Ondo, Chainlink Forge Alliance for On-chain Institutional Adoption

Ondo Finance and Chainlink have announced a strategic partnership to accelerate the adoption of infrastructure by traditional institutions on October 30. The agreement positions Chainlink as the data provider for Ondo’s tokenized stocks and ETFs, and selects Chainlink’s Cross-Chain Interoperability Protocol (CCIP) as the preferred solution for cross-chain asset movement for financial institutions.

Ondo has established itself as a prominent player in the tokenization of real-world assets (RWAs), managing assets across ten blockchains and integrating with more than 100 applications. This collaboration is set to expand the scope of institutional asset tokenization by leveraging Chainlink’s oracle solutions to deliver secure, transparent price feeds.

Mainstream Institutions Eye Tokenized Asset Infrastructure

As part of the new partnership, Chainlink will help Ondo facilitate interoperability and data accuracy for its suite of tokenized stocks and ETFs. Institutions, asset managers, traditional financial intermediaries, and protocol developers are expected to benefit from seamless access to on-chain capital markets, leveraging Chainlink’s infrastructure for transparency and compliance.

Commenting on the announcement, Ondo CEO Nathan Allman stated that integrating Chainlink as the official oracle for tokenized stocks will allow their assets to be natively composable within the decentralized finance (DeFi) ecosystem and institutional channels.

Building on a Growing Tokenization Ecosystem

The strategic move aligns with Ondo’s broader push into new markets and chains. On October 29, Ondo expanded its $1.8 billion tokenization market to BNB Chain, extending its platform for tokenized US Treasury assets, bonds, and equities to one of the largest blockchain ecosystems.

This expansion forms part of a rapid growth phase following the launch of Ondo Global Markets, which now offers a suite of over 100 tokenized equities on Ethereum, targeting non-US investors.

Ondo’s increasing presence is marked not only by its cross-chain ambitions but also by partnerships with key financial players. Earlier this year, Ondo became the first real-world asset provider to join Mastercard’s Multi-Token Network, strengthening its linkages between blockchain and traditional payment systems.

Market Impact on ONDO Token

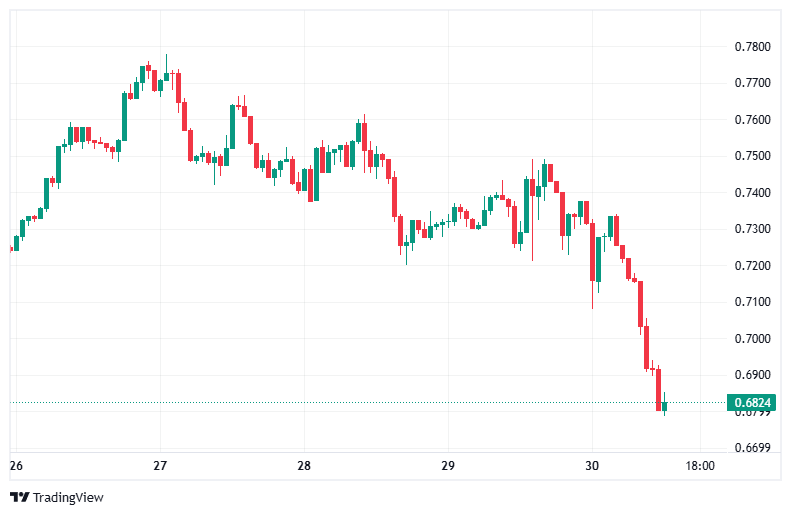

Following the partnership announcement, ONDO’s token price did not receive a positive market response. Trading volumes increased by 60% over the past 24 hours to $165M, while the token saw a noticeable 5% price dip, according to CoinMarketCap, driven by a broader crypto market dip related to the tariff war between the U.S. and China.

Chart of ONDO/USDT | Source: TradingView

Ondo is making big moves with its announcement of BNB and Chainlink, generating expectations of wider enterprise adoption and enhanced interoperability with on-chain and traditional markets. Probably, in better market conditions, we will see whether the predictions of ONDO’s price will come true in the future.

nextThe post Ondo, Chainlink Forge Alliance for On-chain Institutional Adoption appeared first on Coinspeaker.

You May Also Like

The Channel Factories We’ve Been Waiting For

What is the Outlook for Digital Assets in 2026?