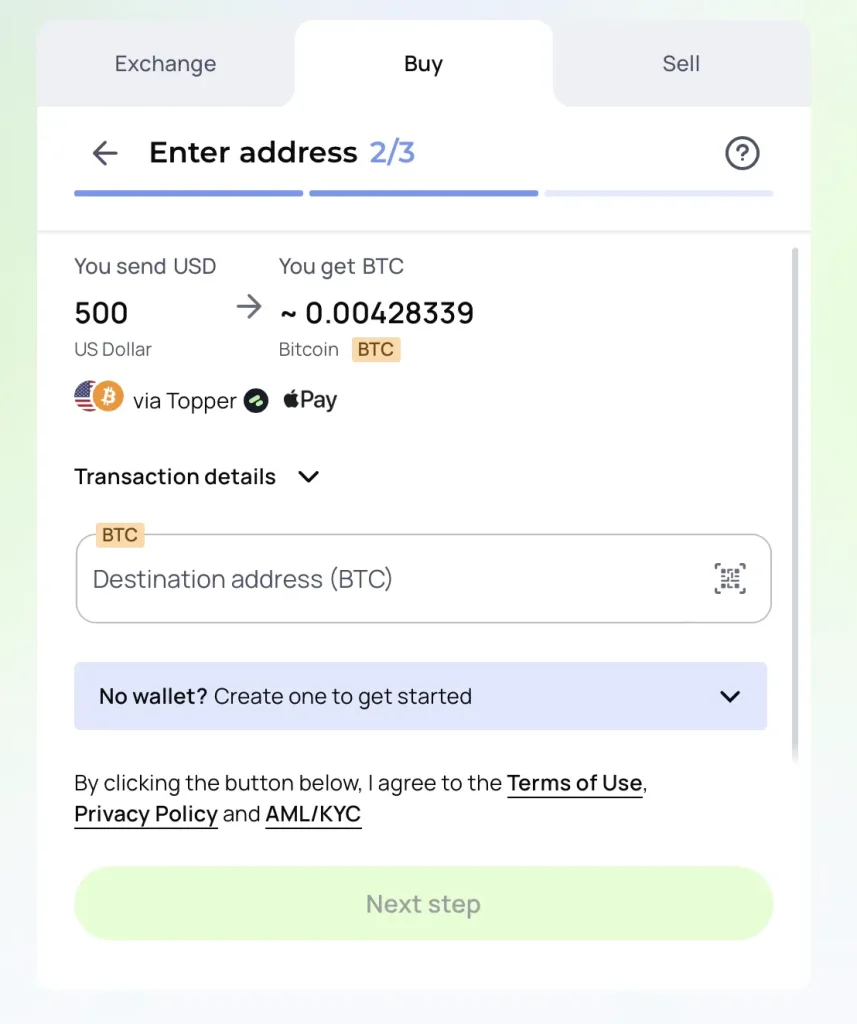

- Crypto Purchases: 350+ coins available for direct purchase, 100+ fiat currencies supported, 20+ payment methods via 10+ fiat providers.

- Fiat On/Off-Ramp: fiat purchases are processed through third-party payment providers, off-ramps are available in select countries.

- Localization: multi-language support and multi-lingual customer service.

- Platform Access: available via web or a mobile app.

- Account Requirement: no mandatory account registration, optional account creation enables transaction history tracking and a small bonus.

Fees and Rates

Changelly’s pricing model is straightforward for crypto swaps and more variable for fiat purchases. The platform itself charges only a small fixed fee, while additional costs may come from external payment providers used for fiat transactions.

For crypto-to-crypto swaps, Changelly applies a flat 0.25% service fee, which is lower than the industry average. Users can choose between floating and fixed rates, both shown before confirming a transaction.

When it comes to fiat transactions, fees depend on the selected third-party payment provider and payment method. Changelly’s own fee is included in the total quote, but external providers may add their own charges, which can vary widely. Users can compare rates from numerous fiat providers directly on the platform before making a purchase.

In terms of transparency, Changelly lists its own service fee clearly, though provider-specific fees and exchange rate spreads are not always shown in full detail upfront. The total cost can change slightly depending on the provider, payment type, and currency used. There are no hidden platform fees beyond the stated 0.25% swap charge.

Custody and Fund Management

Changelly claims to never store or manage user funds on its servers. All transactions occur directly between users’ wallets, with Changelly serving only as an intermediary that facilitates the swap. According to the platform’s Terms of Use (Section 2.2), all exchanges and purchases are executed through external providers rather than by Changelly itself.

