Gold’s $2.5T Crash Surpasses Bitcoin’s Total Market Cap

The recent collapse in gold prices, erasing over $2.5 trillion in market value in a single day, highlights the increasing volatility even in traditionally safe assets. This sharp decline follows a period of strong gains and has sparked renewed debate about the resilience of gold as a hedge in turbulent markets. As cryptocurrencies like Bitcoin continue to experience fluctuations, this market turmoil underscores the unpredictable nature of both traditional and digital assets amid the current economic climate.

- Gold experienced a nearly 8% drop in 24 hours, marking one of its largest two-day declines since 2013, with $2.5 trillion wiped from its market cap.

- The correction is statistically rare, occurring once every 240,000 trading days, yet similar heavy declines have happened multiple times since 1971.

- The sell-off was driven by FOMO-driven momentum, with profit-taking and weak hands contributing to an intense market shakeout.

- While gold’s recent plunge surpasses Bitcoin’s entire market cap, Bitcoin’s own volatility remains significant, sparking discussions about the future of crypto as a store of value.

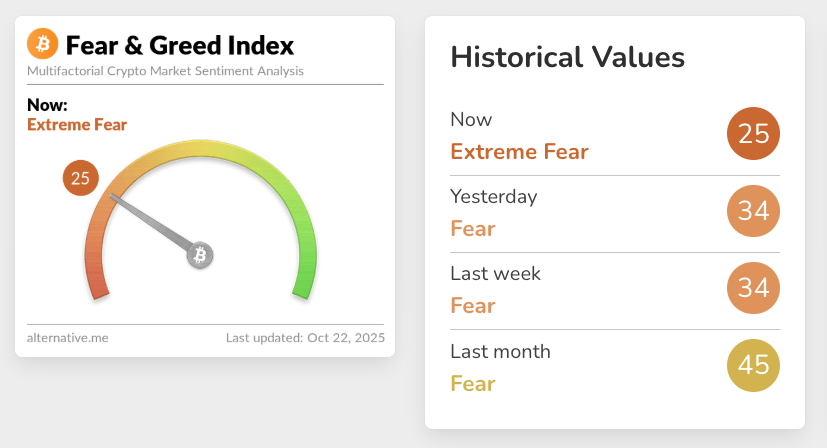

- The crypto Fear & Greed Index has sunk to levels last seen in December 2022, reflecting widespread market apprehension.

Gold, a cornerstone of traditional investing and long considered a safe-haven asset, faced a brutal sell-off that erased over $2.5 trillion from its market value in just 24 hours, surpassing the market cap of Bitcoin. The decline extends a dramatic correction from recent weeks, with the metal dropping nearly 8% in a single day, reminiscent of its largest two-day drops since 2013. Such rapid moves have unsettled investors, many of whom viewed gold as a hedge against inflation and market turbulence, especially after a 60% surge earlier in 2022.

Gold’s 7% drop is rare: Here’s why it crashed

Market analysts point out that this correction is highly unusual, statistically likening it to an event expected only once every 240,000 trading days. Swiss resources investor Alexander Stahel commented on social media that gold has experienced even larger declines historically, with such corrections occurring 21 times since 1971. The recent plunge was fueled by FOMO-driven enthusiasm as investors flocked into gold-related assets—physical gold, gold tokens, and equity—which created a bubble ready to burst.

“FOMO caused the latest rally. Now, profit-taking and weak hands got shaken out,” Stahel explained, adding that calmer days could be on the horizon. This recent volatility comes amid signals that traditional safe assets are no longer immune to market shocks, especially with growing fears about inflation, geopolitical tensions, and uncertain monetary policies.

Crypto Market Impact and Broader Sentiment

The magnitude of the gold correction surpasses Bitcoin’s entire market cap of approximately $2.2 trillion, leading some analysts to compare the two markets. Veteran trader Peter Brandt noted that the gold decline’s scale is equivalent to 55% of all cryptocurrencies combined, emphasizing the size of the move. Meanwhile, Bitcoin itself suffered a modest 5.2% drop from its intra-day high of $114,000, though it remains within a relatively small daily loss range of 0.8% — highlighting its notorious volatility.

The Crypto Fear & Greed Index. Source: Alternative.me

The Crypto Fear & Greed Index. Source: Alternative.me

Despite some inflows into Bitcoin spot ETFs—amounting to $142 million in the past day—the broader cryptocurrency market plunged into a state of “Extreme Fear,” as indicated by the Crypto Fear & Greed Index hitting levels last seen in late 2022. This heightened sentiment of fear reflects ongoing uncertainty across global markets, with investors re-evaluating their risk exposure.

Interestingly, Deutsche Bank analysts recently highlighted parallels between gold and Bitcoin, suggesting that rising interest in both assets might reflect a search for safe-haven alternatives amid ongoing market volatility. Although gold has recently reached new nominal highs, it only surpassed its inflation-adjusted all-time peak earlier this month, showing its complex relationship with real economic growth and inflation dynamics.

Market Implications

The current market upheaval underscores that even traditionally “safe” assets like gold can experience dramatic corrections, especially when driven by speculative momentum. As markets adapt to ongoing macroeconomic uncertainties, cryptocurrency proponents continue to watch for Bitcoin’s ability to establish itself as a reliable store of value comparable to gold amidst rising volatility.

This article was originally published as Gold’s $2.5T Crash Surpasses Bitcoin’s Total Market Cap on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Global Crypto Leaders to Converge in Dubai for Historic 30th Edition of HODL

Buterin pushes Layer 2 interoperability as cornerstone of Ethereum’s future