Western Union to Launch USDPT Stablecoin on Solana by Mid-2026

Western Union announced on Oct. 28 plans to launch a US Dollar Payment Token stablecoin built on the Solana SOL $197.3 24h volatility: 1.5% Market cap: $108.55 B Vol. 24h: $6.90 B blockchain. The company expects USDPT to become available in the first half of 2026.

The stablecoin will be issued by Anchorage Digital Bank, a federally regulated institution, according to a press release published by the company. Western Union said users will access USDPT through partner exchanges. The company stated the initiative combines its global digital footprint with Solana’s blockchain technology and Anchorage Digital’s issuance platform and custody solutions.

Digital Asset Network for Global Cash Access

Western Union also unveiled plans for a Digital Asset Network designed to provide cash off-ramps for digital assets. The network will partner with wallets and wallet providers to enable customers to convert crypto holdings into fiat currency through Western Union’s retail locations worldwide.

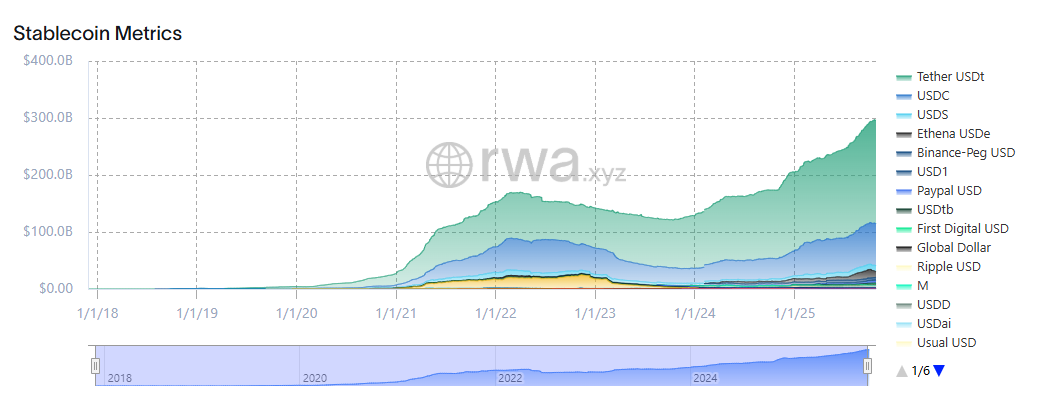

Stablecoin metrics | Source: RWA.xyz

The stablecoin sector recorded $4.30 trillion in monthly transfer volume as of Oct. 28, representing a 35.68% increase over the prior 30 days, based on data from RWA.xyz. Monthly active addresses grew 20.89% to 32.41 million during the same period.

Tether Holdings maintains market dominance with $179 billion in market capitalization, controlling 60.47% of the sector. Circle holds the second position with $73 billion, accounting for 24.68% of the market.

CEO Cites Regulatory Shift as Catalyst

Western Union President and CEO Devin McGranahan said the initiative allows the company to own the economics associated with stablecoins. The executive pointed to recent US regulatory developments, including the GENIUS Act, as factors supporting Western Union’s stablecoin strategy. The company reported a 6% revenue decline in its first quarter, prompting efforts to revive growth through digital asset integration.

The announcement coincides with the first US spot Solana ETP launch on the NYSE, as Bitwise’s $BSOL began trading on Oct. 28.

nextThe post Western Union to Launch USDPT Stablecoin on Solana by Mid-2026 appeared first on Coinspeaker.

You May Also Like

The Channel Factories We’ve Been Waiting For

Why Is the Bitcoin Price Constantly Falling? Analysis Firm Says “The Selling Process Has Reached Saturation,” Shares Its Expectations