Vitalik Buterin Calls for Scrapping Ethereum’s ‘Most ZK-Unfriendly’ Feature

Ethereum co-founder Vitalik Buterin has proposed eliminating a key blockchain feature he originally invented, claiming it severely hampers the network’s scaling efforts.

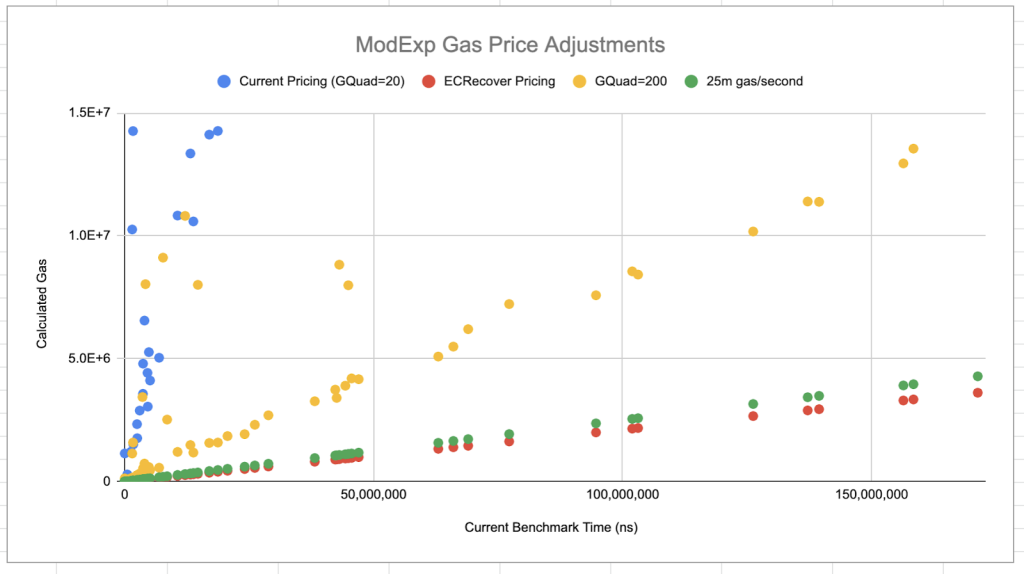

The modular exponentiation precompile, known as modexp, creates verification bottlenecks up to 50 times worse than average blocks when generating zero-knowledge proofs, according to Buterin’s recent statement on X.

The proposal arrives as Ethereum intensifies its push toward a privacy-first infrastructure, while simultaneously addressing technical obstacles that impede the adoption of the zero-knowledge Ethereum Virtual Machine.

Buterin acknowledged his role in creating the problematic feature, stating he “bows his head in shame” while advocating for its replacement with computationally equivalent code that would increase gas costs but dramatically reduce proof generation complexity.

The Technical Burden Holding Back Ethereum’s ZK Ambitions

Zero-knowledge EVMs generate cryptographic proofs validating Ethereum computations off-chain, enabling faster transaction processing without compromising security.

The prover component responsible for creating these proofs encounters exceptional difficulty with modexp operations, which are primarily used in RSA encryption and signing functions employed by minimal applications.

Buterin explained that modexp’s computational intensity creates disproportionate delays in proof generation, directly slowing rollups and layer-2 solutions designed to accelerate Ethereum.

The feature’s complexity also introduces consensus failure risks through potential edge cases and bugs that threaten network stability.

Rather than investing optimization resources into a feature affecting 0.01% of users, Buterin suggested replacing the precompile with standard EVM bytecode that achieves identical results at higher gas costs.

Source: Ethereum Magician

Source: Ethereum Magician

Applications requiring modular exponentiation (modexp) functionality could instead wrap operations in SNARKs, an alternative cryptographic proof system that mitigates inefficiency.

This tradeoff prioritizes ecosystem stability and scaling progress over maintaining legacy features with narrow use cases, particularly as Ethereum faces more urgent performance challenges.

The proposed Ethereum Improvement Proposal would fundamentally change how the network handles cryptographic operations that prove burdensome for zero-knowledge proof systems.

Institutional Gateway Opens as Privacy Solutions Mature

In late October, the Ethereum Foundation launched “Ethereum for Institutions”, providing enterprises and financial organizations with structured pathways for blockchain adoption.

The initiative employs zero-knowledge proofs, fully homomorphic encryption, and trusted execution environments to enable compliant, audit-ready applications on public networks.

Projects including Chainlink, RAILGUN, Aztec Network, and Zama pioneer privacy-preserving smart contracts that secure counterparty information and business logic without sacrificing transparency or composability.

These production-ready solutions address institutional requirements for balancing compliance mandates with secure, programmable finance.

Ethereum dominates real-world asset and stablecoin sectors, hosting over 75% of tokenized RWAs and 60% of global stablecoin supply.

Major financial firms, including BlackRock, Securitize, and Ondo Finance, deploy tokenized instruments that offer 24/7 settlement, transparency, and composability.

Layer-2 networks, like Base, Scroll, and Unichain, now secure over $50 billion in value, delivering throughput and cost efficiency for global-scale applications.

Privacy Infrastructure Accelerates Alongside Technical Refinements

The Ethereum Foundation launched its 47-member Privacy Cluster in October, under the coordination of Blockscout founder Igor Barinov, expanding work initiated in 2018 through the Privacy and Scaling Explorations team.

The cluster addresses critical areas around surveillance, private data verification, selective identity disclosure, user experience improvements, and institutional adoption support.

This initiative follows the September rebranding of the Privacy and Scaling Explorations team to Privacy Stewards for Ethereum, shifting the focus from theoretical research to practical solutions.

The foundation warned that without robust privacy protections, Ethereum risks becoming “the backbone of global surveillance rather than global freedom,” potentially driving institutions and users toward alternative platforms.

Last month, Vitalik also detailed GKR, a cryptographic technique that verifies calculations ten times faster than traditional methods while enabling zero-knowledge proofs that confirm computational accuracy without exposing underlying data.

The protocol processes 2 million calculations per second on standard laptops. It validates entire Ethereum transactions using just fifty consumer-grade graphics cards, compared to traditional methods requiring 100 times more computational work than the original calculations.

The breakthrough is significant because it enables faster verification, resulting in cheaper transactions and enhanced privacy across the network.

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

![[Tambay] Tres niños na bagitos](https://www.rappler.com/tachyon/2026/01/TL-TRES-NINOS-NA-BAGITOS-JAN-17-2026.jpg)