This setup significantly reduces the risks associated with centralized exchanges, as there are no exchange wallets or stored user balances that could be targeted in a security breach. Instead, users maintain control of their assets from start to finish.

Because Changelly does not hold custody of funds, users themselves are responsible for entering the correct wallet addresses and sending payments on time. Once a transaction is confirmed on the blockchain, it cannot be reversed or recovered by the platform.

KYC / AML Policy

Now, we’ve arrived at one of the most important (and somewhat controversial) points. KYC and AML are a headache for most crypto users.

According to their official subreddit, Changelly follows a risk-based KYC and AML framework designed to identify suspicious activity and prevent misuse of its services. From what we’ve discovered, this system is one of the main reasons why claims of a “Changelly scam” occasionally appear online: they’re typically from users whose transactions were delayed by automated security checks rather than from any fraudulent behavior by the platform itself.

What Is the Process Like?

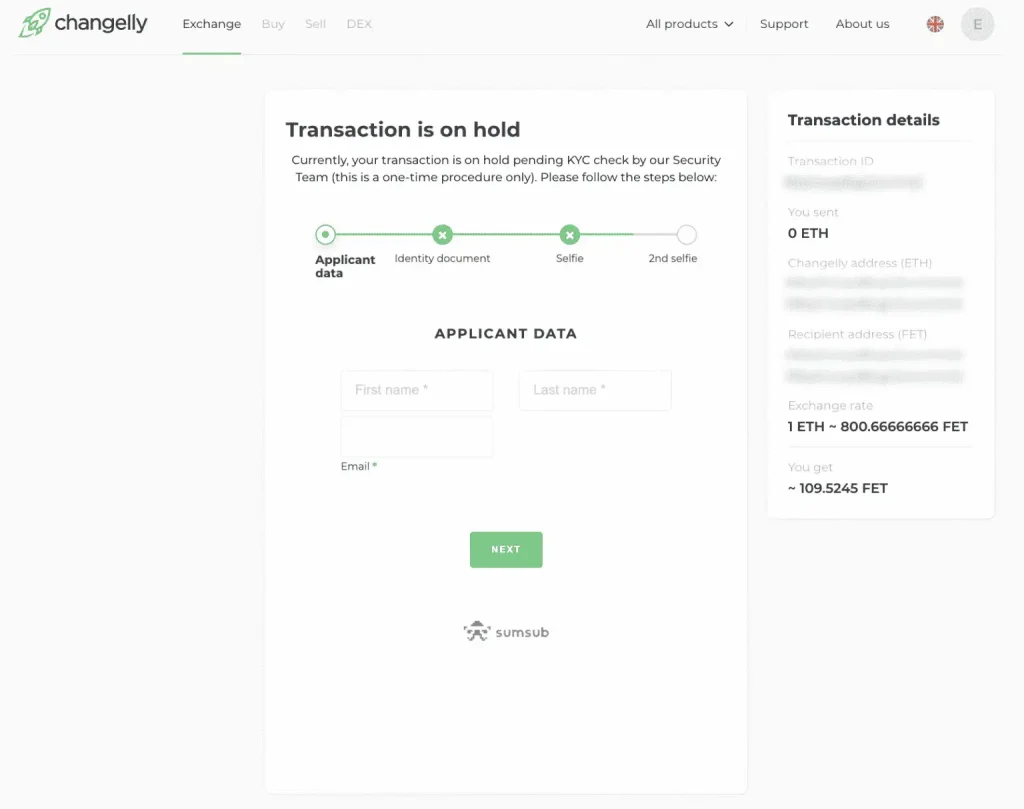

Since we’ve already reviewed dozens of exchanges, we are very familiar with this type of KYC/AML processing. Basically, the exchange uses an automated risk scoring system that flags transactions showing irregular activity or potential compliance risks. Verification is only triggered when certain conditions are met, such as unusual transaction patterns, suspicious wallet destinations, possible connections to stolen or hacked coins, or very large transfer amounts. (While inconvenient, the goal of these checks is to prevent money laundering, reduce fraud, and help recover stolen funds.)

A screenshot we found in Changelly’s KYC guide

Changelly doesn’t do the verification by itself. Instead, it’s done via SumSub, a well-known and reputable platform that manages all document handling and screening. Users may be asked to upload a passport, driver’s license, or ID card, followed by a selfie or liveness check to confirm authenticity. According to official sources, basic verification usually takes about five minutes, while enhanced due diligence may take longer for high-risk cases.

