PI Token Explodes by 25%, BTC Taps $116K as Crypto Markets Add $100B Daily: Market Watch

Bitcoin skyrocketed past $116,000 earlier today to set a multi-week high before it was stopped and pushed south by around a grand.

Numerous altcoins have posted massive gains over the past day, led by ZEC and PI. Some of the larger caps are also well in the green.

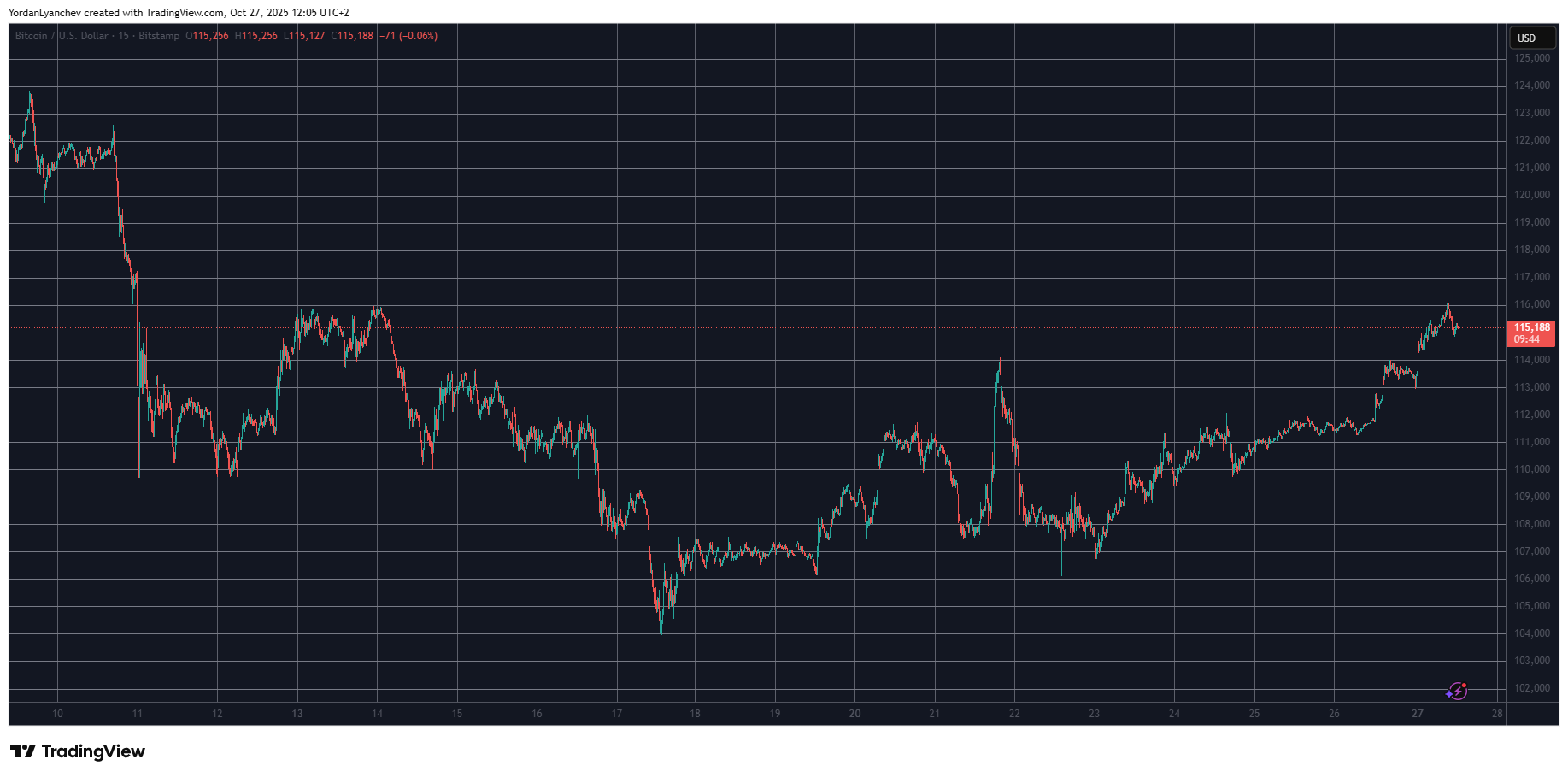

BTC Stopped at $116K

Bitcoin surged at the beginning of the previous business week as well, when it added over six grand in hours and soared to $114,000. However, this rally was short-lived, and the asset slumped by eight grand almost immediately to almost $106,000.

The following days were calmer, as BTC prepared for the Friday release of the CPI numbers for September. Before the announcement went live, the cryptocurrency had calmed at $111,000 but jumped to $112,000 once it became known that the inflation is not as high as experts believed.

The following hours were less positive as BTC slipped to $110,000, but went on the offensive once again during the weekend and challenged $112,000 on Sunday. At first, this resistance held but gave in after the US Secretary hinted at a major trade deal between the US and China.

Bitcoin broke past $113,000 on Sunday and kept climbing on Monday, surpassing $116,000 for the first time since the October 10 massacre. Although it has been pushed south by $1,000 since then, it’s still 2.4% up on the day. Its market cap has risen to almost $2.3 trillion, while its dominance over the alts is close to 58%.

BTCUSD. Source: TradingView

BTCUSD. Source: TradingView

PI, ZEC on the Rise

Pi Network’s native token became the top performer in the past 24 hours, skyrocketing by over 25% at one point to well over $0.28. ZEC follows suit as the privacy coin is up by 15% and tapped $350 for the first time this decade.

The other notable gainers from the larger-cap alts include BCH (6.4%), ETH (4.2%), BNB (2.6%), and UNI (5%). SOL, DOGE, ADA, LINK, and HYPe are also in the green, albeit in a more modest manner.

The total crypto market cap has added over $100 billion since yesterday and briefly tapped $4 trillion earlier today.

Cryptocurrency Market Overview. Source: QuantifyCrypto

Cryptocurrency Market Overview. Source: QuantifyCrypto

The post PI Token Explodes by 25%, BTC Taps $116K as Crypto Markets Add $100B Daily: Market Watch appeared first on CryptoPotato.

You May Also Like

US Courts Dismissed Two Anti-Money Laundering Case

Cronos (CRO) Flatlines Despite Altcoin Season, Analyst Explains Why