France Advances Tax Proposal Targeting Crypto as “Unproductive Wealth” – Will it Pass the Senate Vote?

France has moved a step closer to taxing cryptocurrency holdings as part of a sweeping reform of its wealth tax system, after lawmakers approved a controversial amendment labeling digital assets as “unproductive wealth.”

The measure, introduced by centrist MP Jean-Paul Mattei of the Les Démocrates group, was passed on October 31 by a narrow 163–150 vote in the National Assembly during discussions on the 2026 draft finance bill.

The proposal, however, must still pass through the Senate and the rest of the parliamentary process before becoming law.

Is France’s Crypto Tax a Push for Productivity or a Punishment for Holders?

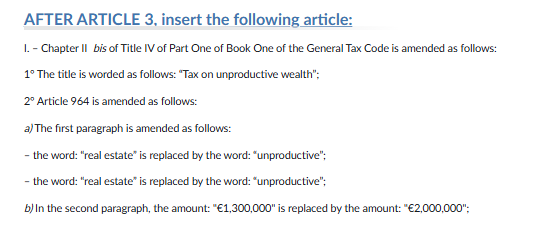

The amendment would replace France’s existing Impôt sur la Fortune Immobilière (IFI), the real estate wealth tax, with a broader Impôt sur la Fortune Improductive (IFI 2.0), or “tax on unproductive wealth.”

Under the reform, the scope of taxable assets would expand beyond real estate to include a range of items viewed as economically “inactive” or “non-productive.”

Source: France National Assembly

Source: France National Assembly

These include luxury goods such as yachts, private jets, jewelry, collectible art, and, for the first time, digital assets like Bitcoin and other cryptocurrencies.

The amendment raises the tax threshold from €1.3 million to €2 million and replaces the current progressive rates (0.5% to 1.5%) with a flat rate of 1% on the portion of net assets exceeding that threshold.

According to the proposal, the reform aims to encourage investment in assets that directly contribute to economic activity while discouraging the accumulation of wealth in assets deemed “unproductive.”

“Gold, coins, classic cars, yachts, and works of art are excluded from the current tax base, yet they represent forms of wealth that do not create jobs or innovation,” Mattei wrote in his summary. “This reform corrects that inconsistency.”

The measure would also affect taxpayers holding crypto that has appreciated in value but has not been sold, raising concerns it could effectively tax unrealized gains.

Critics in France’s crypto industry say the measure unfairly targets savers and investors who hold crypto as a store of value rather than for speculation.

Crypto as ‘Unproductive Wealth’? France’s Tax Reform Sparks Debate.

Éric Larchevêque, co-founder of Ledger, warned that the proposal “punishes all savers who wish to financially anchor themselves to gold and Bitcoin in order to protect their future.”

He added that the political message is clear: “Crypto is equated with an unproductive reserve, not useful to the real economy.”

Larchevêque also expressed concern that many crypto holders could be forced to sell part of their portfolios just to cover the new tax liability, particularly if their holdings are illiquid or volatile

The narrow vote revealed deep divisions across the French political landscape. The amendment passed with support from an unlikely coalition of Socialist, centrist MoDem, and far-right Rassemblement National (RN) MPs.

The government and its Renaissance allies opposed it, describing the measure as “uncertain in scope and revenue.”

Economists remain divided on the potential fiscal impact. Some Socialist MPs estimate the reform could bring in up to €2 billion in additional annual revenue, while others, including France’s Ministry of Public Accounts, project total receipts between €1 billion and €3 billion, or even less if wealthy households restructure their assets to avoid the tax.

Supporters argue the reform would push capital into “productive” areas such as business investment, innovation, and green infrastructure.

Opponents warn it risks penalizing savers, investors, and collectors while creating administrative complexities in valuing diverse assets like digital currencies and art.

Crypto Taxation Already a Contentious Issue

France’s crypto tax framework has long been a point of debate. Under current law, individuals pay a 30% flat tax on realized crypto capital gains, meaning tax is only due when assets are sold for euros or goods. Crypto-to-crypto trades and holding (HODLing) are not taxed.

The current IFI raised €2.2 billion in 2024 from around 186,000 households, roughly half the €4.2 billion once generated by the former ISF in 2017, according to data from France’s tax administration (DGFiP).

If enacted, the new “unproductive wealth” tax would introduce a radically different principle: taxing unrealized gains on crypto holdings annually, even when investors haven’t sold their coins.

Critics say this could set a dangerous precedent for taxing “paper profits.”

You May Also Like

Why The Green Bay Packers Must Take The Cleveland Browns Seriously — As Hard As That Might Be

Academic Publishing and Fairness: A Game-Theoretic Model of Peer-Review Bias