As far as we know, the process is handled automatically, with no direct manual review by the Changelly staff except when legally required. Most users never undergo verification unless their transaction is specifically flagged. Feedback from the community is mixed: some express frustration about unexpected KYC requests or temporary holds, while others report that their funds were released quickly after completing verification.

Overall, Changelly’s AML and KYC practices align with international compliance standards. While they can occasionally cause delays, these procedures are essential for maintaining security and ensuring that the platform remains a legitimate, non-scam service in a space often targeted by fraudsters.

Security and Trustworthiness

Let’s keep exploring whether Changelly is a scam or not by looking at its security track record and transparency. So far, the evidence points to a legitimate, well-secured platform rather than a scam. While it’s not related to the platform’s policies, we also think it’s important to note that, since Changelly’s launch in 2015, it has had no recorded hacks or data breaches.

As we have mentioned previously, the platform doesn’t store either user data or user funds. Changelly also employs standard protections, such as:

- Two-factor authentication (2FA) for accounts.

- SSL encryption for all web and app traffic.

Legally, Changelly is registered in St. Vincent and the Grenadines and operates under that jurisdiction’s framework. Its team members are publicly listed and verifiable through professional sources.

In terms of reputation, Changelly maintains high app store ratings, serves 10+ million users worldwide, and partners with trusted wallets and payment processors. Taken together, these factors reinforce that Changelly is not a scam, but a long-standing and reputable service in the crypto exchange market.

User Experience and Support

Changelly offers a clean, beginner-friendly interface that works consistently across both web and mobile. Users can start swapping crypto immediately without creating an account. The platform runs smoothly and is easy to navigate, even for first-time users.

Transaction speed is one of Changelly’s strengths: most swaps complete in under 10 minutes, with small exchanges often processing almost instantly. Larger transactions may take longer if flagged for verification, but typical delays are minimal.

Customer support is available 24/7 through live chat with real agents, not bots. In testing, responses arrived within seconds and were clear and helpful. The support team is multi-lingual and active across time zones, which adds to the platform’s overall accessibility and reliability.

Advantages

Changelly’s main strengths lie in its simplicity, speed, and non-custodial design. It’s built for users who value convenience and security over complex trading tools.

- 0.25% flat service fee on swaps (competitive pricing)

- Doesn’t store funds on the platform (no risk of centralized fund loss)

- Easy to use for beginners, intuitive design

- 1,000+ supported coins, 350+ purchasable directly

- Available in 170+ countries

- 24/7 live human support

- Fast processing, average under 10 minutes

- No account required for transactions

- Multi-language interface and support

Disadvantages

Some limitations come from its reliance on third-party providers and lack of full regulatory licensing, which may affect costs or availability in certain regions.

- Doesn’t support all fiat currencies

- Fiat operations depend on third-party providers

- Provider fees can increase total cost for fiat purchases

- Restricted in some regions (including the US, UK, Hong Kong, etc.)

- Not a full trading platform (no order books or advanced tools)

- KYC may be unexpectedly triggered for large or flagged transactions

Ideal Use-Cases

Changelly is best suited for users who want to swap or buy crypto quickly without navigating complex trading tools. It’s a good fit for those who value simplicity and privacy. The platform also works well for beginners, offering low minimum limits and fast onboarding.

However, Changelly is less suitable for professional traders who need advanced features like order books or charting tools. It may also not be ideal for users who prefer fully licensed, regulated exchanges or for those making frequent large transactions.

Best Practices for Safe Use

- Break up large transfers: avoid sending large sums in one go, and test with small amounts first.

- Enable 2FA: protect both exchange and email accounts.

- Check official sources: always access via verified URLs or official apps.

- Be KYC-ready: have valid ID and documents available for large or unusual transactions.

Conclusion

Changelly is not a scam. After ten years of continuous operation, the platform has built a solid reputation in the crypto industry. It’s trusted by over 10 million users and 600+ partners, with no record of hacks or data breaches since its launch in 2015.

Its main strengths lie in simplicity, broad asset support, responsive customer service, and a secure, non-custodial design. These qualities make it a dependable option for everyday crypto users who value speed and convenience.

On the downside, Changelly faces regional restrictions, extra fees from third-party providers, and occasional KYC delays, which may inconvenience some users, particularly those handling larger transactions.

Overall, Changelly remains best-suited for fast, small-to-medium crypto swaps or fiat purchases, offering a practical balance of usability and security.

Final Rating (2025): ★ 4.4 / 5 — A secure, long-standing exchange aggregator that delivers reliability and ease of use, though it’s less ideal for advanced traders or users who require licensed fiat operations.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

Strategy leans on STRC to accelerate Bitcoin buying in 2026