Shielded Zcash Supply Reaches 5M All-Time High Despite Market Crash

The shielded Zcash supply has briefly crossed the 5 million mark, with holders moving their coins to the Orchard Pool for increased privacy. This all-time high amount was achieved during an expressive market crash affecting most other cryptocurrencies, while ZEC ZEC $408.3 24h volatility: 0.1% Market cap: $6.68 B Vol. 24h: $2.23 B remained trading around the $400 price level.

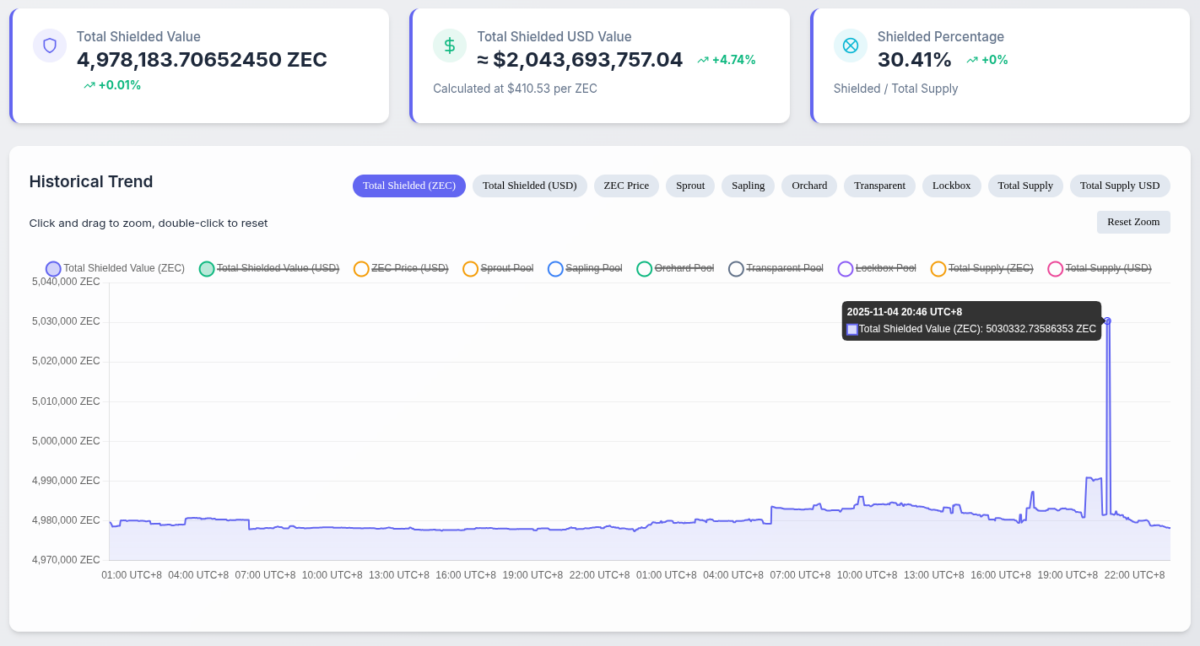

Coinspeaker retrieved this data from the zkp.baby dashboard on November 4, 2025, filtered by daily stats looking at the previous 24 hours. In the chart, we can see a spike to 5.03 million ZEC, now retraced back to 4.97 million—currently valued above $2 billion, accounting for 30.41% of Zcash’s circulating supply and market capitalization.

Zcash: Total shielded value, USD value, and percentage, as of Nov. 4, 2025 | Source: zkp.baby

Shielded Zcash is the name given to ZEC coins deposited in the Orchard Pool, held by special addresses that start either with a “z” or a “u” and, thanks to the zero-knowledge proof technology, hide these addresses’ balances and transaction history—offering total anonymity to its users.

From an economic perspective, shielding Zcash signals a willingness to not only increase the user’s privacy but also to hold or use the coins within the shielded ecosystem, which reduces the available supply for sales on exchanges, as most of these services only support transparent addresses.

Usually, an increase in the total shielded amount reflects a market made mostly by high-conviction buyers that are withdrawing ZEC to self-custody and shielding it for long-term holding, without the intention to sell it in the short term. This scenario can contribute to Zcash’s price growth and resiliency, as we have seen recently.

Zcash Price Amid the Market Crash

The week started with a market crash as most cryptocurrencies experienced significant losses since November 3. Bitcoin BTC $100 872 24h volatility: 5.8% Market cap: $2.01 T Vol. 24h: $95.54 B dropped below the $102,000 mark, revisiting the lowest levels reached during the unprecedented crash on October 10-11 that liquidated $19.35 billion in trading positions.

According to a Coinspeaker report earlier today, the last 24 hours saw $1.33 billion in liquidations, which continue increasing as of this writing.

Yet, Zcash remains strong, trading around the $400 price level with notable volatility up and down in a range that goes between $380 and $440 in the daily chart. At its current price, ZEC accumulates 956% gains year-over-year—more than a 10x increase in purchasing power for Zcash holders, with notable growth since August, as Coinspeaker reported.

Zcash (ZEC) price as of November 4, 2025, with accumulated gains YoY | Source: CoinMarketCap

As things develop, the now-leading privacy coin is proving its value, resiliency, and demand in people’s minds and wallets, with the total shielded amount being a leading indicator for market and users’ behavior worth monitoring.

nextThe post Shielded Zcash Supply Reaches 5M All-Time High Despite Market Crash appeared first on Coinspeaker.

You May Also Like

Ripple (XRP) Pushes Upwards While One New Crypto Explodes in Popularity

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets